371 Homes Sold in Dallas-Fort Worth in a Single Day: Learn How the Home Buying Process Works

Picture the scene on a single day in 2025. Specifically, December 1st, 2025. While many people were just starting to think about holiday shopping, 371 different families and individuals in Dallas-Fort Worth were doing something much bigger. They were signing papers, handing over checks, and receiving the keys to their new lives.

Those 371 transactions tell a fascinating story about our local market. On one end of the spectrum, someone picked up a property for $22,500. On the other end, a luxury buyer closed on an estate for $25.5 million. Somewhere in the middle, 95 people moved into brand-new construction homes that had never been lived in before.

If you are thinking about joining them, you might feel a mix of excitement and nerves. Buying a home in Texas is straightforward on paper, yet it involves many moving parts. This guide breaks down exactly what happens between deciding to buy and turning the key in your front door.

Is Buying a Home Actually Hard?

Let’s be honest: Buying a Home is a big decision!

It’s likely the biggest financial transaction of your life. While the mechanics are straightforward, the variables are endless. Every transaction has its own personality, hiccups, and triumphs.

Think of it like planning a wedding or a major trip. If you try to do it all in your head without a plan, it’s chaotic. But if you have a checklist and a guide, it becomes a series of manageable tasks.

Preparation is your secret weapon. The more you know before you start looking at listings, the less stress you’ll feel when it’s time to sign on the dotted line.

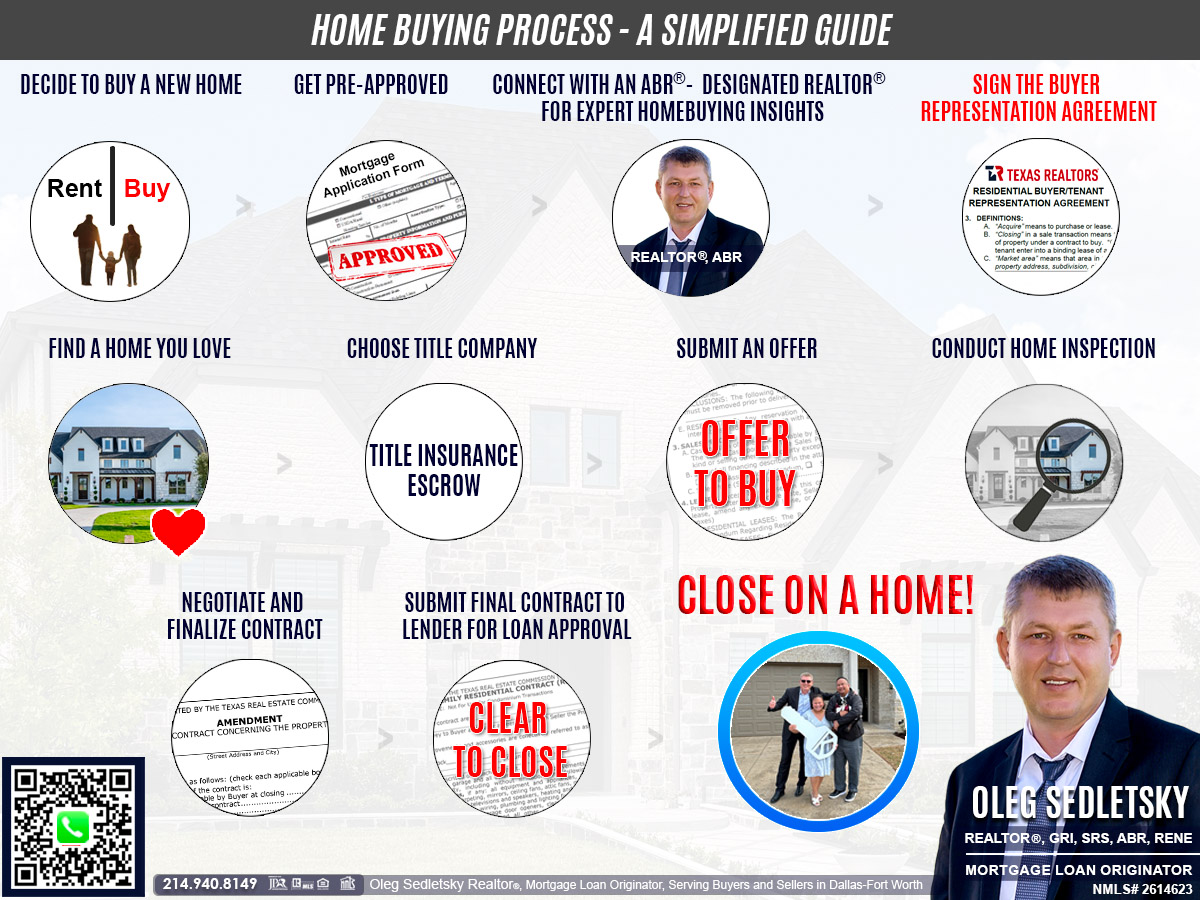

Your Step-by-Step Guide to Buying a Home in DFW

Whether you are looking in Dallas, Fort Worth, or anywhere else in North Texas, the process generally follows a specific rhythm.

1. The Decision Phase

Before you open a single real estate app, pause. Don’t make a spontaneous decision based on a pretty kitchen you saw on Instagram. Buying a home requires commitment. Weigh the pros and cons of your current situation. Are you ready to stay in one place? Are your finances stable? This is the moment to consult with a professional to see if your goals align with reality.

2. The Financial Reality Check (Get Pre-Approved!)

This step is non-negotiable. Before you fall in love with a house that might be out of reach, you need to know your numbers.

Getting pre-approved for a mortgage eliminates the guessing game. It gives you a concrete budget, which saves you time and heartache later. More importantly, in a market as active as DFW, sellers won’t even look at your offer without a pre-approval letter. It proves you are a serious buyer.

As a licensed Mortgage Loan Originator as well as a Realtor, I see this from both sides. When you have your financing lined up early, you walk into every showing with confidence.

3. Partner with a Real Estate Pro

Once your budget is set, it’s time to build your team. This is where connecting with a local Realtor® becomes vital.

A Realtor gives you access to active listings that you might miss on public sites. They handle the awkward conversations with sellers, schedule the tours, and keep the timeline moving.

Pro Tip: Look for someone who understands both the property and the financing. Having a dual expert on your side—someone who is an Accredited Buyer’s Representative (ABR) and a Mortgage Loan Originator—gives you a distinct advantage. You get holistic advice that protects both your lifestyle needs and your wallet.

4. 2026 Update: New Texas Rules

Real estate laws change, and it’s crucial to stay updated. As of 2026, Texas has implemented new regulations regarding buyer representation.

If you want an agent to actively guide you, show you properties, and negotiate for you, you must sign a standard residential buyer representation agreement. This isn’t just paperwork; it’s protection. It legally binds the agent to prioritize your interests above all else. It formalizes the relationship so you know exactly who is in your corner.

5. The Search

Now for the fun part! You are pre-approved, you have your representation agreement signed, and you are ready to hit the pavement.

Dallas-Fort Worth has incredible inventory, from historic charm to new construction homes.

- Identify your lists: Write down your “Must-Haves” (3 bedrooms, close to work), “Nice-to-Haves” (pool, granite counters), and “Deal-Breakers” (busy road, bad school district).

- Browse and Visit: Look online, but also go to open houses. Walk through neighborhoods at different times of the day.

Your Realtor will help you filter through the noise to find the homes that actually match your criteria.

6. Title Company Selection

This part confuses many first-time buyers. You will need to choose a title company to handle the ownership transfer and provide title insurance. If you aren’t sure who to pick, don’t worry, your agent can provide recommendations for reputable local companies that will ensure the property is legally yours, free and clear.

7. Making an Offer

You found “The One.” Your heart is racing. Now, you make an offer.

Your agent will help you draft a competitive offer based on market data, not just emotion. Be prepared to put down an “earnest money” deposit—this is a good-faith deposit that shows the seller you are committed. If they accept, you are officially under contract!

8. The Inspection

Never skip this step. Even a brand-new home can have issues. During your “option period” (a specific number of days you buy to inspect the home), hire a professional inspector. They will check the roof, foundation, electrical, and plumbing. This report gives you the chance to ask for repairs or, if the problems are too big, walk away.

9. Negotiation and Finalizing

Based on the inspection, we might go back to the negotiation table. Maybe the roof needs work, or the HVAC is older than expected. Your Realtor fights for you here to ensure the final contract terms (price and repairs) are fair.

10. The Lender’s Turn

Once the contract is finalized, your lender takes over. They will order an appraisal to ensure the home is worth the price and finalize your loan underwriting. This can take 30 to 60 days. Patience is key here!

11. Closing Day

The finish line! Closing on a home is the grand finale of your hard work. You’ll meet at the title company, sign a stack of documents (remember, read before you sign!), and hand over your funds. Once the loan funds and the deed is recorded, the keys are yours.

Please Don’t Go It Alone-You Deserve an Advocate on Your Side

Picture the home buying process like setting off on a cross-country road trip. There are twists, exits, potholes, and sudden detours-maps and apps help, but having a trusted co-pilot makes all the difference. The paperwork, negotiations, and legal terms can feel overwhelming, but you don’t have to drive solo.

With a local expert beside you, you’ll have someone checking your blind spots and guiding you through every intersection. You’ll spot hidden risks before they become hazards and uncover opportunities that might otherwise sail by unnoticed. An advocate keeps your interests front and center, turning overwhelming moments into smooth sailing and ensuring your new keys come with a sense of ease, not regret.

If you’re thinking of buying-whether it’s your first home or your dream upgrade-I’m here to help with both your search and your financing.

Want more tips and resources?

Explore my website for dedicated resources for Dallas-Fort Worth home buyers, including relocation guides and detailed market articles.

Ready to talk about your next move?

Reach out anytime!

Are you ready to experience the joy of homeownership in the vibrant Dallas-Fort Worth area?

Whether you’re in search of an existing home or a brand-new construction, rest assured that I’m here to assist you every step of the way.

With a dedicated Realtor by your side, the home-buying process becomes a breeze. Say goodbye to stress, and let me handle all the intricate details on your behalf.

Getting the guidance you need is as simple as filling out a brief questionnaire on my Homebuyers contact form. From there, I’ll take care of everything, ensuring a seamless and hassle-free journey towards finding your dream home.

Call/Text 214.940.8149

The Buyer’s Agent Duty

READ: Texas Real Estate Commission Information About Brokerage Services

AS AGENT FOR BUYER/TENANT: The broker becomes the buyer/tenant’s agent by agreeing to represent the buyer, usually through a

written representation agreement. A buyer’s agent must perform the broker’s minimum duties above and must inform the buyer of any

material information about the property or transaction known by the agent, including information disclosed to the agent by the seller or

seller’s agent.

A BROKER’S MINIMUM DUTIES REQUIRED BY LAW (A client is the person or party that the broker represents):

– Put the interests of the client above all others, including the broker’s own interests;

– Inform the client of any material information about the property or transaction received by the broker;

– Answer the client’s questions and present any offer to or counter–offer from the client; and

– Treat all parties to a real estate transaction honestly and fairly.

TO AVOID DISPUTES, ALL AGREEMENTS BETWEEN YOU AND A BROKER SHOULD BE IN WRITING AND CLEARLY ESTABLISH:

– The broker’s duties and responsibilities to you, and your obligations under the representation agreement.

– Who will pay the broker for services provided to you, when payment will be made and how the payment will be calculated.

TYPES OF REAL ESTATE LICENSE HOLDERS:

– A BROKER is responsible for all brokerage activities, including acts performed by sales agents sponsored by the broker.

– A SALES AGENT must be sponsored by a broker and works with clients on behalf of the broker.

Latest from Dallas Real Estate Blog

– Texas Homebuyers Tips, Tricks and Lifehacks

– New Construction Homes in Dallas TX

– Mortgages for Homebuyers and Investors in Dallas-Fort Worth