Blue Ridge, TX Real Estate: 2020 Analysis of the Single-Family Residential Housing Market

The 2020 real estate market in Blue Ridge, TX demonstrated remarkable resilience and adaptability despite the challenges posed by the COVID-19 pandemic. With 41 homes sold during the year, both buyers and sellers displayed continued confidence in the housing market. The year was characterized by significant growth in the luxury segment, along with rising property valuations and enhanced market efficiency.

The pandemic created shifts in consumer priorities, with many individuals seeking homes that offered more space and comfort to accommodate remote work and lifestyle changes. Additionally, historically low mortgage rates and a diverse range of property offerings contributed to making 2020 a surprisingly dynamic and resourceful year for Blue Ridge’s real estate sector, even amidst unprecedented global uncertainty.

Key Takeaways and Trends from Blue Ridge’s 2020 Real Estate Market

Pricing Range: The rise in maximum price to $695,000 was a notable indicator of revitalized interest in premium homes. However, the minimum price drop to $61,300 maintained the inclusivity of the Blue Ridge, TX housing market.

Market Efficiency: Improved close price ratios and a reduction in maximum DOM demonstrated smoother transactions and better expectations alignment between buyers and sellers.

Unique Outliers: Larger-than-average lots and increasing price-per-square-foot suggested a growing preference for quality acreage and premium materials.

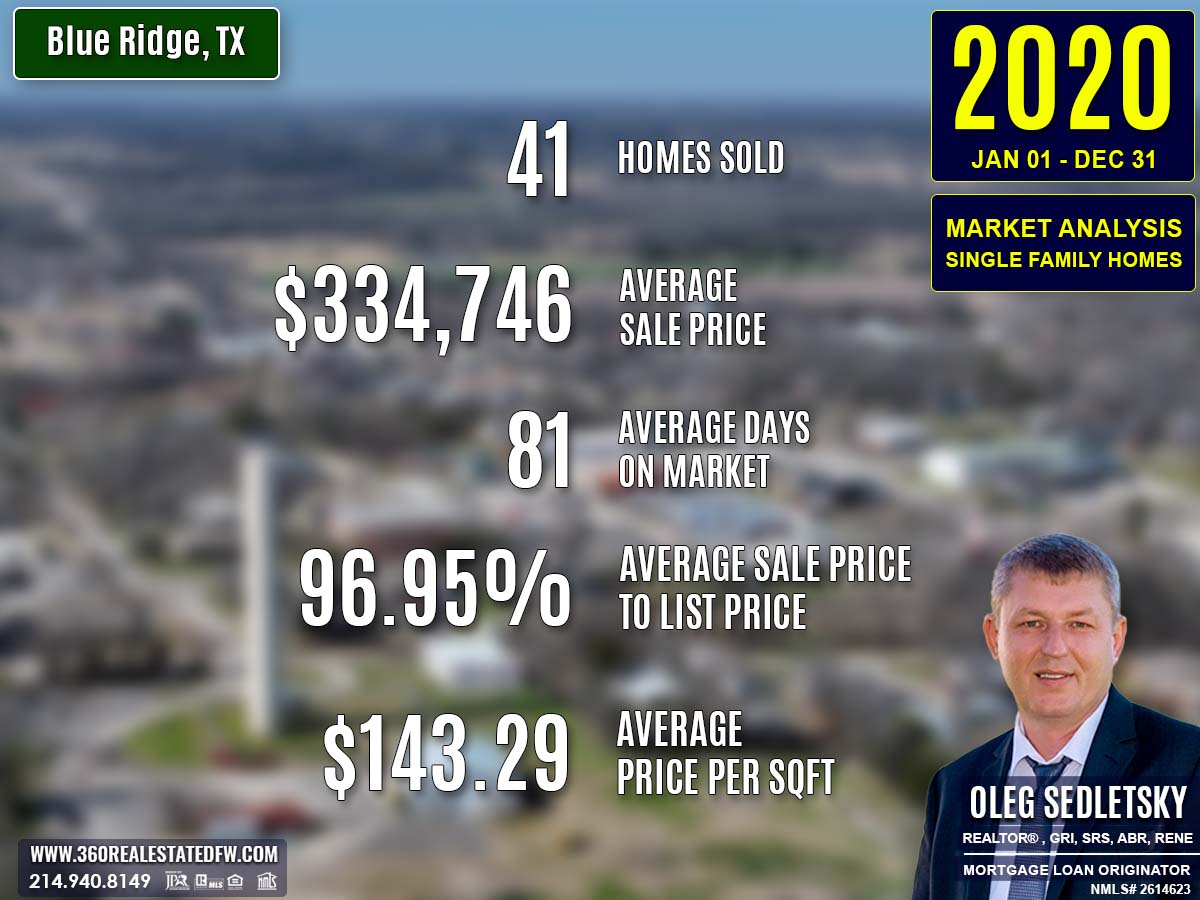

Total Homes Closed

A total of 41 residential single-family homes were sold in 2020, reflecting sustained buyer interest in the local market despite a slight decline from 2019’s total of 45 homes closed. This stability exemplifies the strong demand even during a period of global uncertainties.

Property Pricing Insights

The pricing trends in 2020 emphasized growth in mid-to-high tiers of the market:

- Minimum Price: Decreased to $61,300, offering affordable entry-level opportunities.

- Maximum Price: Jumped to $695,000, highlighting increased activity in premium properties.

- Average Price: Rose to $334,746 from $307,110 in 2019, showcasing increased buyer willingness to invest in higher-value homes.

- Median Price: Climbed to $359,000, up from $340,000 in 2019, demonstrating a robust mid-market segment.

Property Size and Features

Bedrooms and Bathrooms

- Bedrooms: Homes ranged from 2 to 5 bedrooms, with an average of 4 bedrooms, consistent with 2019 trends.

- Bathrooms: Properties offered up to 6 baths, with an average of 3, maintaining a comfortable mix for families and individuals.

Square Footage

- Minimum Size: Slightly declined to 888 sq. ft., reflecting smaller housing options at the entry level.

- Maximum Size: Decreased to 4,438 sq. ft., from 5,620 sq. ft., revealing a shift toward more manageable spaces in the high-end range.

- Average Size: Marginally decreased to 2,391 sq. ft., down from 2,465 sq. ft. in 2019.

- Median Size: Increased to 2,425 sq. ft., up from 2,316 sq. ft., showing greater demand for spacious mid-market properties.

Lot Size

- Minimum Lot Size: Increased to 0.254 acres, from 0.130 acres, offering more expansive properties at the lower end.

- Maximum Lot Size: Fell to 30.109 acres, down from 33.260 acres, indicating a narrowing in ultra-large lot availability.

- Average Lot Size: Rose to 3.571 acres, signaling a preference for larger-than-average properties.

Market Dynamics

Days on Market (DOM)

- Minimum DOM: Increased to 3 days from 2 days in 2019, indicating slightly slowed sales efficiency for the fastest-moving listings.

- Maximum DOM: Reduced to 277 days, from 399 days, showcasing more efficient high-tier transactions.

- Average DOM: Remained stable at 81 days, consistent with 2019’s pace.

Close Price Ratios

- ClsPr/LstPr (Close Price to Listing Price): Improved to 96.95%, up from 96.16% in 2019, reflecting stronger alignment between initial listings and final sale prices.

- ClsPr/OLP (Close Price to Original Listing Price): Increased to 95.06%, compared to 94.23% in 2019, underscoring reduced negotiation margins.

Price Per Square Foot

- Pr$/SqFt (Price Per Square Foot): Rose to $143.29, up from $127.87 in 2019, signaling elevated valuations for property scale and location.

Insights into the Most Expensive Blue Ridge, TX Property Sold in 2020

A standout feature of 2020 was the sale of the year’s most expensive property. This high-value estate reflected the growing upper-tier demand even in a competitive market climate.

Key Highlights:

- Price: $695,000

- Bedrooms: 3

- Bathrooms: 3 (all full baths)

- Square Footage: 4,438 sq. ft.

- Price Per Square Foot: $156.60

- Lot Size: 30.109 acres

- Days on Market: 254 days

- ClsPr/LstPr Ratio: 92.67%

- ClsPr/OLP Ratio: 92.67%

- Year Built: 1996

This property exemplified luxury with its large living space and expansive lot, though its extended time on the market highlighted the challenges of selling high-end properties.

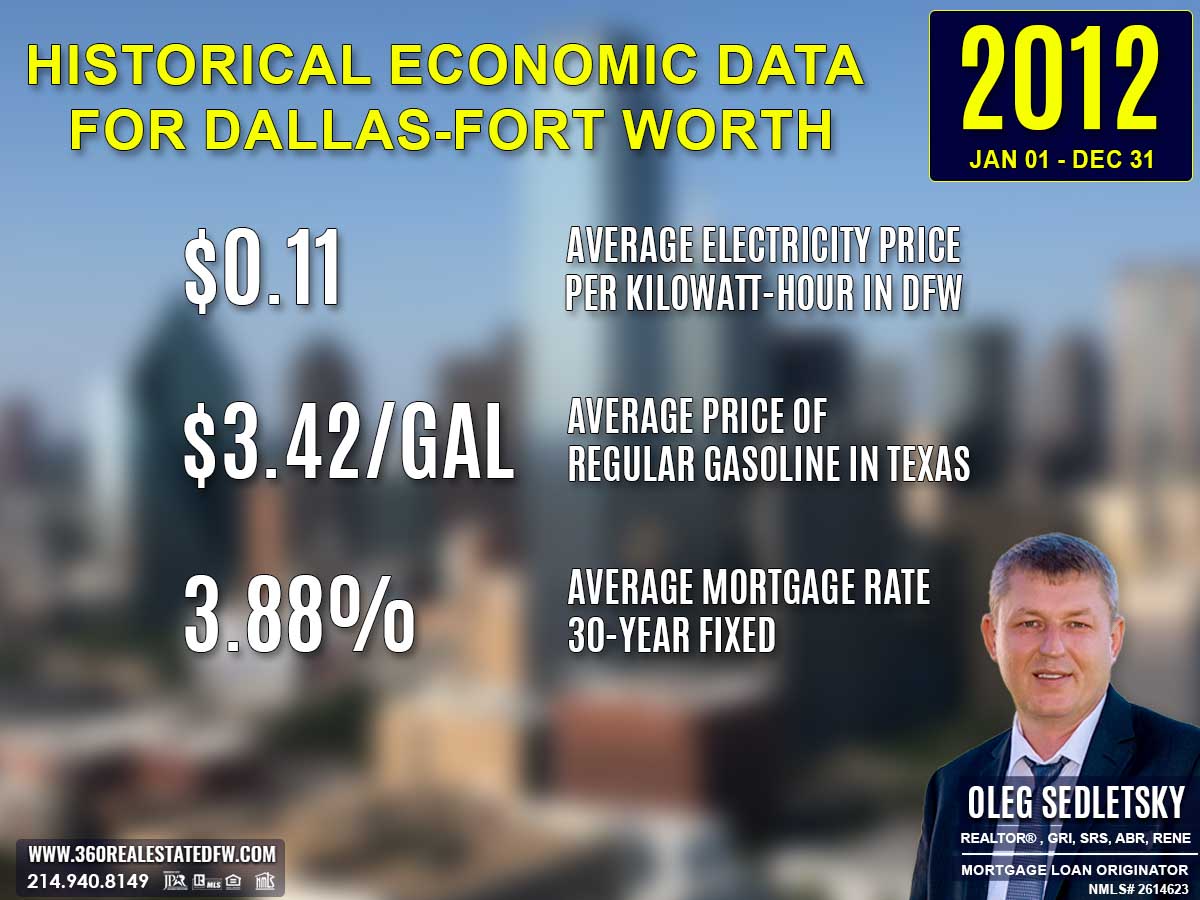

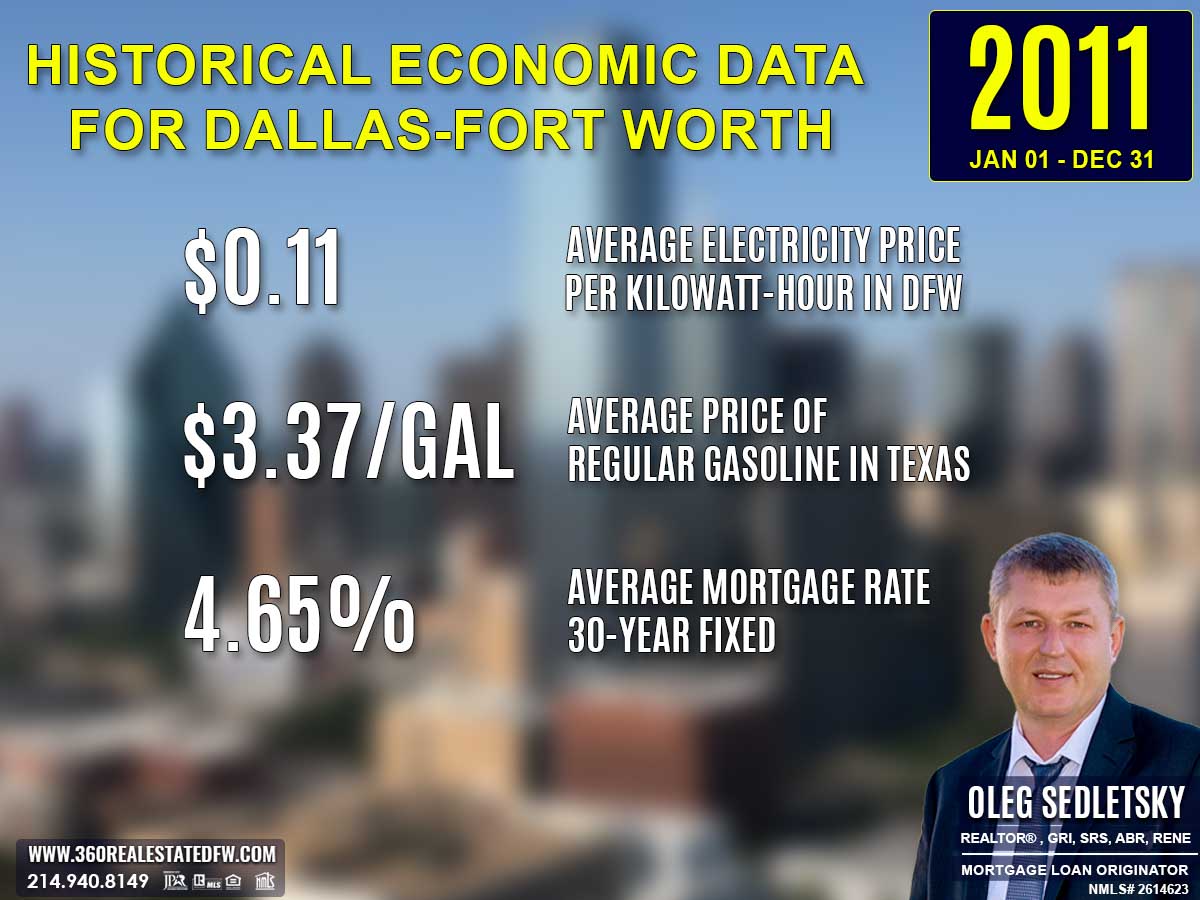

Economic context

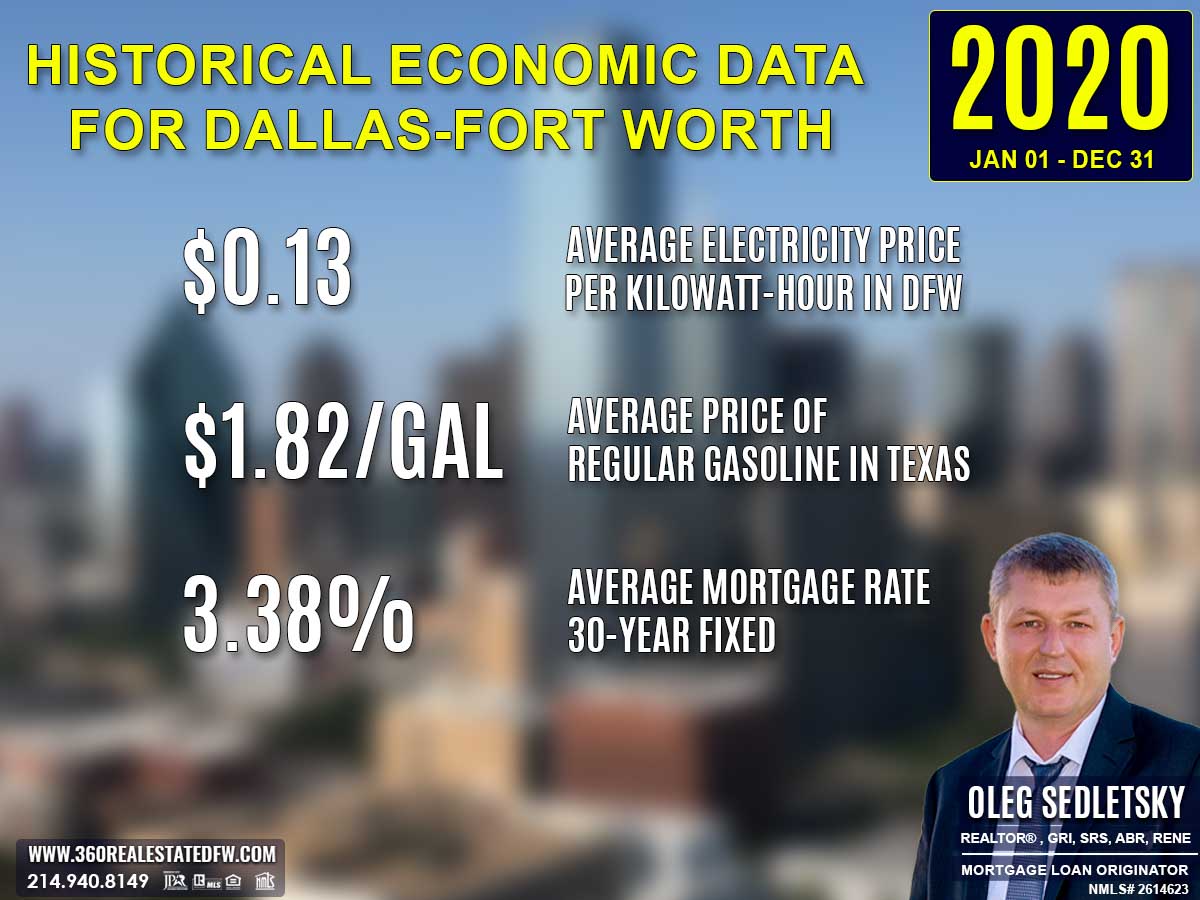

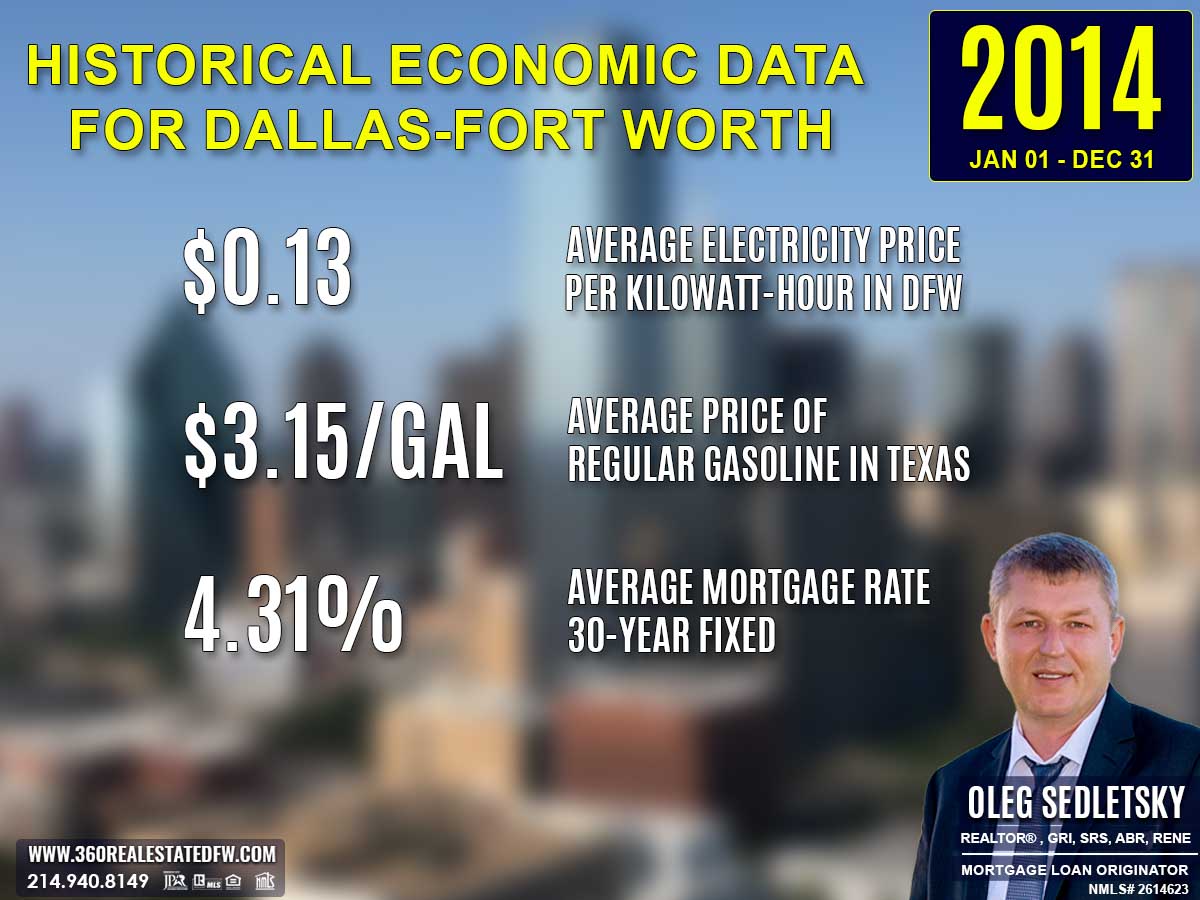

Average Electricity Costs in Dallas-Fort Worth in 2020

The average electricity cost per kilowatt-hour decreased slightly to $0.13, down from $0.14 in 2019. This drop provided homeowners with modest savings on utility expenses.

Texas Average Gas Prices in 2020

Average gas prices dropped significantly to $1.82 per gallon, compared to $2.29 in 2019. This reduction likely eased transportation costs for residents substantially.

Average 30-Year Fixed Mortgage Rate in 2020

The average 30-year fixed mortgage rate in 2020 dropped to 3.38%, a significant reduction compared to the 4.13% rate from the previous year. This decline in rates made home financing more affordable, allowing homebuyers to stretch their budgets and qualify for larger home loans. Lower borrowing costs were especially important during a year marked by economic uncertainties, helping to sustain activity in the housing market and offering buyers a rare opportunity to secure favorable terms.

Curious about today’s mortgage rates and the home you can comfortably afford?

Submit a no-obligation mortgage application today and get pre-approved to determine your budget and take the first step toward homeownership with confidence.

Summary of Differences Between 2019 and 2020 Real Estate Data for Blue Ridge, TX

The 2020 real estate market in Blue Ridge, TX revealed a mix of rising property values, slight changes in property features, and improvements in market efficiency compared to 2019. Key differences are detailed below:

Property Pricing

- Minimum Price: Fell to $61,300 from $70,000 in 2019, indicating more affordable entry-level options.

- Maximum Price: Surged to $695,000, up from $508,474, highlighting renewed activity in the luxury segment.

- Average Price: Increased to $334,746 from $307,110, marking stronger mid-to-high-market demand.

- Median Price: Grew to $359,000 from $340,000, signaling continued upward momentum in mid-market homes.

Property Features

- Bedrooms: Minimum beds increased to 2 from 1 in 2019, while average and maximum beds remained steady at 4 and 5 respectively.

- Bathrooms: Maximum baths rose to 6, up from 7 in 2019. Average baths stayed unchanged at 3 bathrooms per home.

- Square Footage:

- Minimum Size: Slightly decreased to 888 sq. ft. from 900 sq. ft., offering smaller housing options.

- Maximum Size: Decreased to 4,438 sq. ft., down from 5,620 sq. ft., reflecting a narrower high-end range.

- Average Size: Declined modestly to 2,391 sq. ft., from 2,465 sq. ft., demonstrating a marginal contraction in space.

- Median Size: Grew to 2,425 sq. ft., compared to the previous year’s 2,316 sq. ft., reinforcing mid-range property appeal.

Lot Size

- Minimum Lot Size: Increased to 0.254 acres from 0.130 acres, indicating slightly larger entry-level plots.

- Maximum Lot Size: Declined to 30.109 acres, from 33.260 acres, suggesting more manageable high-end land sizes.

- Average Lot Size: Rose to 3.571 acres, up from 2.992 acres, reflecting generally larger lots across the board.

Market Dynamics

-

Days on Market (DOM):

- Minimum DOM: Increased to 3 days from just 2 in 2019, showing slightly less rapid turnaround for the quickest sales.

- Maximum DOM: Dropped to 277 days, down from 399 days, reflecting shorter sale timelines at the higher end.

- Average DOM: Remained stable at 81 days, consistent with last year’s pace.

-

ClsPr/LstPr Ratio: Improved to 96.95%, up from 96.16%, showing better alignment between listing and closing prices.

-

ClsPr/OLP Ratio: Increased to 95.06%, compared to 94.23%, signaling reduced negotiation gaps and firmer seller control.

-

Price Per Square Foot: Rose to $143.29, up from $127.87, indicating higher unit values per square foot.

Year Built

- Oldest Property Built: Shifted forward to properties built in 1945, compared to 1910 in 2019.

- Newest Property Built: Remained consistent at 2020, showcasing new construction activity.

- Average Year Built: Moved forward to 2001 from 1999, reflecting a younger inventory overall.

- Median Year Built: Increased to 2015, from 2012, hinting at more recent housing stock for mid-market buyers.

Key Market Trends

- Luxury Home Growth: An increase in the maximum price, alongside higher square footage pricing, suggests rising demand for premium homes despite slightly smaller high-end properties.

- Improved Efficiency: Stronger close price ratios and a decline in maximum DOM indicate improved transaction processes and buyer confidence.

- Mid-Market Strength: Rising median prices and lot sizes reinforced growth in the mid-tier market, balancing premiums with affordability.

The 2020 market displayed resilience and growth, adapting to shifting buyer preferences while balancing affordability with high-end demand. It maintained stability in pace and efficiency while showcasing new opportunities across market segments.

Summary of Real Estate Market Analysis for Blue Ridge, TX in 2020

The 2020 real estate market in Blue Ridge, TX exemplified resilience and adaptability during an unprecedented year marked by the global COVID-19 pandemic. The market maintained a steady performance, with 41 homes closed, and saw notable growth in property values, particularly in the mid-to-high-tier segments. HomeBuyers, galvanized by historically low mortgage rates of 3.38%, sought properties that offered larger square footage, enhanced outdoor spaces, and features that suited a work-from-home lifestyle. Home Sellers benefited from firmer close price ratios, improved market efficiency, and sustained demand across all price points.

Key trends, such as rising property valuations and increasing per-square-foot prices of $143.29, demonstrated confidence in the market’s growth potential. While the pandemic temporarily affected economic conditions, the real estate sector adapted quickly, with buyers prioritizing lifestyle-oriented features and sellers optimizing returns through efficient transactions.

Ultimately, amidst uncertainties, the Blue Ridge, TX real estate market proved dynamic and robust, paving the way for future growth and innovation in housing solutions. Both buyers and sellers benefited from an environment defined by opportunity, flexibility, and resilience.

Why Statistics Data is Important

Understanding past market data is essential for making informed decisions in today’s real estate landscape. Historical statistics provide a foundational perspective on trends, aiding in fair pricing and negotiation.

Unlock Exceptional Service!

Assistance with all your real estate needs in the Dallas-Fort Worth area is just a click or call away. Reach out at 214-940-8149 or connect through the links below.

Oleg Sedletsky REALTOR® in Blue Ridge, Texas. Call/Text 214.940.8149

Greetings! I’m Oleg Sedletsky, and I’m excited to introduce myself as your go-to full-time licensed Texas REALTOR® and Mortgage Loan Originator.

I proudly represent JPAR® – Real Estate Brokerage as a REALTOR® and Utopia Mortgage LLC as a Mortgage Loan Originator! My designations and certifications reflect my dedication to helping you achieve your real estate goals in Blue Ridge, TX and other locations in the vibrant Dallas-Fort Worth area!

My commitment to ongoing professional development means I’m always enhancing my skills to serve you better. You can count on me as your trusted expert throughout your real estate journey. Plus, I’m fluent in English, Ukrainian, and Russian and ready to assist you every step of the way!

It’s All About You and Your Real Estate Dreams!

My mission is to serve you! With my knowledge and expertise, I’m here to help you achieve all your real estate goals and turn your dreams into reality!

I’m passionate about helping buyers and sellers navigate the exciting real estate landscape in Blue Ridge, Texas! Whether you’re searching for your dream home, exploring land options, or looking for commercial properties, my Real Estate Services have you covered.

Contact me today for all your real estate needs in Blue Ridge, Texas! Call/text 214-940-8149

Discover Yearly Real Estate Market Trends for Blue Ridge, TX

2003-2010

Blue Ridge, TX Real Estate Market in 2003

Blue Ridge, TX Real Estate Market in 2004

Blue Ridge, TX Real Estate Market in 2005

Blue Ridge, TX Real Estate Market in 2006

Blue Ridge, TX Real Estate Market in 2007

Blue Ridge, TX Real Estate Market in 2008

2011-2020

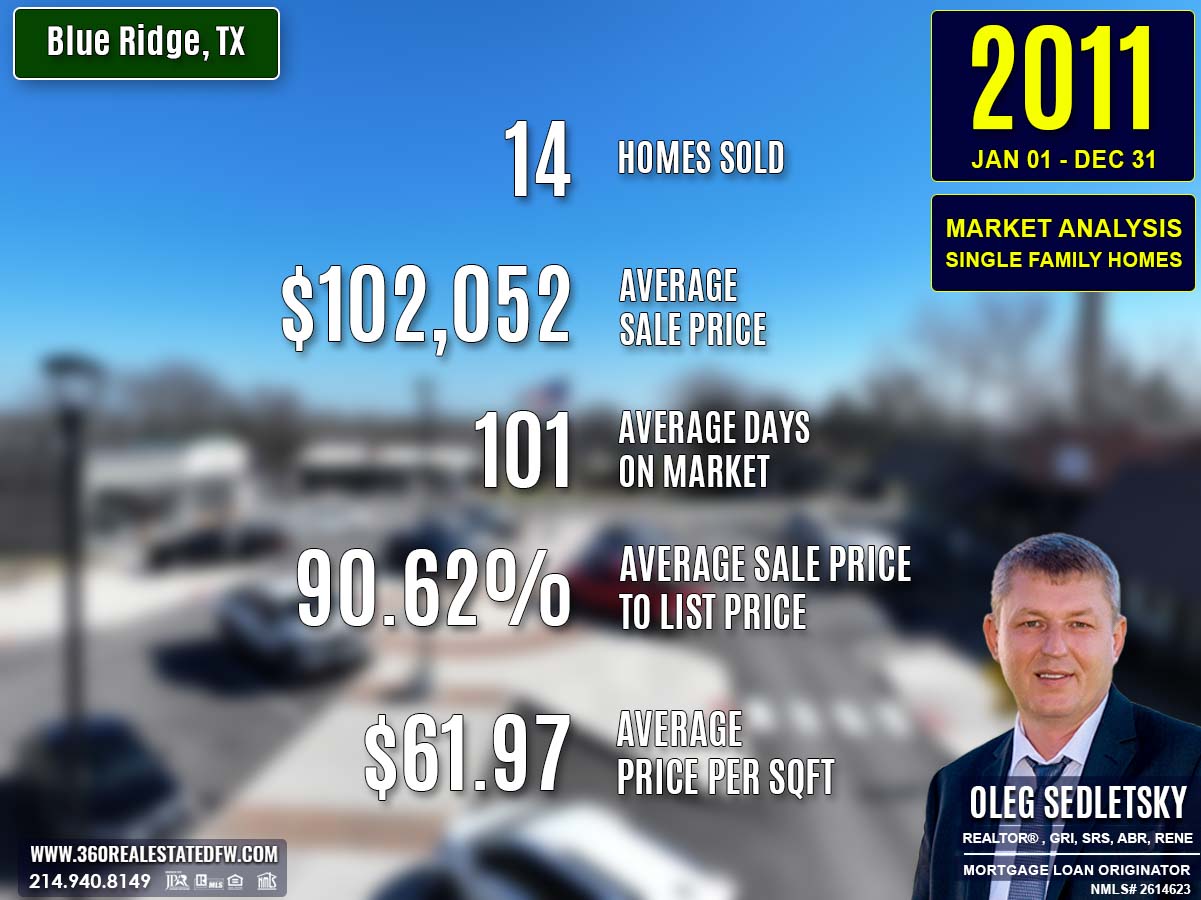

Blue Ridge, TX Real Estate Market in 2011

Blue Ridge, TX Real Estate Market in 2012

Blue Ridge, TX Real Estate Market in 2013

Blue Ridge, TX Real Estate Market in 2014

Blue Ridge, TX Real Estate Market in 2015

Blue Ridge, TX Real Estate Market in 2016

Blue Ridge, TX Real Estate Market in 2017

Blue Ridge, TX Real Estate Market in 2018

This market analysis is intended solely for educational purposes. This market analysis is based on data sourced from NTREIS, Inc. This analysis is exclusively focused on single-family homes and does not account for other property types. The total number of real estate transactions within the specified period and location may vary. Data accuracy cannot be guaranteed due to potential input errors made by NTREIS users. This market analysis does not account for all new construction home sales. If you need detailed information about recorded property sales or other public records, please contact the appropriate city or county office.

Blue Ridge, TX Real Estate: 2019 Analysis of the Single-Family Residential Housing Market

The 2019 real estate market in Blue Ridge, TX showcased an evolving landscape with increased transaction volumes, larger homes, and a robust mid-market segment. A total of 45 homes were sold during the year, highlighting a surge in activity compared to 2018, alongside significant changes in pricing, property characteristics, and economic factors. The year reflected a balanced market that catered to diverse buyer preferences, offering affordability and high-value opportunities.

Key Takeaways and Trends from Blue Ridge’s 2019 Real Estate Market

Pricing Range:

- Rising minimum and median prices highlighted stronger demand for mid-market and entry-level properties.

- A decline in the maximum price signified reduced activity or buyer pushback in the luxury segment.

Market Efficiency:

- Faster minimum DOM reflected high buyer interest in desirable listings, while longer maximum DOM pointed to market variability.

- Improved close price ratios indicated alignment of buyer and seller expectations.

Unique Outliers:

- The increase in larger homes and expansive lot sizes catered to buyers seeking premium and family-friendly properties.

- A drop in price per square foot made the market more accessible despite rising average and median prices.

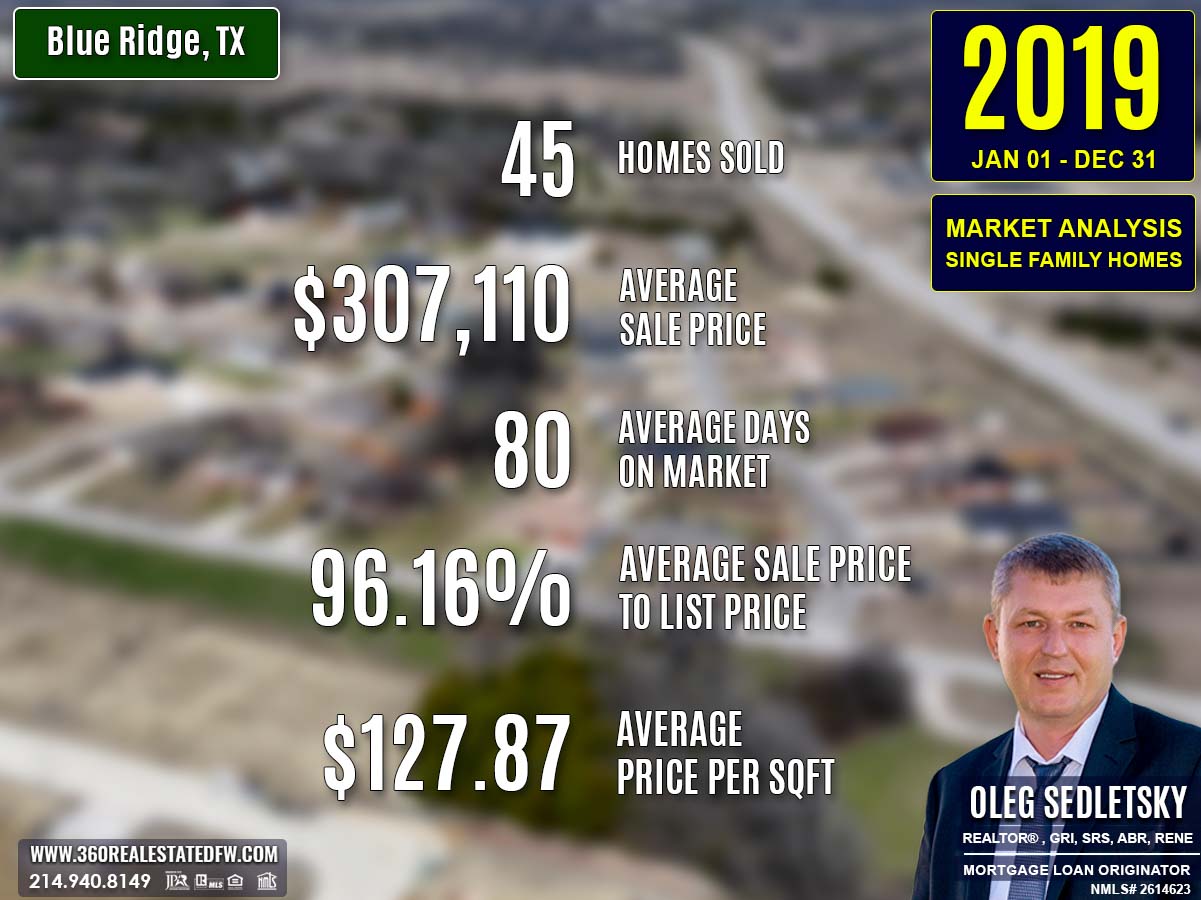

Total Homes Closed

The year concluded with 45 residential single-family homes sold, an increase from the 41 homes closed in 2018. This uptick in sales volume signifies growing buyer interest and confidence in Blue Ridge’s residential market.

Property Pricing Insights

Prices in 2019 painted a picture of diversity and opportunity:

- Minimum Price: Rose to $70,000, up from $55,000 in 2018, showcasing higher valuations in the affordable housing sector.

- Maximum Price: Dropped to $508,474, slightly below the $520,000 high of 2018, indicating less activity in the luxury segment.

- Average Price: Increased to $307,110, up from $283,632, reflecting robust mid-market demand.

- Median Price: Jumped to $340,000, from $302,000 in 2018, further highlighting stronger mid-range market trends.

Property Size and Features

Bedrooms & Bathrooms

- Bedrooms: Homes ranged from 1 to 6 bedrooms, with an average of 4 bedrooms per property, up from 3 in 2018.

- Bathrooms: The number of bathrooms saw growth, with properties featuring up to 7 baths, averaging 3 bathrooms.

Square Footage

- Minimum Size: Held steady at 900 sq. ft., indicating inclusivity in the lower size range.

- Maximum Size: Increased significantly to 5,620 sq. ft., up from 4,012 sq. ft., signaling larger homes entering the market.

- Average Size: Rose to 2,465 sq. ft., from 2,184 sq. ft., showing a clear trend toward spacious properties.

- Median Size: Grew to 2,316 sq. ft., up from 1,827 sq. ft. in the previous year.

Lot Size

- Minimum Lot Size: Remained at 0.130 acres.

- Maximum Lot Size: Expanded to 33.260 acres, from 26.6 acres in 2018, reflecting availability of more extensive properties.

- Average Lot Size: Decreased to 2.992 acres, from 4.375 acres, favoring moderately sized plots.

Market Dynamics

Days on Market (DOM)

- Minimum DOM: Fell to just 2 days, from 13 in 2018, indicating faster sales for highly desirable listings.

- Maximum DOM: Increased to 399 days, up from 215, revealing extended timelines for some properties.

- Average DOM: Lengthened to 80 days, from 62 days, suggesting slower overall market turnover.

Close Price Ratios

- ClsPr/LstPr (Close Price to Listing Price): Improved slightly to 96.16%, up from 95.92%, reflecting better alignment of sale prices with listings.

- ClsPr/OLP (Close Price to Original Listing Price): Increased to 94.23%, up from 93.60%, underscoring price stability through negotiations.

- Price Per Square Foot (Pr$/SqFt): Dropped to $127.87, down from $134.47, reflecting broader affordability across the market.

Insights into the Most Expensive Blue Ridge, TX Property Sold in 2019

The most expensive property sold in 2019 was a spacious and luxurious home offering opulence and comfort.

Key Highlights:

- Price: $508,474

- Bedrooms: 4

- Bathrooms: 4 (3 full and 1 half)

- Square Footage: 4,630 sq. ft.

- Price Per SqFt: $109.82

- Lot Size: 6.640 acres

- Days on Market: 399 days

- ClsPr/LstPr Ratio: 81.36%

- ClsPr/OLP Ratio: 73.69%

- Year Built: 2008

While this property commanded a premium price, the extended DOM and price adjustments underscore negotiation opportunities in the luxury market.

Economic context

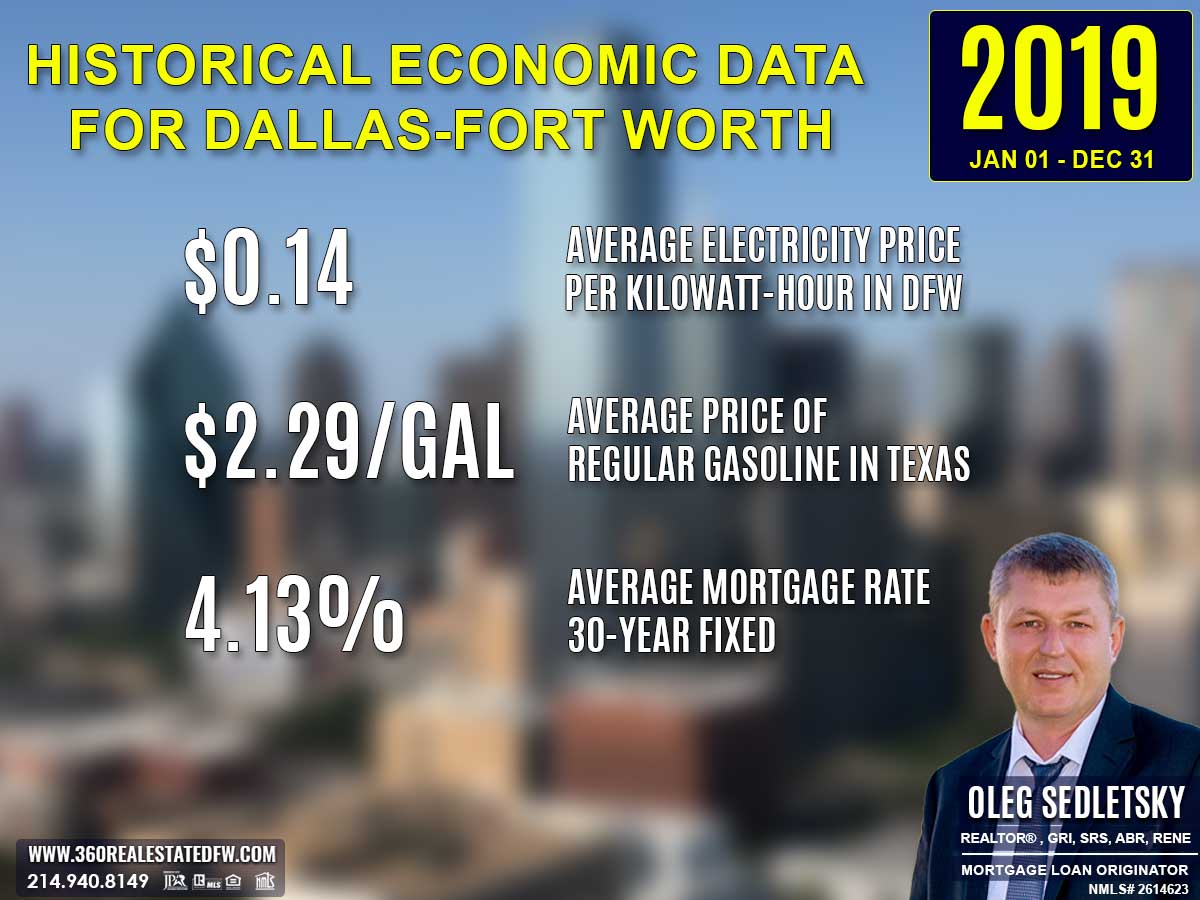

Average Electricity Costs in Dallas-Fort Worth in 2019

The average electricity cost in 2019 increased to $0.14 per kilowatt-hour, up from $0.13 in 2018. This minor rise reflected the growing cost of utilities that homeowners had to manage.

Texas Average Gas Prices in 2019

Gas prices, however, dropped slightly to $2.29 per gallon, from $2.44 in 2018, offering some relief in transportation costs for residents.

Average 30-Year Fixed Mortgage Rate in 2019

The average 30-year fixed mortgage rate in 2019 dropped to 4.13%, a noticeable improvement from 4.70% the previous year. This decline significantly boosted home affordability, allowing homebuyers to qualify for larger loans and secure better financial terms. Lower mortgage rates helped offset rising home prices in the mid-market, making it an ideal time for homebuyers to step into the property market or upgrade their homes.

Curious about today’s mortgage rates and the home you can comfortably afford?

Submit a no-obligation mortgage application today and get pre-approved to determine your budget and take the first step toward homeownership with confidence.

Summary of Differences Between 2018 and 2019 Real Estate Data for Blue Ridge, TX

The 2019 real estate market in Blue Ridge, TX marked significant shifts compared to 2018, indicating growth in activity and property diversity while reflecting mixed changes in pricing, size, and market dynamics.

Property Pricing

- Minimum Price: Increased to $70,000 in 2019 from $55,000 in 2018, reflecting higher valuations for entry-level homes.

- Maximum Price: Decreased slightly to $508,474, down from $520,000, suggesting a mild softening in the luxury market.

- Average Price: Rose noticeably to $307,110 from $283,632, indicating strengthened buyer activity in mid-market properties.

- Median Price: Increased to $340,000, up from $302,000, reinforcing the rise in mid-range market appeal.

Property Features

- Bedrooms: The average home size grew to 4 bedrooms in 2019, up from 3 bedrooms in 2018, offering larger family accommodations.

- Bathrooms: Properties contained more bathrooms, with a maximum of 7 baths compared to 5 in the previous year.

- Square Footage:

- Minimum Size: Increased to 900 sq. ft., from 720 sq. ft., reflecting fewer compact properties sold.

- Maximum Size: Jumped significantly to 5,620 sq. ft., up from 4,012 sq. ft., supporting a resurgence of larger homes.

- Average Size: Gained to 2,465 sq. ft., from 2,184 sq. ft., indicating a trend toward bigger homes.

- Median Size: Increased to 2,316 sq. ft., compared to 1,827 sq. ft. the previous year.

Lot Size

- Minimum Lot Size: Held steady at 0.130 acres.

- Maximum Lot Size: Grew to 33.260 acres, up from 26.6 acres, signifying more expansive properties available in 2019.

- Average Lot Size: Decreased to 2.992 acres, from 4.375 acres, suggesting a focus on moderately sized lots.

Market Dynamics

- Days on Market (DOM):

- Minimum DOM: Dropped drastically to 2 days from 13, indicating faster turnaround for certain properties.

- Maximum DOM: Increased significantly to 399 days, up from 215, reflecting broader variability in sale timelines.

- Average DOM: Lengthened to 80 days from 62 days, pointing to slower overall transaction speeds.

- ClsPr/LstPr Ratio: Improved slightly to 96.16%, from 95.92%, suggesting better alignment of final sale prices with listing prices.

- ClsPr/OLP Ratio: Increased marginally to 94.23%, compared to 93.6%, reinforcing price stability during sale negotiations.

- Price Per Square Foot (Pr$/SqFt): Declined to $127.87, down from $134.47, reflecting increased affordability despite rising average and median prices.

Year Built

- Oldest Property Built: Shifted further back to properties built in 1910, compared to 1930 in 2018, indicating the presence of older housing stock.

- Newest Property Built: Remained at 2019, demonstrating continued availability of newly constructed homes.

- Average Year Built: Moved forward to 1999 from 1996, showing an overall younger inventory.

- Median Year Built: Increased to 2012, from 2003 in 2018, signifying a notable push for more recently built homes.

Key Market Insights

- Larger Homes: A significant increase in maximum and average square footage suggested a preference for more spacious living.

- Mid-Market Strength: Higher median and average prices highlighted growing trends in mid-range buyer activity.

- Broader Market Dynamics: Faster sales for select listings alongside longer sales for others indicated highly variable buyer-seller engagement.

- Affordability Adjustments: Decline in price per square foot reflected affordability for buyers, even with rising average and median prices.

The 2019 market underscored Blue Ridge’s evolving real estate landscape with enhanced property diversity and demand while balancing affordability and value.

Summary of Real Estate Market Analysis for Blue Ridge, TX in 2019

The 2019 real estate market in Blue Ridge, TX demonstrated resilience, growth, and opportunity as the city navigated a changing landscape. With an uptick in sales volume and larger, more diverse property options, the market catered to a spectrum of buyers, from entry-level purchasers to those seeking spacious, high-value homes. Pricing trends reflected a strengthening mid-market, with rising median prices balanced by improved affordability through lower mortgage rates.

While transaction speeds varied, the consistent improvement in close price ratios signified a more stable harmony between buyer and seller expectations. The year solidified Blue Ridge’s reputation as a vibrant and dynamic housing market, setting the stage for continued prosperity and evolution in the years ahead.

Why Statistics Data is Important

Understanding past market data is essential for making informed decisions in today’s real estate landscape. Historical statistics provide a foundational perspective on trends, aiding in fair pricing and negotiation.

Unlock Exceptional Service!

Assistance with all your real estate needs in the Dallas-Fort Worth area is just a click or call away. Reach out at 214-940-8149 or connect through the links below.

Oleg Sedletsky REALTOR® in Blue Ridge, Texas. Call/Text 214.940.8149

Greetings! I’m Oleg Sedletsky, and I’m excited to introduce myself as your go-to full-time licensed Texas REALTOR® and Mortgage Loan Originator.

I proudly represent JPAR® – Real Estate Brokerage as a REALTOR® and Utopia Mortgage LLC as a Mortgage Loan Originator! My designations and certifications reflect my dedication to helping you achieve your real estate goals in Blue Ridge, TX and other locations in the vibrant Dallas-Fort Worth area!

My commitment to ongoing professional development means I’m always enhancing my skills to serve you better. You can count on me as your trusted expert throughout your real estate journey. Plus, I’m fluent in English, Ukrainian, and Russian and ready to assist you every step of the way!

It’s All About You and Your Real Estate Dreams!

My mission is to serve you! With my knowledge and expertise, I’m here to help you achieve all your real estate goals and turn your dreams into reality!

I’m passionate about helping buyers and sellers navigate the exciting real estate landscape in Blue Ridge, Texas! Whether you’re searching for your dream home, exploring land options, or looking for commercial properties, my Real Estate Services have you covered.

Contact me today for all your real estate needs in Blue Ridge, Texas! Call/text 214-940-8149

Discover Yearly Real Estate Market Trends for Blue Ridge, TX

2003-2010

Blue Ridge, TX Real Estate Market in 2003

Blue Ridge, TX Real Estate Market in 2004

Blue Ridge, TX Real Estate Market in 2005

Blue Ridge, TX Real Estate Market in 2006

Blue Ridge, TX Real Estate Market in 2007

Blue Ridge, TX Real Estate Market in 2008

2011-2020

Blue Ridge, TX Real Estate Market in 2011

Blue Ridge, TX Real Estate Market in 2012

Blue Ridge, TX Real Estate Market in 2013

Blue Ridge, TX Real Estate Market in 2014

Blue Ridge, TX Real Estate Market in 2015

Blue Ridge, TX Real Estate Market in 2016

Blue Ridge, TX Real Estate Market in 2017

Blue Ridge, TX Real Estate Market in 2018

This market analysis is intended solely for educational purposes. This market analysis is based on data sourced from NTREIS, Inc. This analysis is exclusively focused on single-family homes and does not account for other property types. The total number of real estate transactions within the specified period and location may vary. Data accuracy cannot be guaranteed due to potential input errors made by NTREIS users. This market analysis does not account for all new construction home sales. If you need detailed information about recorded property sales or other public records, please contact the appropriate city or county office.

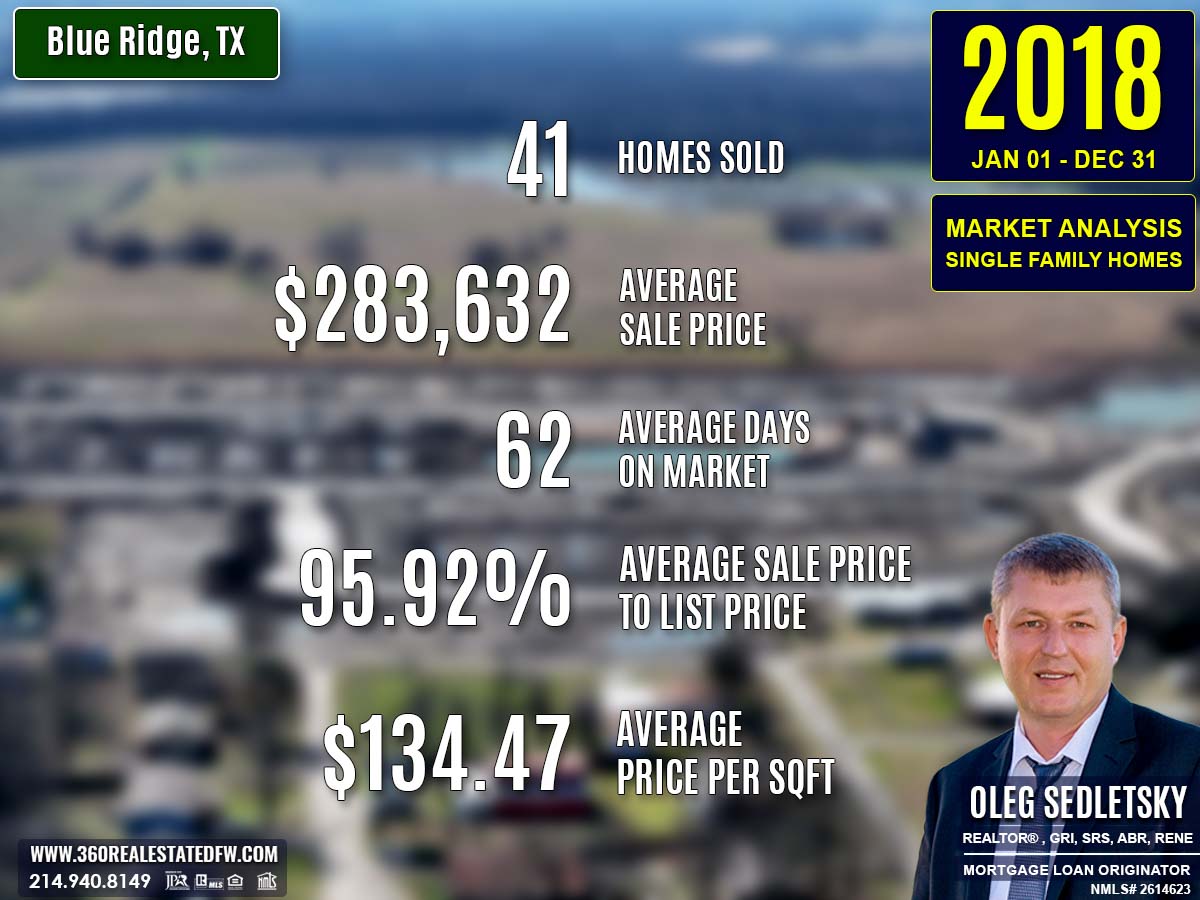

Blue Ridge, TX Real Estate: 2018 Analysis of the Single-Family Residential Housing Market

The 2018 real estate market in Blue Ridge, TX showcased a period of evolution and adjustments as the city adapted to shifting housing demands and economic conditions. A total of 41 homes were sold, reflecting slight market softening compared to the prior year, with reduced activity in the mid- and luxury-price segments.

However, the year maintained a competitive environment with diverse property options in terms of size, amenities, and pricing. Key economic factors such as rising mortgage rates and utility costs impacted affordability but did not hinder growth in certain metrics like price per square foot.

Key Takeaways and Trends from Blue Ridge’s 2018 Real Estate Market

Pricing Range: The drop in both maximum and median prices highlighted some softening in the luxury and mid-market segments. However, the market retained opportunities for entry-level buyers with the lower minimum price of $55,000.

Market Efficiency: The slightly longer average DOM and lower close price ratios indicated reduced sales velocity and buyer confidence, partially due to economic shifts.

Unique Outliers: The increase in price per square foot and limited availability of larger homes emphasized changing buyer preferences towards compact, high-value homes.

Total Homes Closed

The year ended with 41 residential single-family homes closed, fewer than the 46 homes sold in 2017. This decline pointed to reduced transaction volume, possibly influenced by changing buyer activity and rising interest rates.

Property Pricing Insights

The 2018 market delivered varied pricing options across different segments:

- Minimum Price: Dropped to $55,000, from $65,000 in 2017, broadening affordability for entry-level buyers.

- Maximum Price: Reduced slightly to $520,000, compared to the $570,000 high seen the prior year.

- Average Price: Declined moderately to $283,632, down from $293,666, indicating tempered overall valuations.

- Median Price: Fell to $302,000, lower than 2017’s $318,250, reflecting reduced mid-market activity.

Property Size and Features

Bedrooms & Bathrooms

- Bedrooms: Ranged from 2 to 5 bedrooms, with an average of 3 bedrooms, slightly lower than the 4-bedroom average in 2017.

- Bathrooms: Homes offered up to 5 baths, with an average of 3 bathrooms, consistent with the previous year.

Square Footage

- Minimum Size: Decreased to 720 sq. ft., down from 900 sq. ft., introducing smaller home options.

- Maximum Size: Reduced to 4,012 sq. ft., compared to 4,538 sq. ft. in 2017.

- Average Size: Moderated to 2,184 sq. ft., down from 2,355 sq. ft., reflecting more compact properties overall.

- Median Size: Dropped to 1,827 sq. ft., from 2,213 sq. ft., suggesting a prevailing trend toward smaller homes.

Lot Size

- Minimum Lot Size: Decreased to 0.130 acres, compared to 0.172 acres in 2017.

- Maximum Lot Size: Reduced to 26.600 acres, down from 49.310 acres, signaling less availability of expansive properties.

- Average Lot Size: Increased slightly to 4.375 acres, from 4.020 acres, reflecting a preference for moderately larger plots.

Market Dynamics

Days on Market (DOM)

- Minimum DOM: Increased significantly to 13 days, up from just 2 days in 2017, indicating slower turnaround for the quickest sales.

- Maximum DOM: Dropped to 215 days, an improvement over the 369-day maximum in the prior year.

- Average DOM: Increased slightly to 62 days, compared to 59 days in 2017, suggesting a slight slowdown in overall sales activity.

Close Price Ratios

- ClsPr/LstPr (Close Price to Listing Price): Declined to 95.92%, from 97.98%, giving buyers more bargaining flexibility.

- ClsPr/OLP (Close Price to Original Listing Price): Dropped to 93.60%, from 96.89%, reflecting increased price adjustments.

- Price Per Square Foot (Pr$/SqFt): Increased to $134.47, up from $131.47 in 2017, indicating strong valuation for smaller, more efficient homes.

Insights into the Most Expensive Blue Ridge, TX Property Sold in 2018

The most expensive property sold in 2018 was a well-appointed, modern home offering substantial value and design appeal.

Key Highlights:

- Price: $520,000

- Bedrooms: 3

- Bathrooms: 2

- Square Footage: 2,273 sq. ft.

- Price Per SqFt: $228.77

- Lot Size: 10.000 acres

- Days on Market: 13 days (fast turn-around time)

- ClsPr/LstPr Ratio: 96.67%

- ClsPr/OLP Ratio: 96.67%

- Year Built: 1999

This property combined modern features with ample space, making it highly desirable in the market.

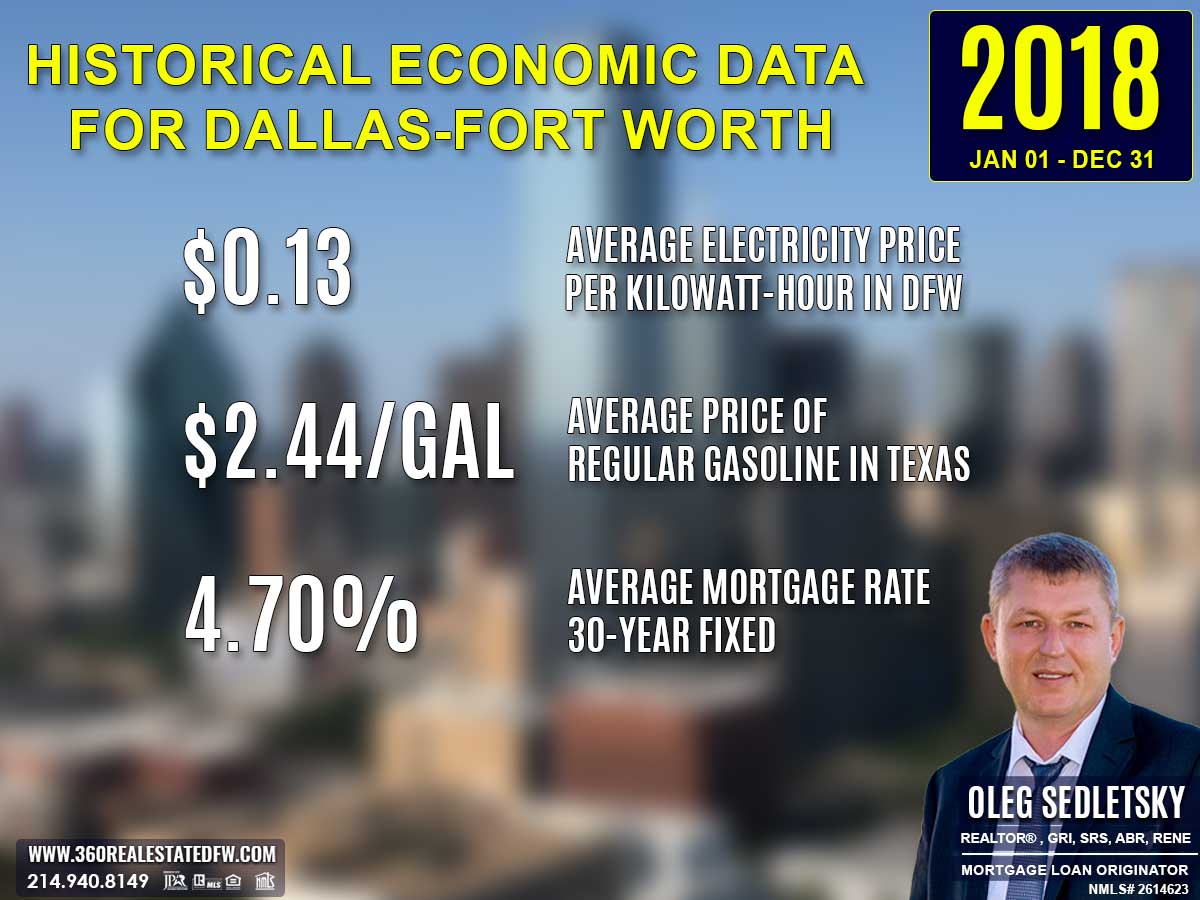

Economic context

Average Electricity Costs in Dallas-Fort Worth in 2018

The average electricity cost in 2018 increased to $0.13 per kilowatt-hour. Though marginally higher than 2017’s rate, it remained manageable for homeowners and reflected minor increases in utility expenses.

Texas Average Gas Prices in 2018

Gas prices rose to $2.44 per gallon, up from $2.19 in 2017. This increment may have slightly impacted transportation and commuting budgets but was not a significant deterrent for homebuyers.

Average 30-Year Fixed Mortgage Rate in 2018

The average 30-year fixed mortgage rate in 2018 climbed to 4.70%, marking an increase from the 4.14% rate witnessed in 2017. This rise in rates slightly tightened home affordability, potentially influencing buyer activity and market trends. Despite the increase, the rate remained within historical norms, keeping homeownership accessible for many.

Curious about today’s mortgage rates and the home you can comfortably afford?

Submit a no-obligation mortgage application today and get pre-approved to determine your budget and take the first step toward homeownership with confidence.

Summary of Differences Between 2017 and 2018 Real Estate Data for Blue Ridge, TX

The 2018 real estate market in Blue Ridge, TX experienced some notable shifts compared to 2017, reflecting adjustments in property values, buyer activity, and market performance.

Property Pricing

- Minimum Price: Decreased to $55,000 from $65,000, offering greater affordability for entry-level buyers.

- Maximum Price: Dropped slightly to $520,000, compared to $570,000 in 2017, reflecting a softening at the luxury end of the market.

- Average Price: Declined to $283,632 from $293,666, indicating tempered overall property valuations.

- Median Price: Fell to $302,000 from $318,250, signifying reduced activity in the mid-market segment.

Property Size

- Square Footage:

- Minimum Size: Decreased to 720 sq. ft. from 900 sq. ft., signaling smaller homes entering the market.

- Maximum Size: Reduced to 4,012 sq. ft. from 4,538 sq. ft., limiting larger home offerings.

- Average Size: Moderated to 2,184 sq. ft. from 2,355 sq. ft.

- Median Size: Dropped to 1,827 sq. ft. from 2,213 sq. ft., reflecting a smaller average property size overall.

Lot Size

- Minimum Lot Size: Decreased slightly to 0.130 acres from 0.172 acres.

- Maximum Lot Size: Reduced significantly to 26.600 acres from 49.310 acres, suggesting fewer large-lot properties in the mix.

- Average Lot Size: Increased slightly to 4.375 acres from 4.020 acres, showing a mild shift towards moderately larger plots.

Bedrooms and Bathrooms

- Bedrooms: The average number decreased to 3 bedrooms in 2018, down from 4 bedrooms in 2017.

- Bathrooms: Held strong at an average of 3 bathrooms, although the maximum count dropped to 5, from 6 in 2017.

Market Dynamics

-

Days on Market (DOM):

- Minimum DOM: Increased to 13 days from 2 days, indicating a slowdown in the quickest close category.

- Maximum DOM: Reduced to 215 days from 369, suggesting fewer prolonged sales.

- Average DOM: Rose to 62 days from 59 days, indicating slightly longer wait times to close.

-

ClsPr/LstPr Ratio: Decreased marginally to 95.92% from 97.98%, giving buyers slightly more room for negotiation.

-

ClsPr/OLP Ratio: Declined to 93.60% from 96.89%, reflecting more significant price reductions before sales.

-

Price Per Square Foot (Pr$/SqFt): Increased to $134.47 from $131.47, highlighting improved valuations despite lower overall property prices.

Year Built

- Oldest Property Built: Advanced to 1930, from 1919, signaling a removal of older historical homes from the market.

- Newest Property Built: Remained unchanged at 2018, reflecting continued newly built options.

- Average Year Built: Stepped back slightly to 1996 from 2001.

- Median Year Built: Stayed consistent at 2003.

Key Market Shifts

- Softening Prices: Reduced minimum, maximum, average, and median prices suggested slight buyer hesitancy or an adjustment in expectations.

- Smaller Properties Listed: Decreases in property size and lot size metrics reflected changing inventory.

- Moderate Market Activity: Slightly longer average DOM and lower price realization ratios indicated a less competitive environment.

- Improved Value Per Square Foot: The increase in Pr$/SqFt highlighted stronger valuation for smaller or more efficiently designed homes.

Overall, the 2018 market balanced affordability with demand, featuring more compact and value-conscious options while adjusting to evolving buyer preferences and economic conditions.

Summary of Real Estate Market Analysis for Blue Ridge, TX in 2018

The 2018 real estate market in Blue Ridge, TX highlighted a year of adaptation and stabilization. With a slight decrease in sales volume and moderation in pricing trends, the market catered to a balance of affordability and value. HomeBuyers benefited from lower entry-point prices and a wide range of property options, while sellers saw improved valuations with a rise in price per square foot.

Despite a minor slowdown in transaction speeds and tighter financing conditions, the market maintained resilience, offering opportunities for both seasoned investors and first-time homebuyers. The year closed on a stable note, setting the stage for potential growth and further evolution in the years ahead.

Why Statistics Data is Important

Understanding past market data is essential for making informed decisions in today’s real estate landscape. Historical statistics provide a foundational perspective on trends, aiding in fair pricing and negotiation.

Unlock Exceptional Service!

Assistance with all your real estate needs in the Dallas-Fort Worth area is just a click or call away. Reach out at 214-940-8149 or connect through the links below.

Oleg Sedletsky REALTOR® in Blue Ridge, Texas. Call/Text 214.940.8149

Greetings! I’m Oleg Sedletsky, and I’m excited to introduce myself as your go-to full-time licensed Texas REALTOR® and Mortgage Loan Originator.

I proudly represent JPAR® – Real Estate Brokerage as a REALTOR® and Utopia Mortgage LLC as a Mortgage Loan Originator! My designations and certifications reflect my dedication to helping you achieve your real estate goals in Blue Ridge, TX and other locations in the vibrant Dallas-Fort Worth area!

My commitment to ongoing professional development means I’m always enhancing my skills to serve you better. You can count on me as your trusted expert throughout your real estate journey. Plus, I’m fluent in English, Ukrainian, and Russian and ready to assist you every step of the way!

It’s All About You and Your Real Estate Dreams!

My mission is to serve you! With my knowledge and expertise, I’m here to help you achieve all your real estate goals and turn your dreams into reality!

I’m passionate about helping buyers and sellers navigate the exciting real estate landscape in Blue Ridge, Texas! Whether you’re searching for your dream home, exploring land options, or looking for commercial properties, my Real Estate Services have you covered.

Contact me today for all your real estate needs in Blue Ridge, Texas! Call/text 214-940-8149

Discover Yearly Real Estate Market Trends for Blue Ridge, TX

2003-2010

Blue Ridge, TX Real Estate Market in 2003

Blue Ridge, TX Real Estate Market in 2004

Blue Ridge, TX Real Estate Market in 2005

Blue Ridge, TX Real Estate Market in 2006

Blue Ridge, TX Real Estate Market in 2007

Blue Ridge, TX Real Estate Market in 2008

2011-2020

Blue Ridge, TX Real Estate Market in 2011

Blue Ridge, TX Real Estate Market in 2012

Blue Ridge, TX Real Estate Market in 2013

Blue Ridge, TX Real Estate Market in 2014

Blue Ridge, TX Real Estate Market in 2015

Blue Ridge, TX Real Estate Market in 2016

Blue Ridge, TX Real Estate Market in 2017

Blue Ridge, TX Real Estate Market in 2018

This market analysis is intended solely for educational purposes. This market analysis is based on data sourced from NTREIS, Inc. This analysis is exclusively focused on single-family homes and does not account for other property types. The total number of real estate transactions within the specified period and location may vary. Data accuracy cannot be guaranteed due to potential input errors made by NTREIS users. This market analysis does not account for all new construction home sales. If you need detailed information about recorded property sales or other public records, please contact the appropriate city or county office.

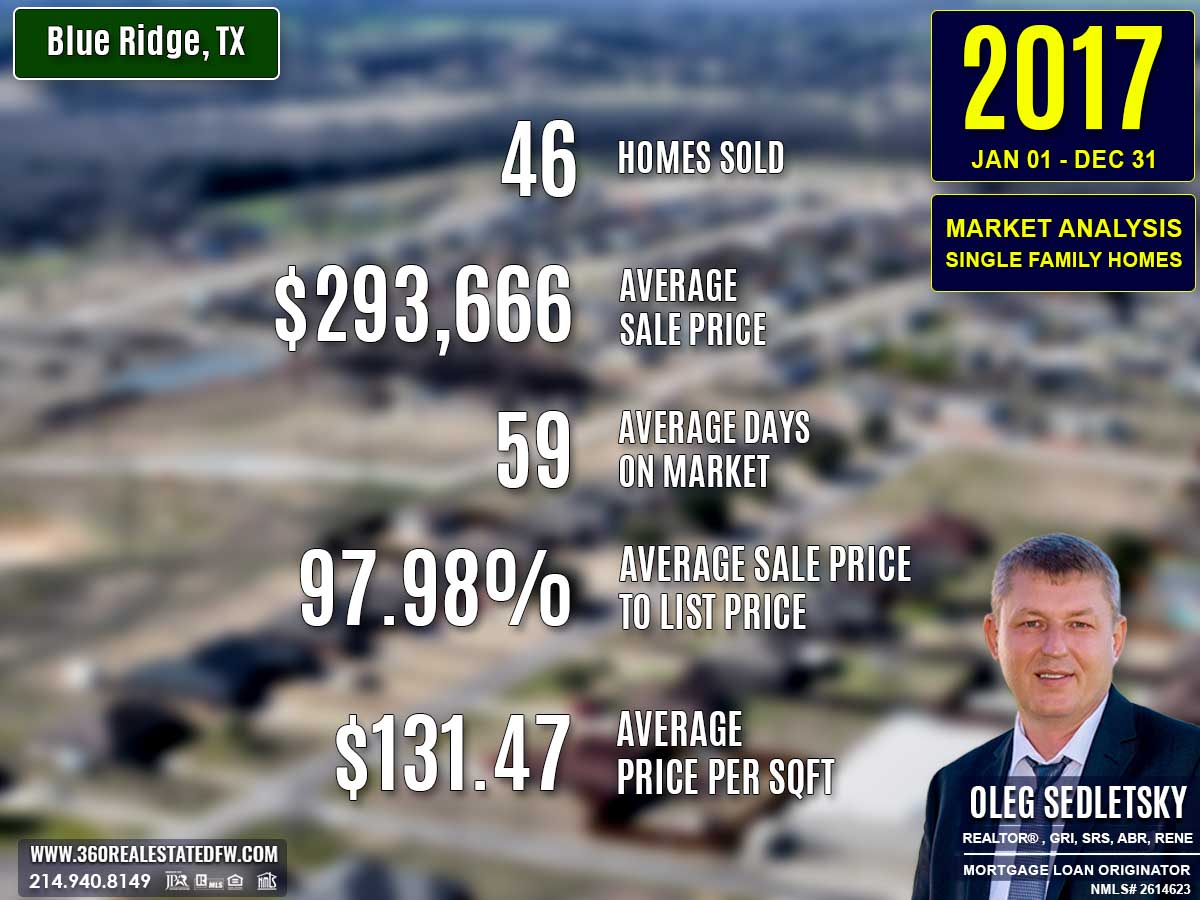

Blue Ridge, TX Real Estate: 2017 Analysis of the Single-Family Residential Housing Market

The year 2017 marked a period of strong activity and growth for Blue Ridge, Texas’s real estate market. With 46 homes sold, a significant rise from 35 sales in 2016, the market demonstrated heightened buyer demand and expanding opportunities.

Housing prices continued to climb, properties showcased greater diversity, and market dynamics improved, making it a fruitful year for both Home-buyers and Home-sellers. Additionally, economic factors such as low mortgage rates and moderate cost increases maintained affordability and encouraged homeownership.

Key Takeaways and Trends from Blue Ridge’s 2017 Real Estate Market

Pricing Range: The market emphasized growth in all pricing tiers, with both the average and median prices reflecting stronger demand. The broad spectrum of property values, ranging from $65,000 to $570,000, catered to diverse buyers, strengthening the mid- and luxury-market segments.

Market Efficiency: The average time on the market improved dramatically to 59 days, reflecting enhanced efficiency. Higher close price percentages and reduced price adjustments before sale reinforced a seller-friendly environment.

Unique Outliers:

- The largest property spanned 49.310 acres, showcasing opportunities for rural retreats or large estates.

- At $527.78 per square foot, the priciest home demonstrated premium valuation potential in Blue Ridge.

Total Homes Closed

In 2017, 46 single-family residential homes were sold, marking a significant increase of 11 homes compared to the 35 sold in 2016. This growth reflected a thriving market driven by increased buyer engagement and varied property options.

Property Pricing Insights

The 2017 market saw an upward trajectory in home pricing, accompanied by a broad range of affordability:

- Minimum Price: $65,000 (matched with 2016), keeping entry points affordable.

- Maximum Price: $570,000, slightly higher than 2016’s $568,500, indicating continued strength in luxury homes.

- Average Price: $293,666, rising from $281,767, showcasing an overall increase in market value.

- Median Price: $318,250, up from $300,000, underscoring robust mid-market demand.

Property Size and Features

The homes sold in 2017 offered a mix of configurations to meet diverse buyer preferences:

Bedrooms & Bathrooms

- Bedrooms: Homes featured 2 to 5 bedrooms, with an average of 4 bedrooms, consistent with 2016 levels.

- Bathrooms: Ranges expanded to up to 6 bathrooms, with an average of 3 bathrooms, slightly more than the year before.

Square Footage

- Minimum Size: 900 sq. ft., slightly smaller than 2016’s 1,024 sq. ft.

- Maximum Size: Grew to 4,538 sq. ft., from 4,000 sq. ft.

- Average Size: 2,355 sq. ft., a slight increase from 2,348 sq. ft. in 2016.

- Median Size: Increased moderately to 2,213 sq. ft., from 2,162 sq. ft., reflecting a preference for spacious homes.

Lot Size

- Minimum Lot Size: Increased slightly to 0.172 acres, from 0.151 acres in 2016.

- Maximum Lot Size: Expanded significantly to 49.310 acres, from 36.587 acres, showcasing broader land opportunities.

- Average Lot Size: Decreased to 4.020 acres, from 4.574 acres, reflecting diversity in property offerings.

Market Dynamics

Days on Market (DOM)

The market exhibited improved efficiency in 2017:

- Minimum DOM: Decreased to 2 days, from 4 days in 2016, enabling quicker sales for well-positioned properties.

- Maximum DOM: Dropped slightly to 369 days, from 400 days.

- Average DOM: Improved significantly to 59 days, down from 86 days, signaling faster property turnovers.

Close Price Ratios

- ClsPr/LstPr (Close Price to Listing Price): Increased to 97.98%, from 95.15%, showing greater alignment between list and sale prices.

- ClsPr/OLP (Close Price to Original Listing Price): Improved to 96.89%, from 93.51%, indicating reduced price reductions prior to closing.

- Price Per Square Foot: Jumped to $131.47, up from $118.01 in 2016, reflecting stronger valuation.

Insights into the Most Expensive Blue Ridge, TX Property Sold in 2017

The priciest home sold in 2017 was a historic estate that seamlessly blended timeless charm, unmatched exclusivity, and a sprawling 49.3-acre lot.

Property Highlights:

- Price: $570,000

- Bedrooms: 2

- Bathrooms: 1

- Square Footage: 1,080 sq. ft.

- Price Per SqFt: $527.78

- Lot Size: 49.310 acres

- Days on Market: 77 days

- ClsPr/LstPr Ratio: 95.00%

- ClsPr/OLP Ratio: 95.00%

- Year Built: 1919

This extraordinary property offered vast acreage, a cozy living space, and a unique historical appeal in Blue Ridge’s housing landscape.

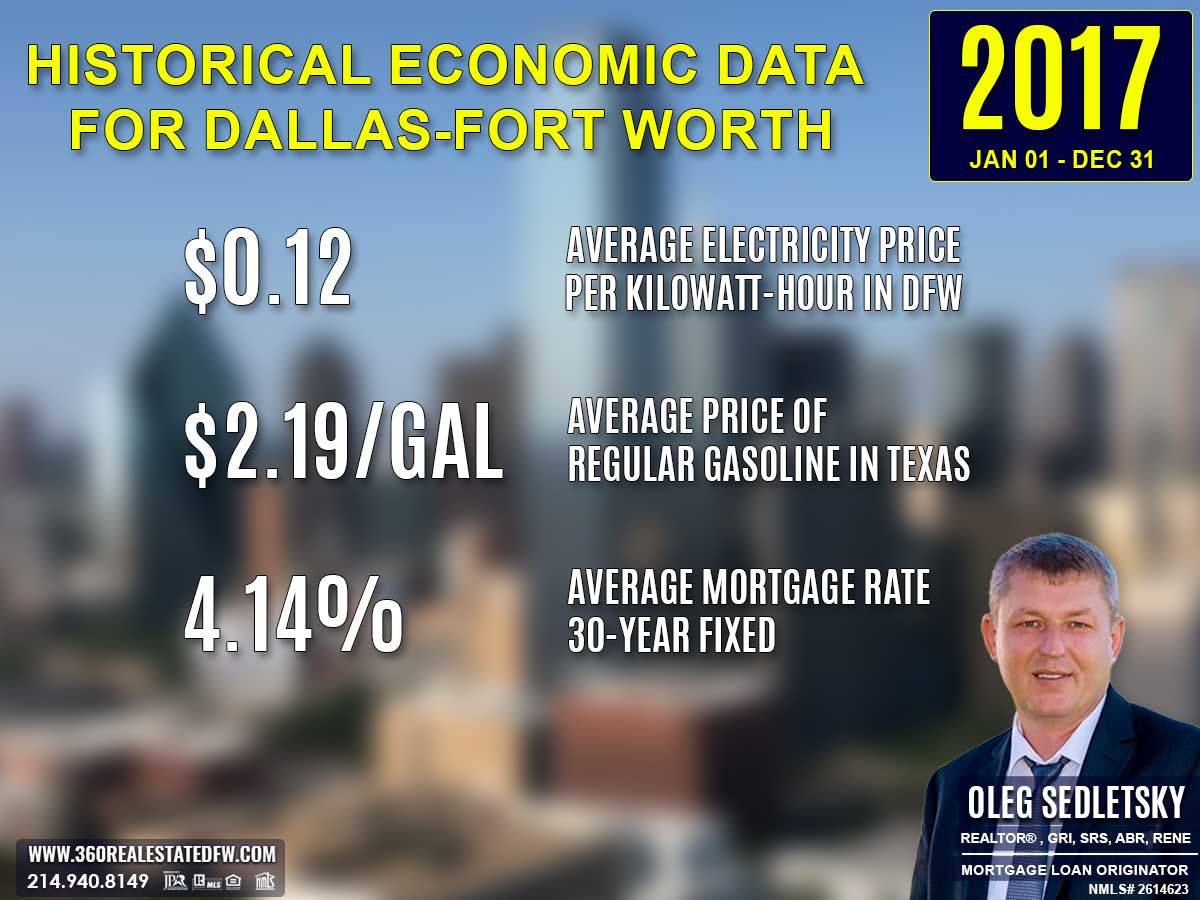

Economic context

Average Electricity Costs in Dallas-Fort Worth in 2017

The average electricity cost in 2017 increased slightly to $0.12 per kilowatt-hour. Although higher than the previous year, this rate remained affordable for homeowners, balancing utility bills effectively.

Texas Average Gas Prices in 2017

Gas prices rose to an average of $2.19 per gallon, up from $1.91. This increase may have impacted commuting costs but remained manageable for homebuyers.

Average 30-Year Fixed Mortgage Rate in 2017

The average 30-year fixed mortgage rate in 2017 was 4.14%, reflecting a modest increase from the previous year’s 3.79%. Despite this rise, the rate remained historically low, making home financing accessible for many buyers. This affordability encouraged broader participation in the real estate market, enabling buyers to secure loans for both entry-level and premium properties.

Curious about today’s mortgage rates and the home you can comfortably afford?

Submit a no-obligation mortgage application today and get pre-approved to determine your budget and take the first step toward homeownership with confidence.

Summary of Differences Between 2016 and 2017 Real Estate Data for Blue Ridge, TX

The 2017 real estate market in Blue Ridge, Texas showed notable shifts and trends compared to 2016, including increased sales volume, rising prices, and evolving market dynamics.

Property Pricing

- Minimum Price: Stayed consistent at $65,000, maintaining affordability for entry-level buyers.

- Maximum Price: Increased slightly to $570,000, from $568,500 in 2016, showing strength in the high-end market.

- Average Price: Rose to $293,666, up from $281,767, indicating further growth in property values.

- Median Price: Jumped to $318,250 from $300,000, reflecting robust demand in the mid-market segment.

Property Features

- Bedrooms: Varied from 2 to 5, compared to 2 to 6 in 2016. The average remained steady at 4 bedrooms.

- Bathrooms: Expanded to 1 to 6 baths, up from 1 to 5, with the average staying at 3 bathrooms.

- Square Footage:

- Minimum Size: Decreased slightly to 900 sq. ft., from 1,024 sq. ft.

- Maximum Size: Increased to 4,538 sq. ft., up from 4,000 sq. ft.

- Average Size: Stayed nearly the same at 2,355 sq. ft., compared to 2,348 sq. ft.

- Median Size: Grew moderately to 2,213 sq. ft., from 2,162 sq. ft.

Lot Size

- Minimum Lot Size: Increased slightly to 0.172 acres, up from 0.151 acres.

- Maximum Lot Size: Expanded significantly to 49.310 acres, compared to 36.587 acres, catering to buyers seeking larger spaces.

- Average Lot Size: Decreased to 4.020 acres from 4.574 acres, showing a focus on compact properties.

Market Dynamics

-

Days on Market (DOM):

- Minimum DOM: Dropped to 2 days, down from 4 days, signifying quicker sales for efficiently priced properties.

- Maximum DOM: Fell to 369 days, from 400 days, reducing the duration of extended sales.

- Average DOM: Decreased dramatically to 59 days, from 86 days, reflecting improved market efficiency.

-

ClsPr/LstPr (Close Price to Listing Price): Improved significantly to 97.98%, from 95.15%, showcasing stronger alignment between list and sale prices.

-

ClsPr/OLP (Close Price to Original Listing Price): Rose to 96.89%, from 93.51%, indicating fewer price reductions before a sale.

-

Price Per Square Foot (Pr$/SqFt): Increased sharply to $131.47, from $118.01, highlighting further property value appreciation.

Year Built

- Oldest Property Built: Shifted to 1919, from 1938, indicating the inclusion of older, historical homes in 2017.

- Newest Property Built: Remained at 2017, showing ongoing opportunities in new constructions.

- Average Year Built: Advanced to 2001, from 1997, favoring more modern homes.

- Median Year Built: Progressed to 2015, from 2003, signifying a trend toward newer properties.

Notable Market Shifts

- Higher Prices: The boost in average and median prices, paired with an increased price per square foot, reflects strong demand and market growth.

- Improved Efficiency: The significant reduction in average Days on Market (DOM) and higher close price ratios demonstrate a competitive and efficient market.

- Unique Outliers: The substantial increase in the largest lot size to over 49 acres and a new pricing high of $570,000 indicate greater diversity within the market framework.

Overall, the 2017 market in Blue Ridge proved to be dynamic, with heightened activity, sharper pricing trends, and enhancements in market efficiency, making it a pivotal year.

Summary of Real Estate Market Analysis for Blue Ridge, TX in 2017

The 2017 real estate market in Blue Ridge, TX showcased significant progress, demonstrating an active and thriving housing sector. With a notable rise in total sales and sustained growth in property values, the market provided excellent opportunities for buyers and sellers across various segments.

Pricing trends pointed to a strengthening mid- to upper-market sector, while faster sales cycles and improved market efficiency emphasized a competitive and dynamic environment. Economic conditions, including historically low mortgage rates and manageable utility costs, supported continued buyer interest and accessibility.

Ultimately, 2017 reinforced Blue Ridge‘s position as a robust and evolving real estate market, attracting both new homeowners and seasoned investors while setting a solid foundation for future growth.

Why Statistics Data is Important

Understanding past market data is essential for making informed decisions in today’s real estate landscape. Historical statistics provide a foundational perspective on trends, aiding in fair pricing and negotiation.

Unlock Exceptional Service!

Assistance with all your real estate needs in the Dallas-Fort Worth area is just a click or call away. Reach out at 214-940-8149 or connect through the links below.

Oleg Sedletsky REALTOR® in Blue Ridge, Texas. Call/Text 214.940.8149

Greetings! I’m Oleg Sedletsky, and I’m excited to introduce myself as your go-to full-time licensed Texas REALTOR® and Mortgage Loan Originator.

I proudly represent JPAR® – Real Estate Brokerage as a REALTOR® and Utopia Mortgage LLC as a Mortgage Loan Originator! My designations and certifications reflect my dedication to helping you achieve your real estate goals in Blue Ridge, TX and other locations in the vibrant Dallas-Fort Worth area!

My commitment to ongoing professional development means I’m always enhancing my skills to serve you better. You can count on me as your trusted expert throughout your real estate journey. Plus, I’m fluent in English, Ukrainian, and Russian and ready to assist you every step of the way!

It’s All About You and Your Real Estate Dreams!

My mission is to serve you! With my knowledge and expertise, I’m here to help you achieve all your real estate goals and turn your dreams into reality!

I’m passionate about helping buyers and sellers navigate the exciting real estate landscape in Blue Ridge, Texas! Whether you’re searching for your dream home, exploring land options, or looking for commercial properties, my Real Estate Services have you covered.

Contact me today for all your real estate needs in Blue Ridge, Texas! Call/text 214-940-8149

Discover Yearly Real Estate Market Trends for Blue Ridge, TX

2003-2010

Blue Ridge, TX Real Estate Market in 2003

Blue Ridge, TX Real Estate Market in 2004

Blue Ridge, TX Real Estate Market in 2005

Blue Ridge, TX Real Estate Market in 2006

Blue Ridge, TX Real Estate Market in 2007

Blue Ridge, TX Real Estate Market in 2008

2011-2020

Blue Ridge, TX Real Estate Market in 2011

Blue Ridge, TX Real Estate Market in 2012

Blue Ridge, TX Real Estate Market in 2013

Blue Ridge, TX Real Estate Market in 2014

Blue Ridge, TX Real Estate Market in 2015

Blue Ridge, TX Real Estate Market in 2016

Blue Ridge, TX Real Estate Market in 2017

Blue Ridge, TX Real Estate Market in 2018

This market analysis is intended solely for educational purposes. This market analysis is based on data sourced from NTREIS, Inc. This analysis is exclusively focused on single-family homes and does not account for other property types. The total number of real estate transactions within the specified period and location may vary. Data accuracy cannot be guaranteed due to potential input errors made by NTREIS users. This market analysis does not account for all new construction home sales. If you need detailed information about recorded property sales or other public records, please contact the appropriate city or county office.

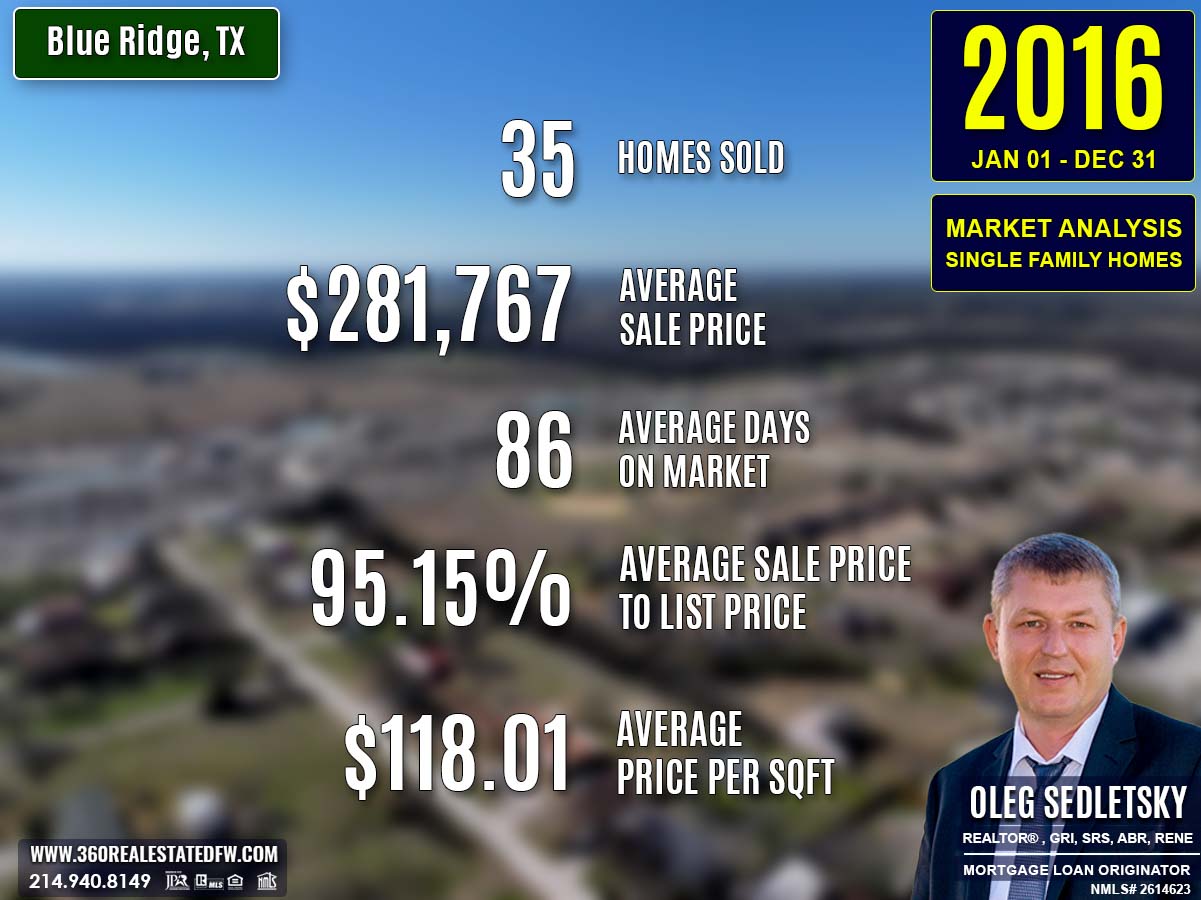

Blue Ridge, TX Real Estate: 2016 Analysis of the Single-Family Residential Housing Market

The year 2016 marked a period of expanded opportunities, rising home values, and broad appeal in Blue Ridge, Texas’s real estate market. With 35 homes sold, the market showed steady activity, maintaining momentum from previous years.

Larger homes with modern features dominated the market alongside rising price trends, reflecting a growing demand for family-oriented living spaces. Lower gas prices, electricity costs, and declining mortgage rates enhanced affordability, making 2016 a notable year for both home-buyers and home-sellers.

Key Takeaways and Trends from Blue Ridge’s 2016 Real Estate Market

Pricing Range: The 2016 market exhibited a clear trend of rising prices, with a sharp increase in both average and median sales prices. While the luxury market showed a slight contraction, the mid-market segment surged, catering to growing demand.

Market Efficiency: The average DOM increased slightly to 86 days, reflecting the higher valuation and larger size of properties sold. However, the market maintained a strong ClsPr/LstPr Ratio of 95.15%, showcasing stable negotiation dynamics.

Unique Outliers:

- The largest property sold spanned 36.587 acres, showing strong demand for spacious land options.

- Price per square foot rose to $118.01, an indicator of rising property values across all segments.

Total Homes Closed

A total of 35 residential single-family homes were sold in 2016, maintaining consistency in closed sales compared to the 34 homes sold in 2015. The market continued to cater to varied buyer demands, from smaller homes to expansive estates.

Property Pricing Insights

The 2016 market showed growth in property values across multiple pricing points, offering a range to suit diverse buyers:

- Minimum Price: $65,000, a significant increase from 2015’s $21,000, indicating growth in starter home options.

- Maximum Price: $568,500, showing a slight decrease from the 2015 high of $699,000.

- Average Price: $281,767, a remarkable jump from $200,022 in 2015, pointing to an overall rise in home values.

- Median Price: $300,000, nearly doubling from the previous year’s $142,100, signaling a stronger preference for mid-level homes.

Property Size and Features

Bedrooms & Bathrooms

The year saw an increase in both size and variety for living spaces:

- Bedrooms: Expanded to options ranging from 2 to 6 bedrooms, with an average of 4 bedrooms.

- Bathrooms: Homes offered configurations between 1 and 5 baths, with an average of 3 bathrooms, a boost from 2 in 2015.

Square Footage

Buyers had access to larger homes in 2016 compared to previous years:

- Minimum Size: 1,024 sq. ft.

- Maximum Size: 4,000 sq. ft.

- Average Size: 2,348 sq. ft., a considerable increase from 1,943 sq. ft. in 2015.

- Median Size: 2,162 sq. ft., showing a market shift toward bigger, family-oriented homes.

Lot Size

- Minimum Lot Size: 0.151 acres.

- Maximum Lot Size: 36.587 acres, an increase from 2015’s 19.500 acres, providing options for spacious living.

- Average Lot Size: 4.574 acres.

Market Dynamics

Days on Market (DOM)

Market efficiency adjusted slightly in 2016:

- Minimum DOM: 4 days.

- Maximum DOM: 400 days, slightly shorter than 463 days in 2015.

- Average DOM: 86 days, a slight increase from 65 days, signaling larger and higher-priced inventory requiring longer sale times.

Close Price Ratios

- ClsPr/LstPr (Close Price to Listing Price): Maintained at 95.15%, consistent with 2015, showing stable buyer-seller negotiation alignment.

- ClsPr/OLP (Close Price to Original Listing Price): Decreased slightly to 93.51%, indicating more frequent price adjustments during the selling process.

- Price Per Square Foot (Pr$/SqFt): Rose sharply to $118.01, up from $92.06, reflecting increased property value.

Insights into the Most Expensive Blue Ridge, TX Property Sold in 2016

The most expensive home sold in 2016 encapsulated luxury and space, setting a benchmark in Blue Ridge, TX.

Property Highlights:

- Price: $568,500

- Bedrooms: 4

- Bathrooms: 3 (2 full, 1 half)

- Square Footage: 3,206 sq. ft.

- Price per SqFt: $177.32

- Lot Size: 36.587 acres

- Days on Market: 121 days

- ClsPr/LstPr Ratio: 94.94%

- ClsPr/OLP Ratio: 87.46%

- Year Built: 2008

This stunning property exemplified modern living on a grand scale, offering both expansive indoor space and vast acreage, ideal for high-end buyers seeking privacy and sophistication.

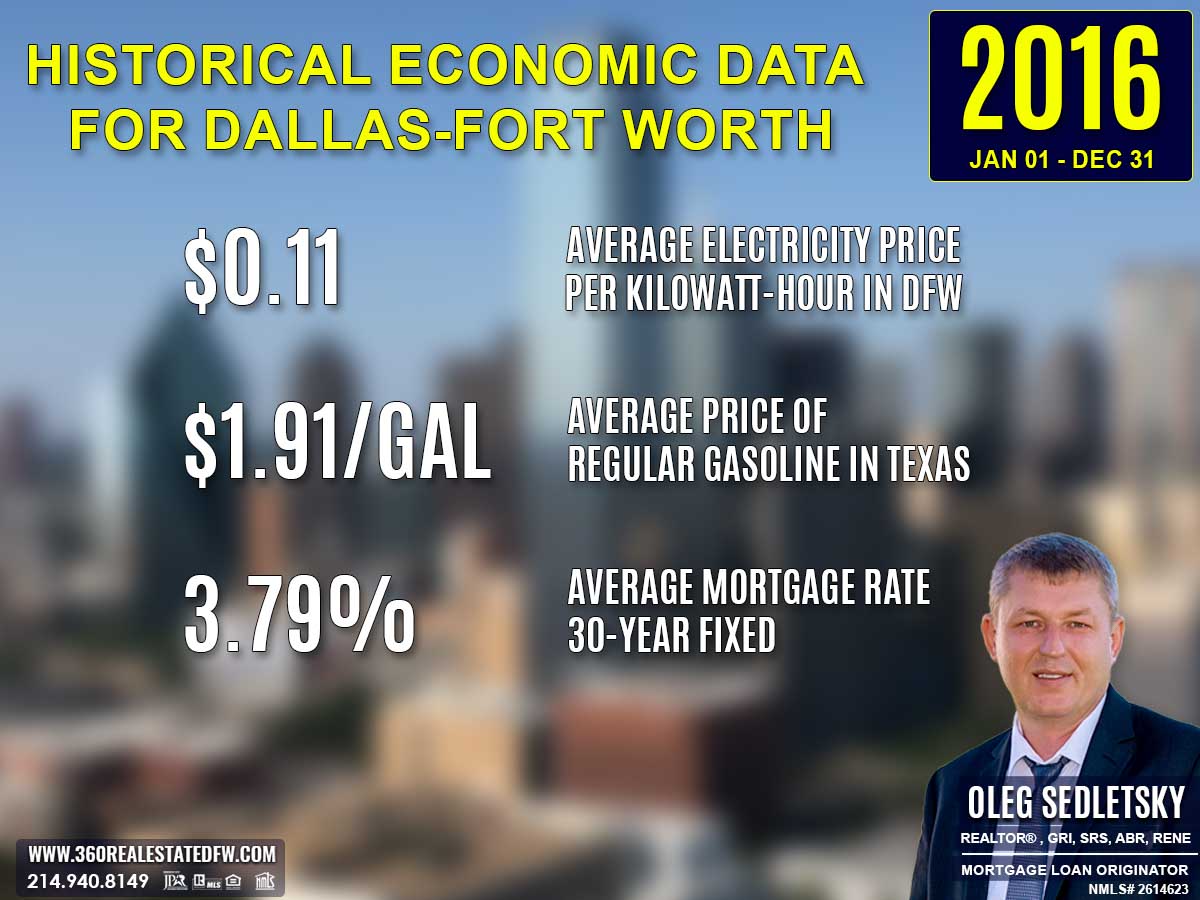

Economic context

Average Electricity Costs in Dallas-Fort Worth in 2016

The average electricity cost in 2016 dropped to $0.11 per kilowatt-hour, providing cost savings to homeowners and adding appeal to energy-efficient properties.

Texas Average Gas Prices in 2016

Fuel costs continued to decline, with gas averaging $1.91 per gallon. This drop made commuting more affordable, likely boosting suburban appeal for homebuyers in Blue Ridge, Texas.

Average 30-Year Fixed Mortgage Rate in 2016

The average 30-year fixed mortgage rate in 2016 was 3.79%, marking a slight decrease from the previous year. This low rate significantly boosted housing affordability, making it easier for homebuyers to secure financing and invest in larger or higher-value properties. With such favorable rates, many homebuyers were able to enter the market or upgrade to larger homes, driving demand and supporting rising home values.

Curious about today’s mortgage rates and the home you can comfortably afford?

Submit a no-obligation mortgage application today and get pre-approved to determine your budget and take the first step toward homeownership with confidence.

Summary of Differences Between 2015 and 2016 Real Estate Data for Blue Ridge, TX

The year 2016 brought notable changes to Blue Ridge’s real estate market compared to 2015. The trends showcased a shift toward larger homes, higher average pricing, and more diversity in property features. Here’s a breakdown of the key differences:

Property Pricing

- Minimum Price: Rose significantly to $65,000 in 2016 (up from $21,000 in 2015), signaling strengthened entry-level market values.

- Maximum Price: Decreased to $568,500 (from $699,000), indicating reduced high-end property sales.

- Average Price: Jumped to $281,767, a remarkable increase from $200,022 in 2015, suggesting overall property value appreciation.

- Median Price: Increased to $300,000 in 2016, almost doubling 2015’s $142,100, reflecting stronger mid-market sales.

Property Features

- Bedrooms: Expanded from 2-4 bedroom options in 2015 to 2-6 bedroom properties in 2016, offering more spacious homes.

- Bathrooms: Grew in range, with 2016 properties including up to 5 baths compared to 4 in 2015.

- Square Footage:

- Minimum Size: Increased to 1,024 sq. ft. (from 780 sq. ft.), emphasizing larger homes overall.

- Maximum Size: Slightly contracted to 4,000 sq. ft. (from 4,500 sq. ft.).

- Average Size: Rose significantly to 2,348 sq. ft. in 2016, from 1,943 sq. ft. in 2015, catering to families and groups needing bigger spaces.

- Median Size: Increased to 2,162 sq. ft., reflecting a preference for larger standard homes.

Lot Size

- Minimum Lot Size: Slightly decreased to 0.151 acres in 2016 (from 0.230 acres in 2015).

- Maximum Lot Size: Expanded to 36.587 acres (from 19.500 acres), creating opportunities for buyers seeking more land.

- Average Lot Size: Grew to 4.574 acres (from 4.445 acres), reflecting increased diversity.

Market Dynamics

-

Days on Market (DOM):

- Minimum DOM: Rose modestly to 4 days (from 2 days), indicating some cooling for quick sales.

- Maximum DOM: Lowered to 400 days in 2016 (compared to 463 days), only slightly trimming extended sale times for unique properties.

- Average DOM: Lengthened to 86 days (from 65 days), potentially reflecting higher-priced property adjustments.

-

ClsPr/LstPr (Close Price to List Price Ratio): Stayed consistent at around 95% across both years, showing stable buyer-seller pricing alignment.

-

ClsPr/OLP (Close Price to Original Listing Price): Lowered slightly to 93.51% (from 93.09%), indicating a marginal increase in price adjustments before closing.

-

Price Per Square Foot (Pr$/SqFt): Increased significantly to $118.01 (from $92.06), signaling rising property valuation.

Year Built

- Oldest Property Built: Adjusted to 1938 in 2016 (from 1910 in 2015), showing a shift in older inventory.

- Newest Property Built: Stayed consistent at 2016, reflecting continued opportunities for new builds.

- Average Year Built: Improved to 1997 (from 1985 in 2015), favoring more modern homes.

- Median Year Built: Moved up to 2003 (from 1991), highlighting newer home options.

Notable Market Shifts

- Bigger Homes: Increase in average number of bedrooms, bathrooms, and square footage showcased a demand for larger homes.

- Rising Prices: A striking surge in both median and average sales prices underlined increased property value.

- Market Timing: Longer average time on market and expanded price per square foot indicated a maturing, premium-focused market.

Overall, 2016 reflected a market evolving toward higher value, larger family-oriented living options, and a steadily growing economy.

Summary of Real Estate Market Analysis for Blue Ridge, TX in 2016

The 2016 real estate market in Blue Ridge, Texas showcased a year of consistent activity, expanding opportunities, and noticeable growth in property values. With a balance of affordability and rising demand for larger, family-oriented homes, the market evolved to meet the needs of homebuyers. Key trends, like the increase in average and median prices, emphasized a strengthening mid-market segment, while favorable economic factors such as lower electricity costs, gas prices, and mortgage rates further encouraged homeownership.

Sellers benefited from stable negotiation dynamics and steady demand, making 2016 a year of mutual opportunity. Blue Ridge’s real estate market remained resilient and forward-moving, setting a positive foundation for years to come.

Why Statistics Data is Important

Understanding past market data is essential for making informed decisions in today’s real estate landscape. Historical statistics provide a foundational perspective on trends, aiding in fair pricing and negotiation.

Unlock Exceptional Service!

Assistance with all your real estate needs in the Dallas-Fort Worth area is just a click or call away. Reach out at 214-940-8149 or connect through the links below.

Oleg Sedletsky REALTOR® in Blue Ridge, Texas. Call/Text 214.940.8149

Greetings! I’m Oleg Sedletsky, and I’m excited to introduce myself as your go-to full-time licensed Texas REALTOR® and Mortgage Loan Originator.

I proudly represent JPAR® – Real Estate Brokerage as a REALTOR® and Utopia Mortgage LLC as a Mortgage Loan Originator! My designations and certifications reflect my dedication to helping you achieve your real estate goals in Blue Ridge, TX and other locations in the vibrant Dallas-Fort Worth area!

My commitment to ongoing professional development means I’m always enhancing my skills to serve you better. You can count on me as your trusted expert throughout your real estate journey. Plus, I’m fluent in English, Ukrainian, and Russian and ready to assist you every step of the way!

It’s All About You and Your Real Estate Dreams!

My mission is to serve you! With my knowledge and expertise, I’m here to help you achieve all your real estate goals and turn your dreams into reality!

I’m passionate about helping buyers and sellers navigate the exciting real estate landscape in Blue Ridge, Texas! Whether you’re searching for your dream home, exploring land options, or looking for commercial properties, my Real Estate Services have you covered.

Contact me today for all your real estate needs in Blue Ridge, Texas! Call/text 214-940-8149

Discover Yearly Real Estate Market Trends for Blue Ridge, TX

2003-2010

Blue Ridge, TX Real Estate Market in 2003

Blue Ridge, TX Real Estate Market in 2004

Blue Ridge, TX Real Estate Market in 2005

Blue Ridge, TX Real Estate Market in 2006

Blue Ridge, TX Real Estate Market in 2007

Blue Ridge, TX Real Estate Market in 2008

2011-2020

Blue Ridge, TX Real Estate Market in 2011

Blue Ridge, TX Real Estate Market in 2012

Blue Ridge, TX Real Estate Market in 2013

Blue Ridge, TX Real Estate Market in 2014

Blue Ridge, TX Real Estate Market in 2015

Blue Ridge, TX Real Estate Market in 2016

Blue Ridge, TX Real Estate Market in 2017

Blue Ridge, TX Real Estate Market in 2018

This market analysis is intended solely for educational purposes. This market analysis is based on data sourced from NTREIS, Inc. This analysis is exclusively focused on single-family homes and does not account for other property types. The total number of real estate transactions within the specified period and location may vary. Data accuracy cannot be guaranteed due to potential input errors made by NTREIS users. This market analysis does not account for all new construction home sales. If you need detailed information about recorded property sales or other public records, please contact the appropriate city or county office.

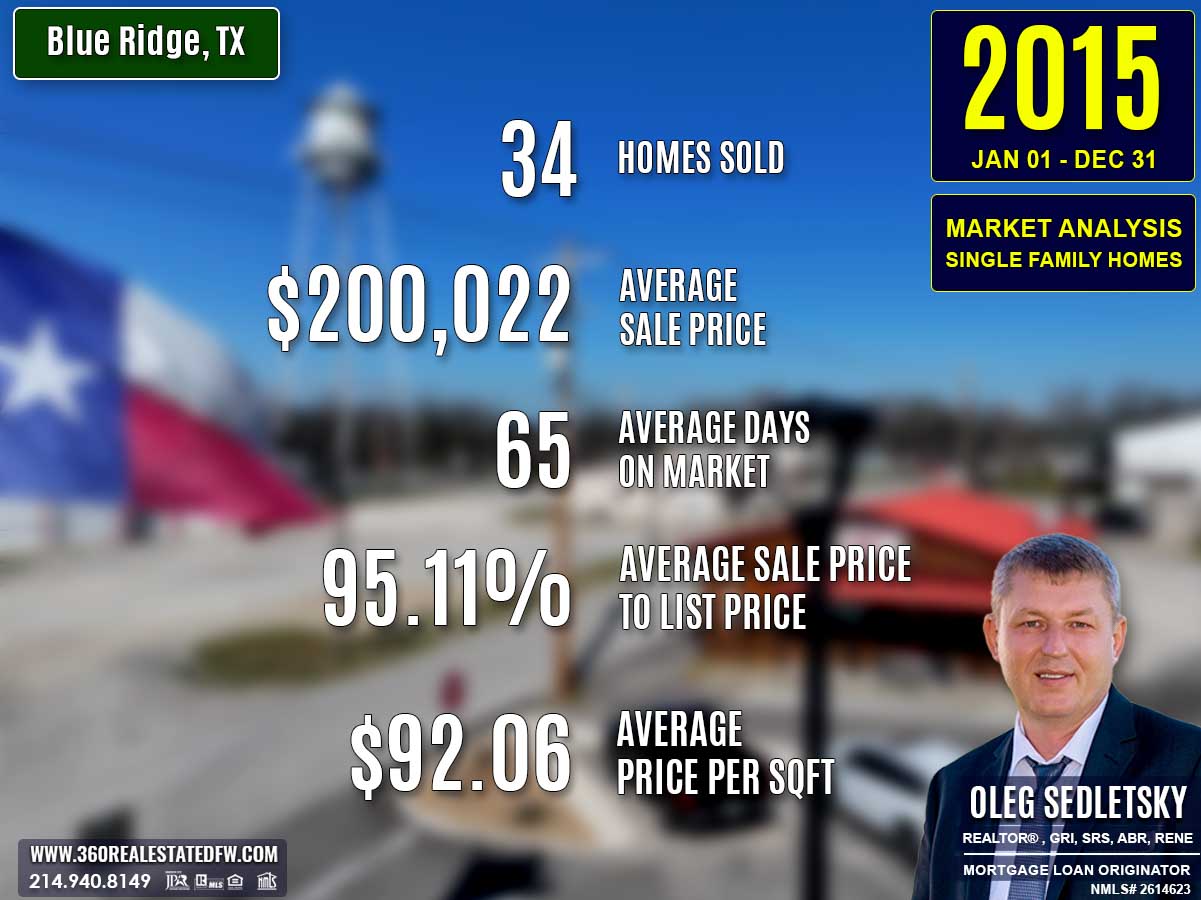

Blue Ridge, TX Real Estate: 2015 Analysis of the Single-Family Residential Housing Market

The 2015 real estate market in Blue Ridge, TX displayed remarkable growth and diversity, making it an exciting year for both buyers and sellers. With 34 homes sold, the market showed higher activity than in previous years.

From entry-level properties to premium luxury homes, the market offered something for everyone. With economic factors favoring affordability and transaction efficiency, 2015 became a standout year in Blue Ridge, TX‘s real estate history.

Key Takeaways and Trends from Blue Ridge’s 2015 Real Estate Market

Pricing Range: The market featured a broad price spectrum, from accessible entry-level homes to a record-breaking luxury property, giving potential buyers extensive options.

Market Efficiency: Quicker average DOM and high buyer urgency for desirable properties highlighted an active and efficient market, balanced by ongoing negotiations for high-end inventory.

Unique Outliers: The standout $699,000 luxury property and the diverse array of smaller, older homes showcased the flexibility of Buba’s market in meeting various buyer needs.

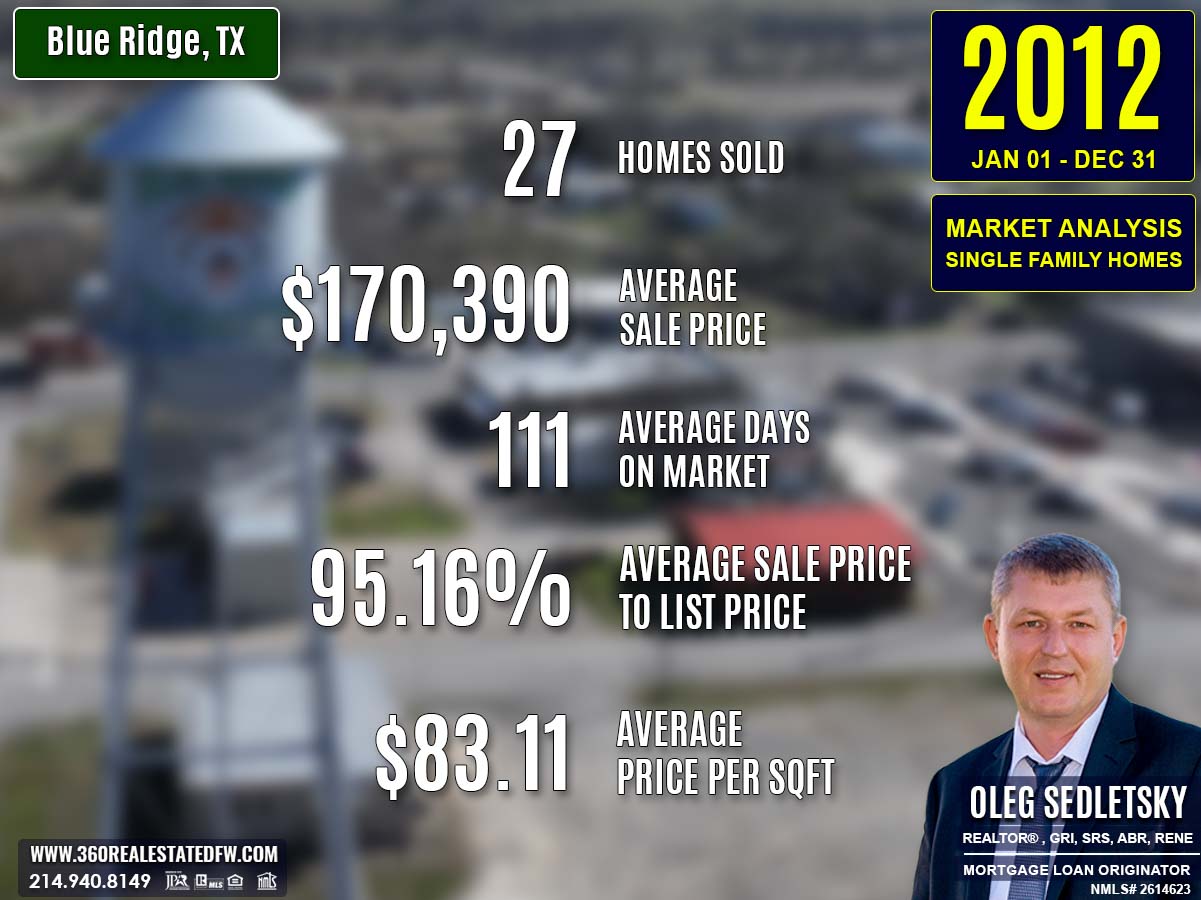

Total Homes Closed

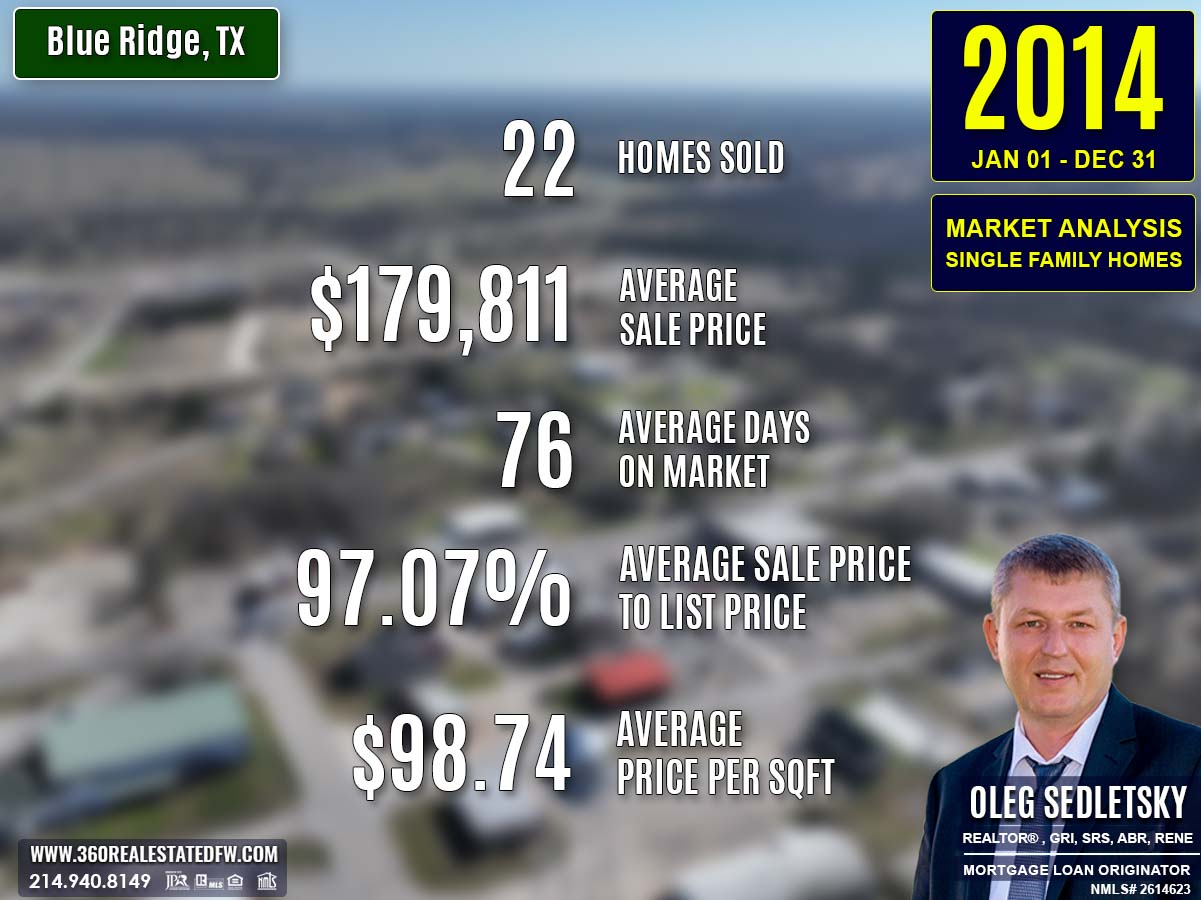

A total of 34 residential single-family homes were closed during 2015. This marked a significant jump from the 22 homes sold in 2014, reflecting growing demand and an active market that catered to a variety of buyers.

Property Pricing Insights

The 2015 market showcased a wide range of property prices, offering affordability and opportunities for high-end investments:

- Minimum Price: $21,000

- Maximum Price: $699,000

- Average Price: $200,022

- Median Price: $142,100

The affordability at the lower range allowed access for first-time homebuyers, while the highest price signaled robust activity in the luxury segment.

Property Size and Features

Bedrooms & Bathrooms

Homes in 2015 were designed to cater to varying household needs:

- Bedrooms: Ranged from 2 to 4, with the majority averaging 3 bedrooms.

- Bathrooms: Offered between 1 to 4 baths, meeting both basic and premium buyer expectations.

Square Footage

Homes ranged in size to provide options for both small families and luxury buyers:

- Minimum Size: 780 sq. ft., appealing to those seeking compact living spaces.

- Maximum Size: 4,500 sq. ft., catering to premium buyers looking for expansive homes.

- Average Size: 1,943 sq. ft., slightly larger than in 2014.

- Median Size: 1,663 sq. ft., offering consistency for standard family preferences.

Lot Size

The lot sizes provided flexibility for buyers seeking different levels of privacy and land use:

- Minimum Lot Size: 0.230 acres.

- Maximum Lot Size: 19.500 acres.

- Average Lot Size: 4.445 acres.

Market Dynamics

Days on Market (DOM)

Homes in 2015 saw quicker transactions compared to 2014:

- Minimum Time: Just 2 days!

- Maximum Time: Extended to 463 days for unique or premium properties.

- Average Time: 65 days, an improvement over the previous year’s 76 days.

Close Price Ratios

- ClsPr/LstPr Ratio: Homes closed at 95.11% of their list price, slightly lower than in 2014.

- ClsPr/OLP Ratio: At 93.09%, this decline indicates more price adjustments for homes over long listing periods.

Price Per Square Foot

The $92.06 per square foot average showed a slight decrease from 2014, reflecting balancing trends in market value.

Insights into the Most Expensive Blue Ridge, TX Property Sold in 2015

The most expensive property sold in 2015 set a benchmark for luxury living in Blue Ridge, Texas.

Highlights of the Property:

- Price: $699,000

- Bedrooms: 4

- Bathrooms: 4 (3 full, 1 half)

- Square Footage: 4,500 sq. ft.

- Price per SqFt: $155.33

- Lot Size: 10.000 acres

- DOM: 8 days

- ClsPr/LstPr Ratio: 103.57%

- ClsPr/OLP Ratio: 103.57%

- Year Built: 2008

This property combined spacious living, modern construction, and an enviable lot size, selling above the original asking price in just 8 days.

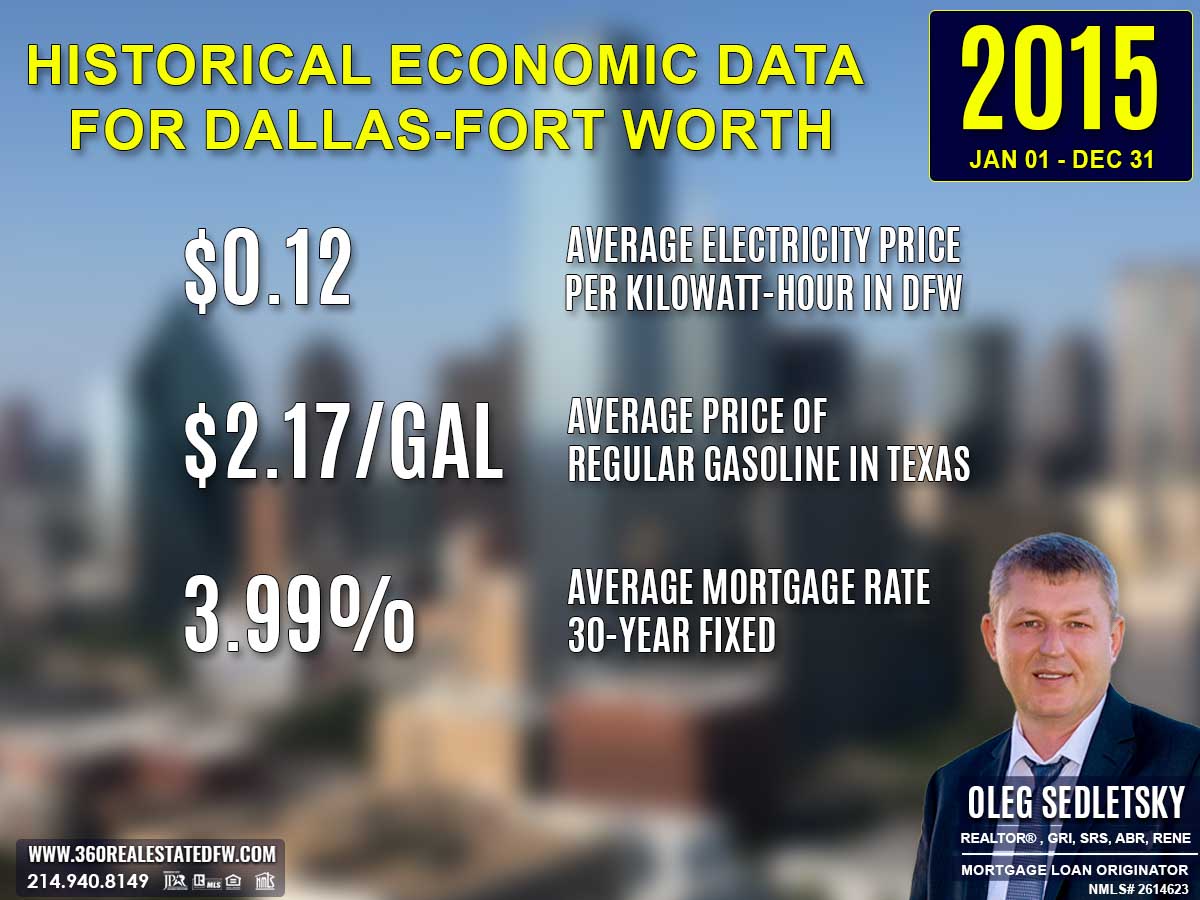

Economic context

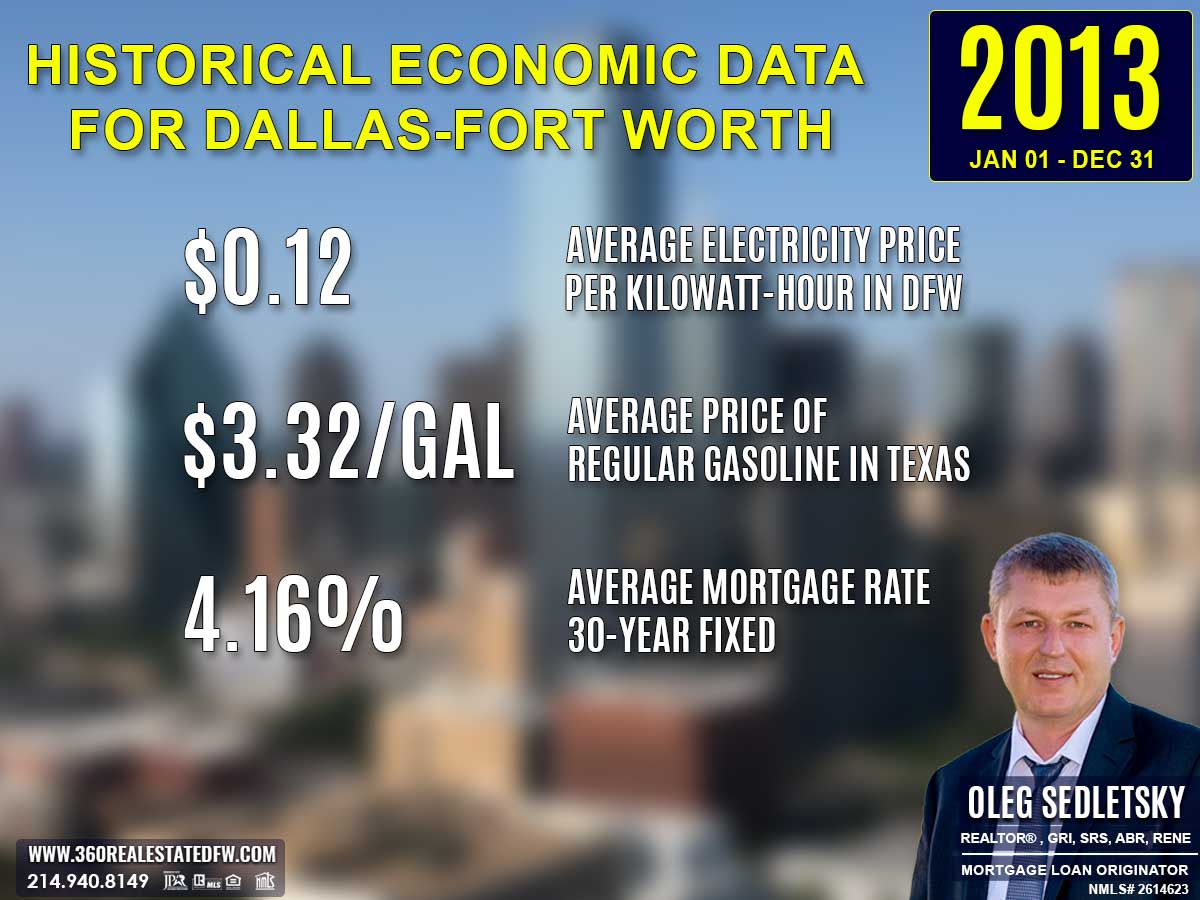

Average Electricity Costs in Dallas-Fort Worth in 2015

The average electricity cost fell to $0.12/kWh, providing slight relief to homeowners and increasing interest in energy-efficient properties.

Texas Average Gas Prices in 2015

Gas prices plummeted to $2.17 per gallon, making longer commutes more manageable, thus encouraging demand for suburban and rural properties in the market.

Average 30-Year Fixed Mortgage Rate in 2015

Mortgage rates declined to 3.99%, boosting affordability and helping facilitate higher sales volume.

Curious about today’s mortgage rates and the home you can comfortably afford?

Submit a no-obligation mortgage application today and get pre-approved to determine your budget and take the first step toward homeownership with confidence.

Summary of Differences Between 2014 and 2015 Real Estate Data for Blue Ridge, TX

The 2015 real estate market in Blue Ridge, Texas saw significant changes from 2014, characterized by higher activity, more affordability, and expanding property options. Below are the key differences:

Property Pricing Insights

- Minimum Price: Dropped to $21,000 in 2015 (from $44,000 in 2014), offering more affordable opportunities for buyers.

- Maximum Price: Surged to $699,000 in 2015 (from $425,000), demonstrating heightened luxury market activity.

- Average Price: Grew to $200,022 (from $179,811), signaling broader price appreciation.

- Median Price: Lowered slightly to $142,100 (from $148,500), indicating stronger sales in more affordable price brackets.

Property Features

-

Bedrooms:

- Ranged from 2 to 4 bedrooms in both years but included properties with smaller footprints in 2015.

-

Bathrooms: Both years offered up to 4 baths, remaining consistent in premium property features.

-

Square Footage:

- Minimum Size: Shrunk to 780 sq. ft. in 2015 (from 1,025 sq. ft. in 2014), signaling an increase in compact property sales.

- Maximum Size: Expanded to 4,500 sq. ft. (from 3,312 sq. ft.), reflecting greater luxury options.

- Average Size: Increased to 1,943 sq. ft. (from 1,722 sq. ft.), appealing to families and larger households.

- Median Size: Slightly up at 1,663 sq. ft. (from 1,643 sq. ft.), showing consistency in typical home sizes.

Lot Size Area

- Minimum Lot Size: Reduced marginally to 0.230 acres (from 0.240 acres), reflecting smaller parcels for entry-level homes.

- Maximum Lot Size: Declined to 19.500 acres (from 28.000 acres), limiting options for buyers seeking very large properties.

- Average Lot Size: Fell to 4.445 acres (from 6.044 acres), indicating a shift toward moderate-sized lots.

Market Dynamics

-

Days on Market (DOM):

- Minimum DOM: Dropped dramatically to 2 days in 2015 (from 4 days in 2014), highlighting quick sales of highly desirable listings.

- Maximum DOM: Extended to 463 days (from 330 days), reflecting prolonged sale times for certain properties.

- Average DOM: Improved to 65 days (from 76 days), showing stronger market efficiency.

-

ClsPr/LstPr Ratio (Close Price to List Price): Lowered to 95.11% in 2015 (from 97.07%), signaling slightly more negotiation in final sale prices.

-

ClsPr/OLP Ratio (Close Price to Original Listing Price): Declined to 93.09% (from 98.33%), suggesting more frequent price reductions.

-

Price Per Square Foot (Pr$/SqFt): Dropped slightly to $92.06 (from $98.74), indicating a slight rollback in per-unit value.

Year Built

- Oldest Property: Predates by 40 years, dating back to 1910 in 2015 (compared to 1950 in 2014), showcasing increased diversity in historical options.

- Newest Property: Advanced to 2015 (compared to 2007 in 2014), reflecting new construction in the marketplace.

- Average Year Built: Declined to 1985 (from 1991), likely due to the inclusion of older listings.

- Median Year Built: Dropped slightly to 1991 (from 1998), showing a broader inclusion of aging inventory.

Notable Market Shifts

- Broader Affordability: The wider range in pricing and smaller property sizes attracted more buyers at lower price points.

- Luxury Market Expansion: More premium properties entered the market, reflected in the higher maximum price and larger square footage.

- Efficient Sales: The faster average DOM indicates an active market, although some high-priced listings extended sale times.

- Moderation in Lot Sizes and Per SqFt Pricing: Reductions in lot sizes and small shifts in price per square foot emphasized affordability while retaining value.

Overall, 2015 reflected an energizing real estate market with higher sales volume, broader buyer choices, and marked affordability improvements, paving the way for a balanced and vibrant housing environment.

Summary of Real Estate Market Analysis for Blue Ridge, TX in 2015