Princeton, TX Real Estate: A Comprehensive Analysis of the 2022 Single-Family Residential Housing Market

The 2022 real estate market in Princeton, Texas experienced a pivotal shift, shaped by economic adjustments such as the rise in 30-year average mortgage rates to 5.53%. Despite the increased cost of financing, property values soared to record-breaking levels, with both average and median prices reaching all-time highs. New construction homes and properties featuring pools remained in high demand, reflecting continued growth and evolving lifestyle preferences in the area.

Key Takeaways and Trends from Princeton’s 2022 Real Estate Market

Pricing Range: Princeton, TX saw its pricing range expand, with the minimum price rising slightly and the maximum reaching $1.6M.

Market Efficiency: Properties sold much faster in 2022 (21 days compared to 38 days in 2021), and close-to-list price ratios held steady at over 101%.

Unique Outliers: The most expensive property sold not only broke pricing records but also reflected growing interest in luxury acreage and leisure-friendly features.

Mortgage Rates Impact: Despite mortgage rates jumping from 3.15% to 5.53%, demand remained strong, driven by lifestyle-focused decisions and buyer competition.

Total Homes Closed

A total of 690 single-family homes were sold in 2022, marking an overall decline from 849 the previous year.

New construction homes accounted for 249 properties, showing sustained demand for modern builds.

Homes with pools increased to 17 properties, indicating a growing appeal for leisure-oriented features.

Property Pricing Insights

- Minimum Price: $135,000

- Maximum Price: $1,600,000

- Average Price: $369,296 (up from $311,550 in 2021)

- Median Price: $351,996 (up from $300,000 in 2021)

Rising prices reflect stronger competition and evolving homebuyer priorities.

Property Size and Features

- Bedrooms: Ranged from 1 to 6, with an average of 4 bedrooms per home.

- Bathrooms: Ranged from 1 to 5, with most homes featuring 2 bathrooms on average.

- Square Footage: Homes ranged from 576 sqft to 5,348 sqft, with an average of 1,869 sqft—a slight decrease from 2021.

- Lot Size: Varied from 0 to 19,189 acres, with the median being 0.140 acres, showing smaller average lot sizes in general.

Market Dynamics

- Days on Market (DOM): Homes sold in an average of 21 days, a sharp improvement from 38 days in 2021, highlighting faster sales.

- ClsPr/LstPr Ratio: Averaged 101.63%, showing sustained demand with buyers paying slightly above listing prices.

- ClsPr/OLP Ratio: Spiked to 245.02%, driven by standout properties that performed exceptionally well.

- Average Price Per SqFt: $201.61, up significantly from $154.56 in 2021.

Insights into the Most Expensive Princeton, TX Property Sold in 2022

The most expensive property sold in Princeton in 2022 was a stunning 4-bedroom, 3-bathroom estate built in 1986, exuding both charm and modern luxury. Spanning an impressive 5,348 square feet, the home featured a spacious layout perfect for upscale living. It sat on a vast 12.061-acre lot, providing plenty of both privacy and outdoor possibilities. This luxurious property also boasted a beautiful pool, making it an ideal retreat for relaxation and leisure. Selling for $1,600,000, the home commanded a price of $299.18 per square foot, showcasing its premium value. What’s more, it moved quickly, with a record-breaking 6 days on market (DOM). The sale price exceeded the listing price, achieving a ClsPr/LstPr (close price to listing price) ratio of 108.48% and demonstrating its high buyer demand. The same ratio for ClsPr/OLP (close price to original listing price) was also 108.48%, indicating consistent interest and competitiveness of the listing.

Key Highlights::

- Price: $1,600,000

- Beds/Baths: 4 bedrooms, 3 bathrooms

- Square Footage: 5,348 sqft

- Price/SqFt: $299.18

- Lot Size: 12.061 acres

- DOM: 6 days

- ClsPr/LstPr Ratio: 108.48%

- ClsPr/OLP Ratio: 108.48%

- Year Built: 1986

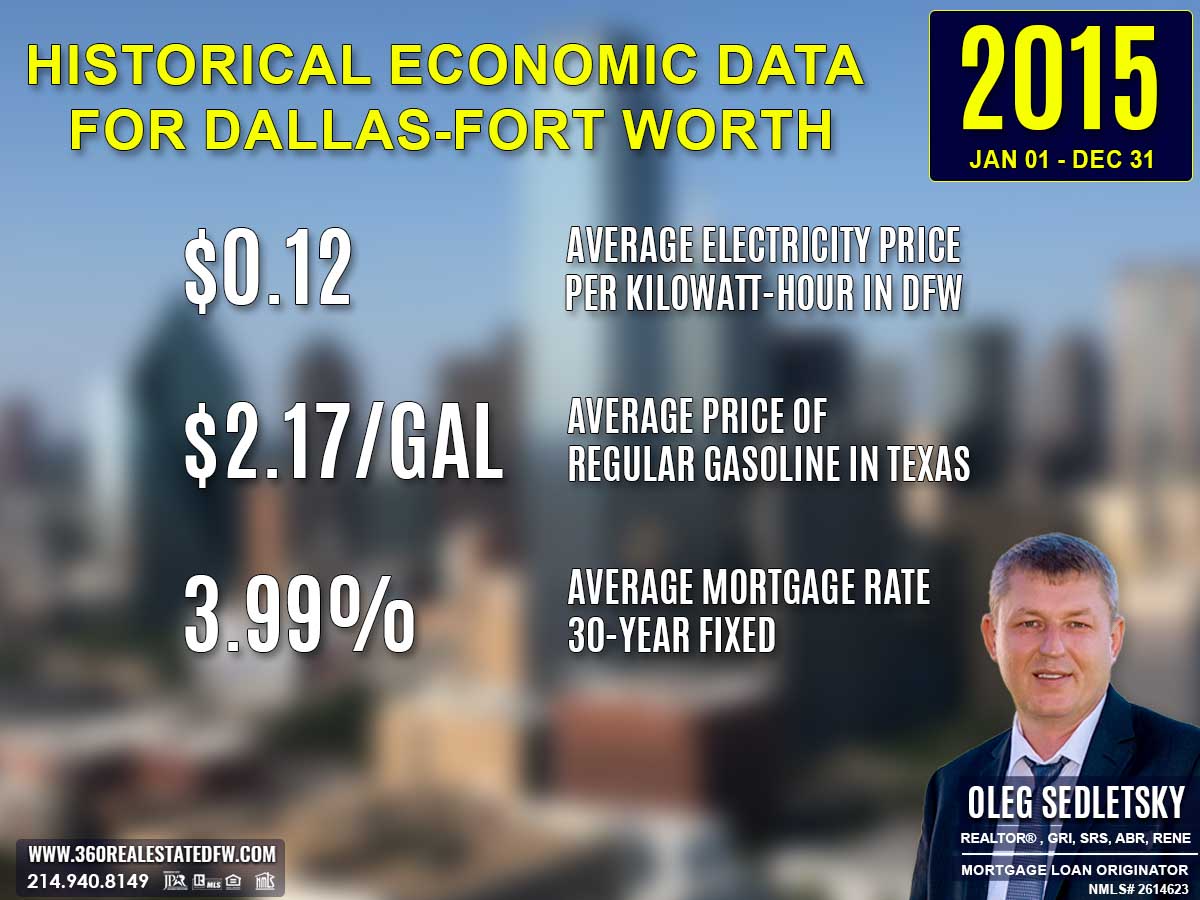

Economic context

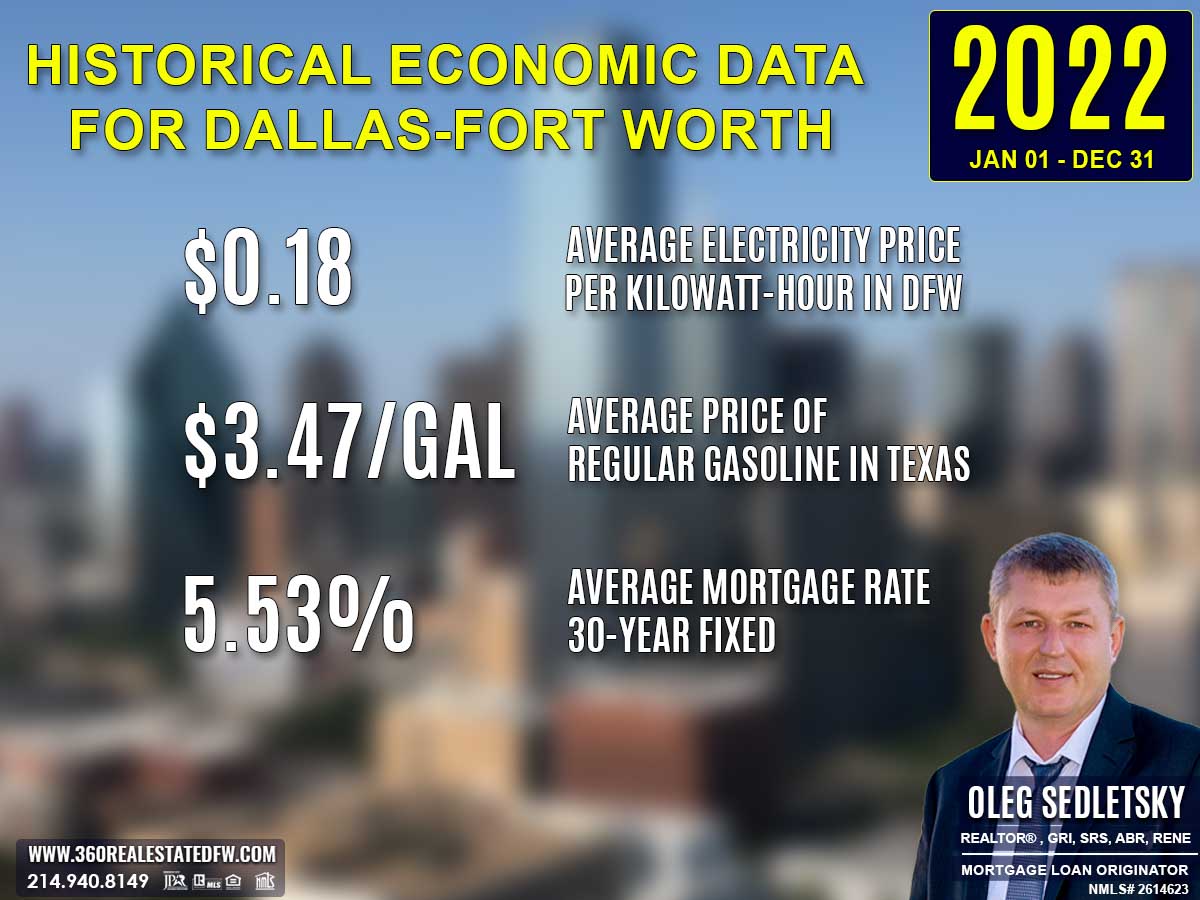

Average Electricity Costs in Dallas-Fort Worth in 2022

Average electricity prices spiked to $0.18 per kilowatt-hour in 2022, a sharp increase from $0.14 in 2021. Higher energy expenses placed added strain on household budgets, driving demand for energy savings. Homes with modern insulation, solar installations, or energy-saving appliances gained significant appeal during this period.

Average Price for Regular Gasoline in Texas in 2022

Gas prices surged to $3.47 per gallon in 2022, jumping from $2.65 in 2021. The substantial increase in transportation costs likely swayed homebuyers to favor central locations or areas close to public transit. Long commutes to suburban or rural homes might have lost some appeal in light of elevated gas prices.

Average 30-Year Fixed Mortgage Rate in 2022

Mortgage rates climbed steeply to 5.53% in 2022, up from 3.15% the year before. The notable rise in rates significantly impacted affordability, persuading many to reassess their homeownership goals. Homebuyers were urged to secure pre-approval with a local mortgage loan originator to better understand their financial limits in a tightened market.

Curious about today’s mortgage rates and the home you can comfortably afford?

Submit a no-obligation mortgage application today and get pre-approved to determine your budget and take the first step toward homeownership with confidence.

Overview of Differences Between the 2021 and 2022 Real Estate Markets in Princeton, Texas

Volume of Sales

Sales volume dropped from 849 homes in 2021 to 690 homes in 2022, marking an 18.7% decline, likely influenced by rising mortgage rates and affordability constraints.

Pricing

- The minimum price rose from $115,000 to $135,000, while the maximum price increased slightly to $1.6M.

- Average prices climbed from $311,550 in 2021 to $369,296 in 2022, reflecting an 18.5% rise.

- Median prices also rose, from $300,000 in 2021 to $351,996 in 2022, indicating broader price appreciation across the market.

Market Efficiency

- Days on Market (DOM): Improved significantly, dropping from 38 days in 2021 to just 21 days in 2022.

- ClsPr/LstPr ratios: Held steady at just over 101%, indicating properties continued to sell above listing price.

- ClsPr/OLP ratios: Increased dramatically from 245.02% to much higher levels, driven by standout transactions and market dynamics.

Property Features

- Square Footage: Average home size slightly decreased from 1,902 sqft in 2021 to 1,869 sqft in 2022.

- Lot Sizes: Median lot sizes remained small, with a marginal difference between both years.

- Pools: Homes with pools sold increased from 11 in 2021 to 17 in 2022, showing rising demand for leisure features.

- New Construction Homes: Sales declined from 402 in 2021 to 249 in 2022, signaling a slowdown in new developments.

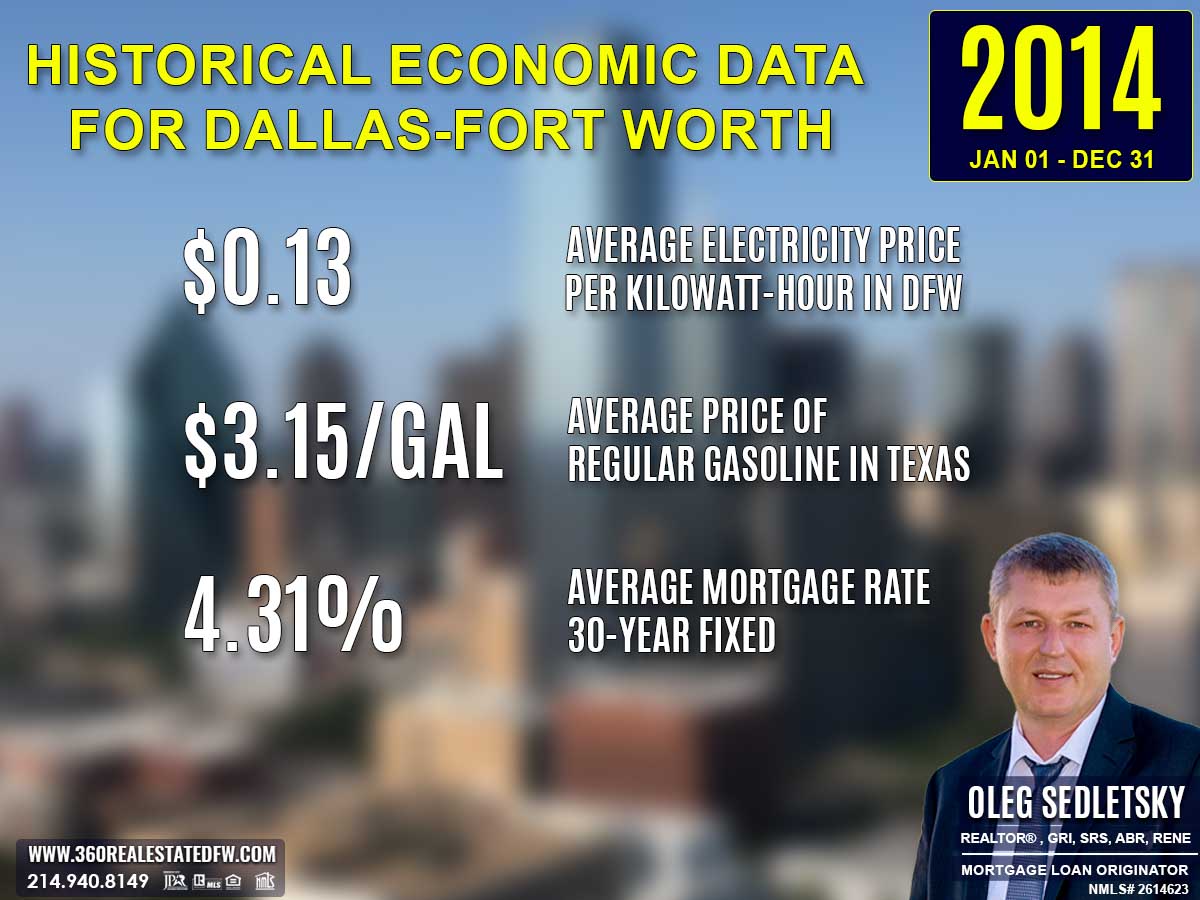

Economic Context

Average mortgage rates rose from 3.15% in 2021 to 5.53% in 2022, which likely constrained affordability and contributed to reduced sales volume.

Rising costs for utilities and fuel also impacted overall purchasing power for buyers.

These differences highlight the market’s resilience and adaptability despite economic challenges, with rising prices and faster sales underscoring strong demand for quality properties.

Summary of Real Estate Market Analysis for Princeton, TX in 2022

The 2022 real estate market in Princeton, Texas presented unique challenges and opportunities for both homebuyers and home-sellers, shaped by shifting economic conditions and evolving buyer preferences.

Homebuyers’ Perspective

For homebuyers, rising mortgage rates—reaching an average of 5.53%—posed significant affordability challenges, especially for entry-level buyers. Higher average and median property prices further narrowed access to homes in lower price ranges. However, the market offered notable opportunities, particularly in the availability of new construction homes, with 249 properties catering to those seeking modern designs and updated features. The increase in homes with pools also provided buyers the chance to invest in lifestyle-focused properties. With the average Days on Market (DOM) dropping to just 21 days, the market became highly competitive, reinforcing the need for buyers to act decisively and prepare strategically to secure desired properties before they sell.

Home-Sellers’ Perspective

For home-sellers, the 2022 market dynamics created substantial advantages. Average property prices soared by 18.5%, while the median price increased by over $50,000 compared to 2021, positioning sellers to gain significant returns. The faster pace of sales—reflected in the reduced DOM—meant well-priced, move-in-ready homes were in high demand. Sellers needed to carefully balance competitive pricing with market conditions to meet buyer expectations and maximize offers. Features like pools and larger properties resonated strongly with buyers seeking additional value, giving sellers of such homes an edge in the market. Meanwhile, the slight decline in new construction home sales hinted at an opportunity for resale properties to fill the gap in supply.

Both homebuyers and home-sellers in 2022 navigated a dynamic, fast-moving market influenced by economic shifts and changing priorities. Sellers enjoyed the benefits of increasing property values and brisk sales, while buyers had to overcome financial barriers but still found value in new developments and lifestyle-focused investments. The year emphasized the importance of preparation, understanding market trends, and adapting to the fast-evolving real estate environment.

The Importance of Statistical Data in Princeton, Texas Real Estate Market

Did you know that appraisers and Realtors rely on historical statistical data to determine a property’s current value?

Analyzing historical market data is essential for making informed decisions in today’s real estate market. Examining past trends provides valuable insights that facilitate accurate pricing, more strategic negotiations, and a comprehensive understanding of market dynamics. By understanding market dynamics, both homebuyers and home-sellers can leverage the conditions to achieve their goals.

Unlock Exceptional Service!

Assistance with all your real estate needs in the Dallas-Fort Worth area is just a click or call away. Reach out at 214-940-8149 or connect through the links below.

Greetings! I’m Oleg Sedletsky, and I’m excited to introduce myself as your go-to full-time licensed Texas REALTOR® and Mortgage Loan Originator.

I proudly represent JPAR® – Real Estate Brokerage as a REALTOR® and Utopia Mortgage LLC as a Mortgage Loan Originator! My designations and certifications reflect my dedication to helping you achieve your real estate goals in Princeton, TX and other locations in the vibrant Dallas-Fort Worth area!

My commitment to ongoing professional development means I’m always enhancing my skills to serve you better. You can count on me as your trusted expert throughout your real estate journey. Plus, I’m fluent in English, Ukrainian, and Russian and ready to assist you every step of the way!

It’s All About You and Your Real Estate Goals!

My mission is to serve you! With my knowledge and expertise, I’m here to help you achieve all your real estate goals!

I’m passionate about helping buyers and sellers navigate the exciting real estate landscape in Princeton, Texas! Whether you’re searching for your dream home, exploring land options, or looking for commercial properties, my Real Estate Services have you covered.

Contact me today for all your real estate needs in Princeton, Texas! Call/text 214-940-8149

A Comprehensive Analysis of Single-Family Residential Housing Market in Princeton, TX: 2010 to Present

Discover the trends, stats, and insights shaping Princeton’s real estate market year by year!

2010-2020

Princeton, TX Real Estate Market Report 2010: Analysis and Trends

Princeton, TX Real Estate Market Report 2011: Analysis and Trends

Princeton, TX Real Estate Market Report 2012: Analysis and Trends

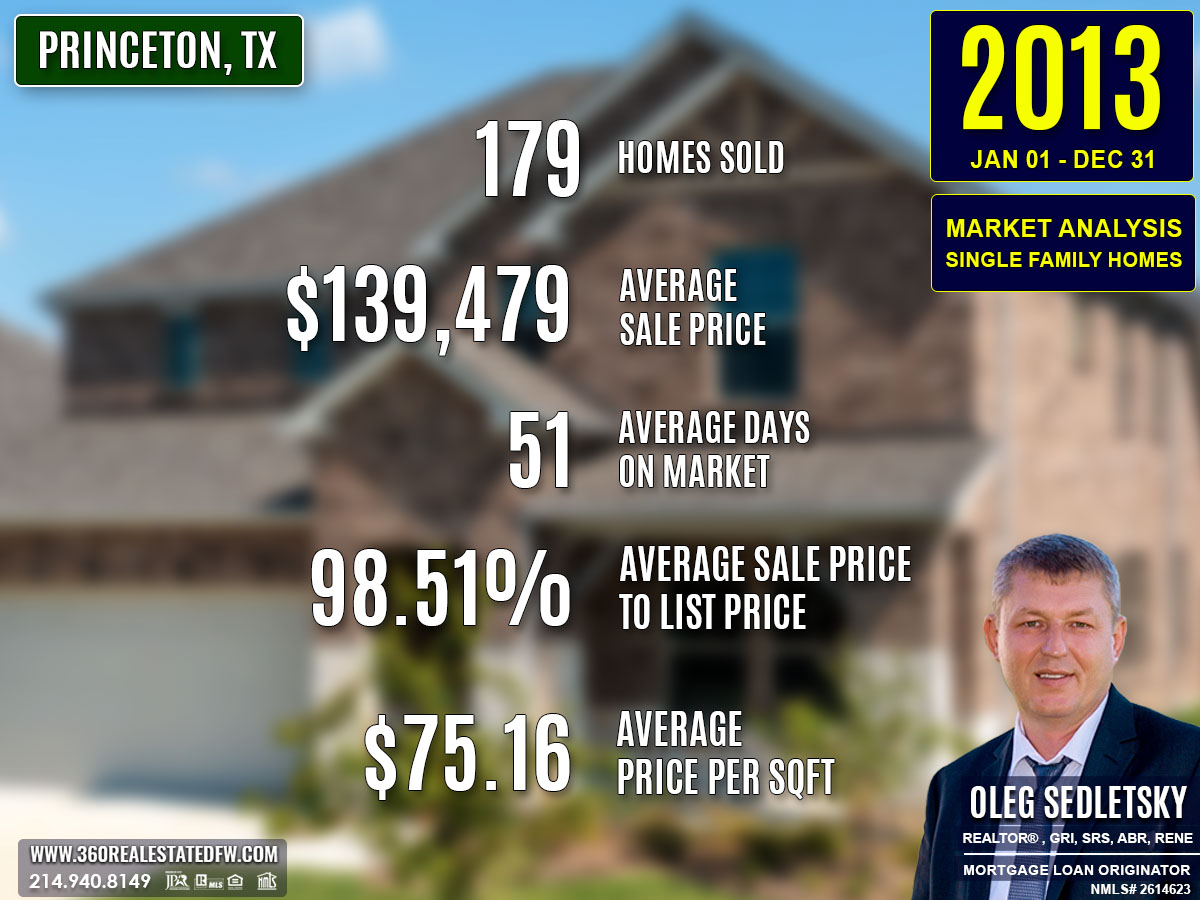

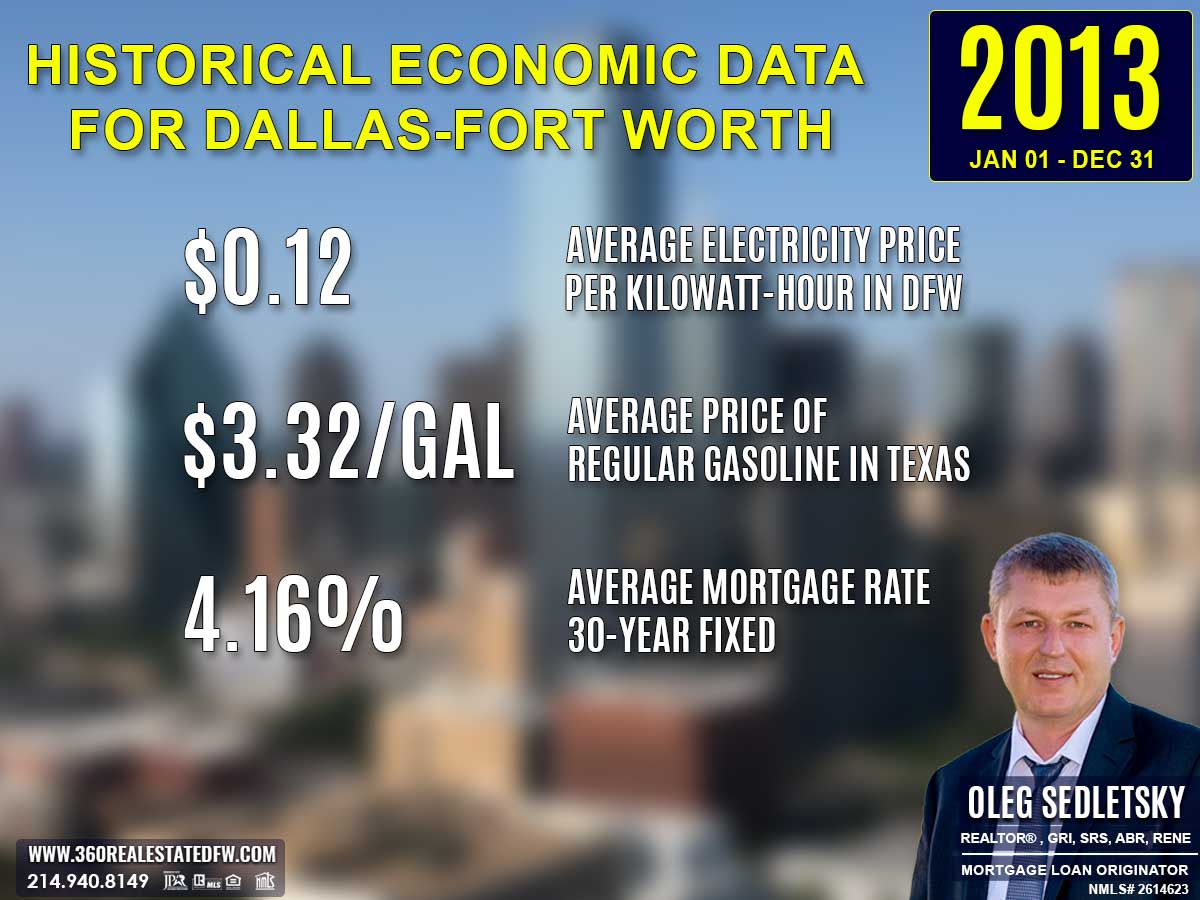

Princeton, TX Real Estate Market Report 2013: Analysis and Trends

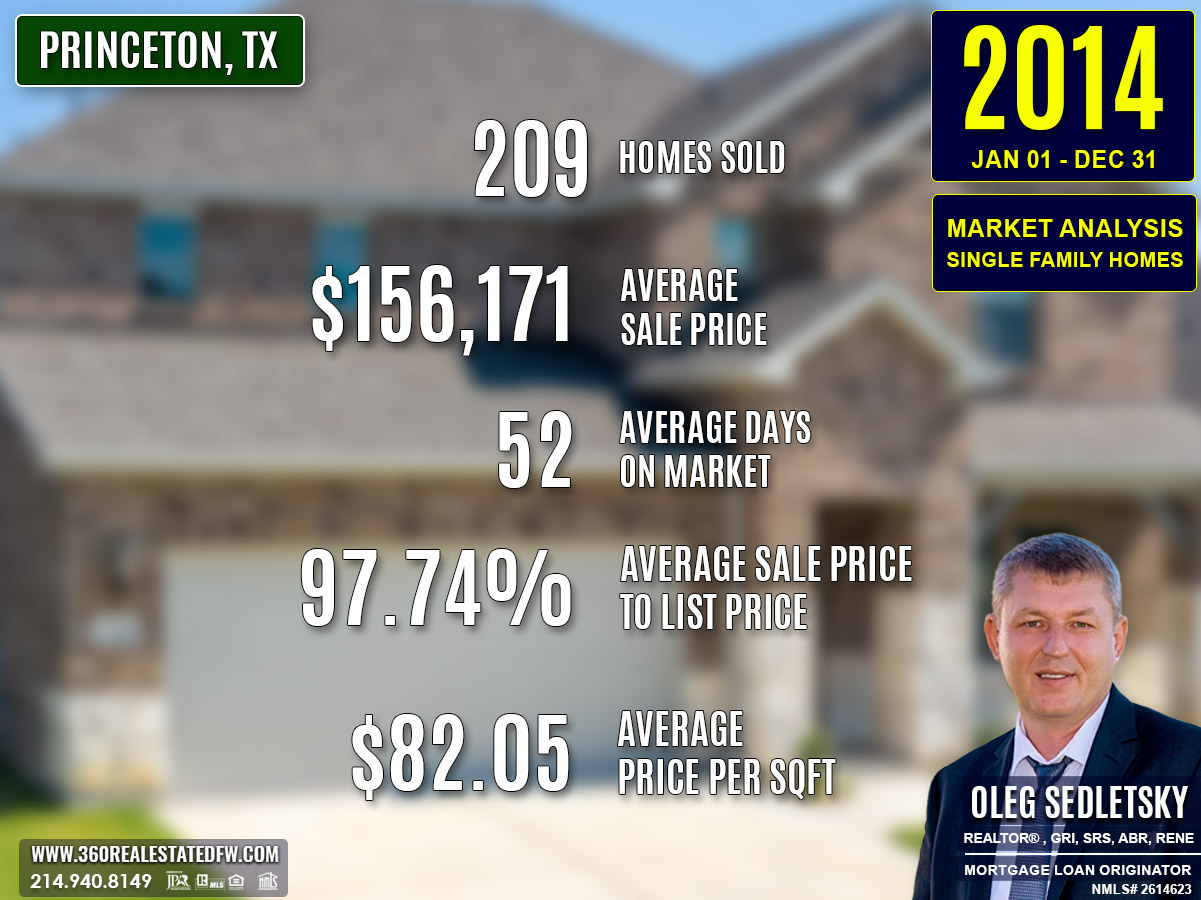

Princeton, TX Real Estate Market Report 2014: Analysis and Trends

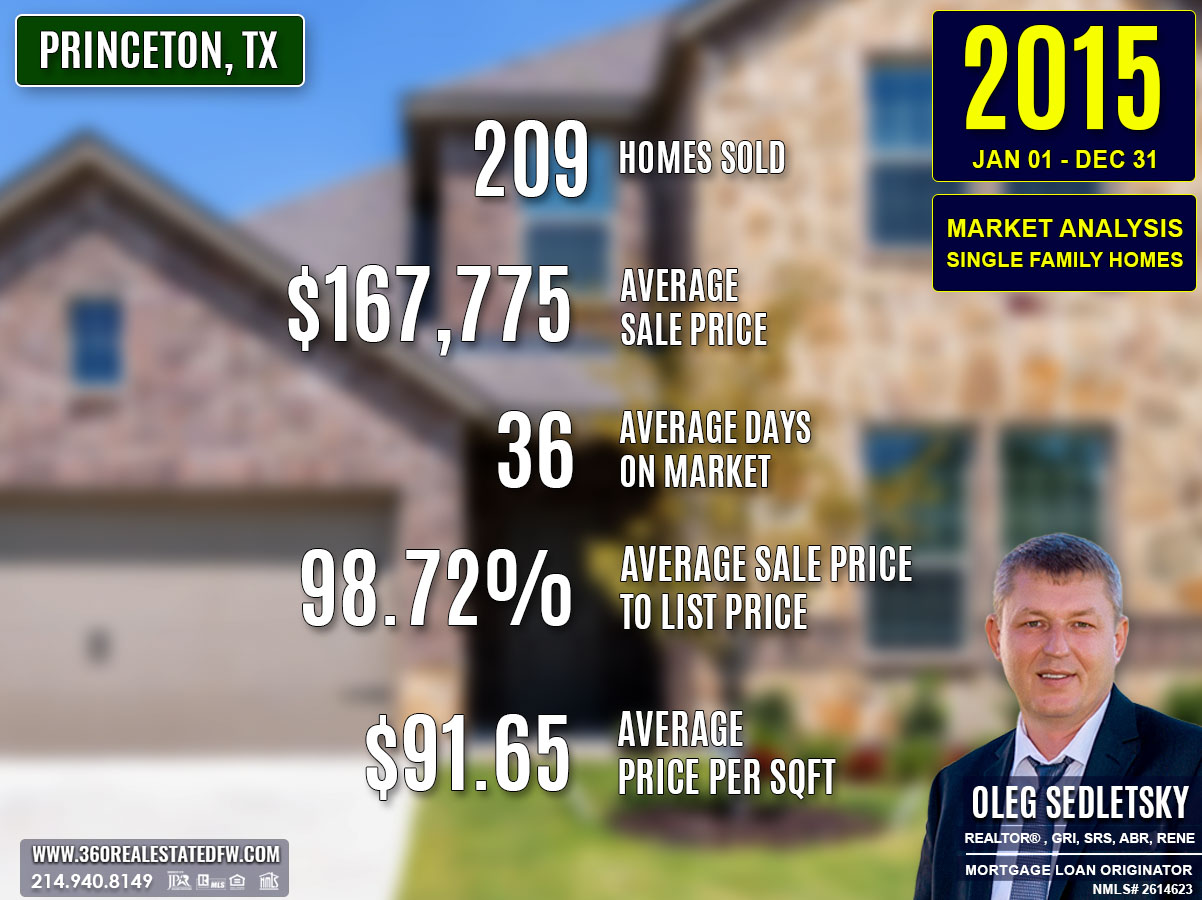

Princeton, TX Real Estate Market Report 2015: Analysis and Trends

Princeton, TX Real Estate Market Report 2016: Analysis and Trends

Princeton, TX Real Estate Market Report 2017: Analysis and Trends

Princeton, TX Real Estate Market Report 2018: Analysis and Trends

Princeton, TX Real Estate Market Report 2019: Analysis and Trends

Princeton, TX Real Estate Market Report 2020: Analysis and Trends

This market analysis is intended solely for educational purposes. This market analysis is based on data sourced from NTREIS, Inc. This analysis is exclusively focused on single-family homes and does not account for other property types. The total number of real estate transactions within the specified period and location may vary. Data accuracy cannot be guaranteed due to potential input errors made by NTREIS users. This market analysis does not account for all new construction home sales. If you need detailed information about recorded property sales or other public records, please contact the appropriate city or county office.

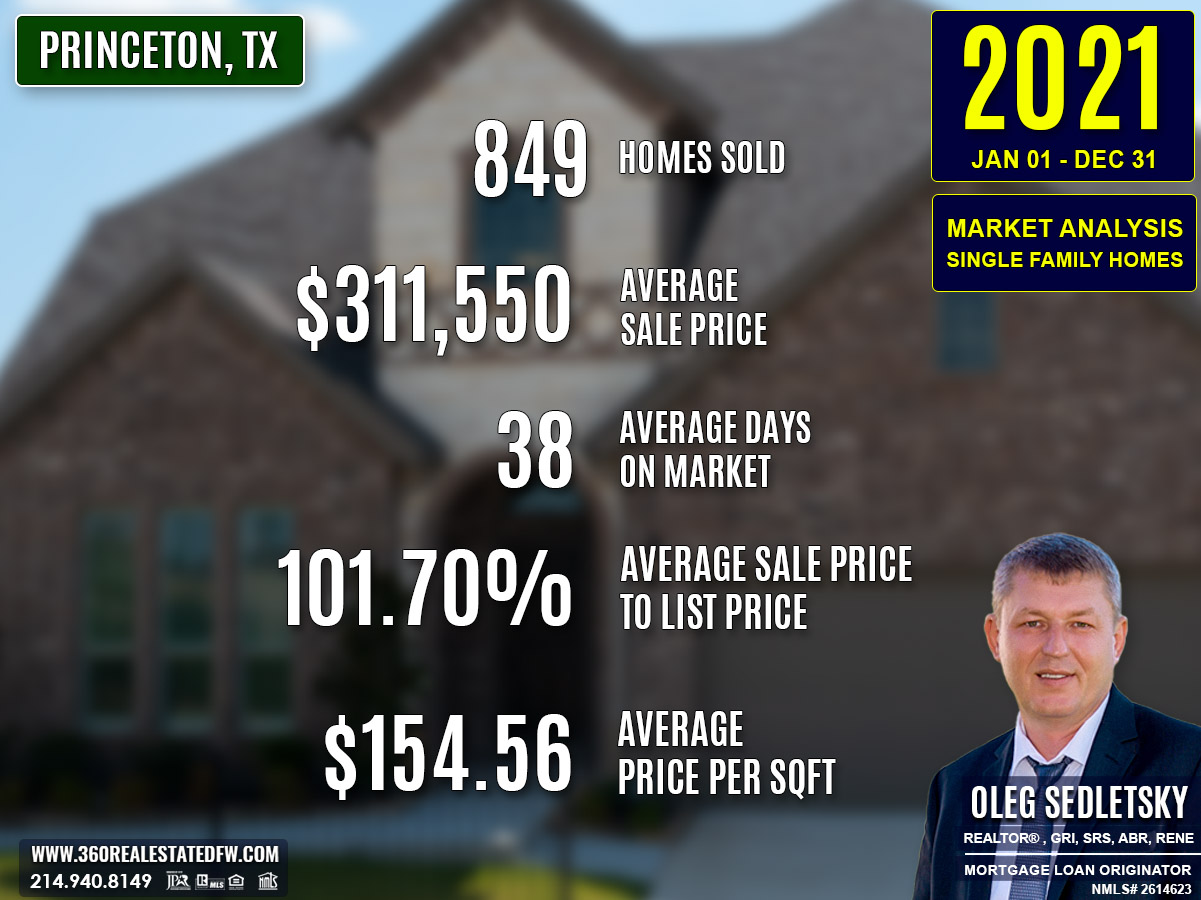

Princeton, TX Real Estate: A Comprehensive Analysis of the 2021 Single-Family Residential Housing Market

The second year of the COVID-19 pandemic continued to shape the real estate market in Princeton, Texas. Work-from-home trends and lifestyle changes encouraged demand for spacious homes and properties with unique features. HomeBuyers benefited from historically low mortgage rates averaging 3.15%, further fueling market activity. With 849 homes sold, the market demonstrated resilience in the face of economic challenges.

Key Takeaways and Trends from Princeton’s 2021 Real Estate Market

Pricing Range: A broader pricing spectrum emerged, from $130,000 to over $1 million, appealing to diverse buyers.

Market Efficiency: Faster closings and higher close price ratios reflected strong buyer confidence and competitive dynamics.

Unique Outliers: The sale of luxury properties and new construction homes drove significant price tiers upward.

Mortgage Rates Impact: The low 3.15% mortgage rate spurred buyer activity, further boosting transaction volume.

Total Homes Closed

A total of 849 residential single-family homes closed in Princeton, TX in 2021.

New Construction Homes: 402, highlighting an active development year.

Homes with Pools: 12, reflecting steady interest in leisure-driven amenities.

Property Pricing Insights

- Minimum Price: $130,000

- Maximum Price: $1,025,000

- Average Price: $311,550

- Median Price: $300,000

This data reflects rising property values and a growing demand across pricing tiers, especially in the mid-to-luxury range.

Property Size and Features

- Bedrooms: Properties ranged from 1 to 6 bedrooms, with an average of 4.

- Bathrooms: Ranged from 1 to 5 baths, with an average of 2 full baths.

- Square Footage: Homes varied from 768 sqft to 4,543 sqft, with an average of 2,080 sqft.

- Lot Size: Lot areas ranged from 0.000 to 12.980 acres, averaging 0.308 acres per home.

The focus on larger homes and generous lot sizes illustrated buyer preferences for comfort and space.

Market Dynamics

- Days on Market (DOM): Properties averaged 38 days on the market, showing slightly quicker transactions than 2020.

- ClsPr/LstPr Ratio: 101.70%, indicating frequent sale prices above listing prices.

- ClsPr/OLP Ratio: 104.22%, showcasing competitive buyer demand compared to original listings.

- Average Price Per Square Foot: $154.56, reflecting a per-square-foot increase aligned with overall price growth.

Insights into the Most Expensive Princeton, TX Property Sold in 2021

The most expensive property sold in 2021 was an elegant home with standout features:

- Price: $1,025,000

- Beds: 5

- Baths: 5 (4 full, 1 half)

- Square Footage: 3,967 sqft

- Price Per Sqft: $258.38

- Lot Size: 9.000 acres

- Days on Market: 112

- ClsPr/LstPr Ratio: 97.62%

- ClsPr/OLP Ratio: 132.26%

- Year Built: 2007

This property exemplifies high-end living, with a high price driven by its substantial acreage, spacious layout, and premium amenities. This sale reflected the increasing demand for premium and luxury homes in Princeton, TX. Though such properties remained outliers, they underscored market readiness for high-value purchases.

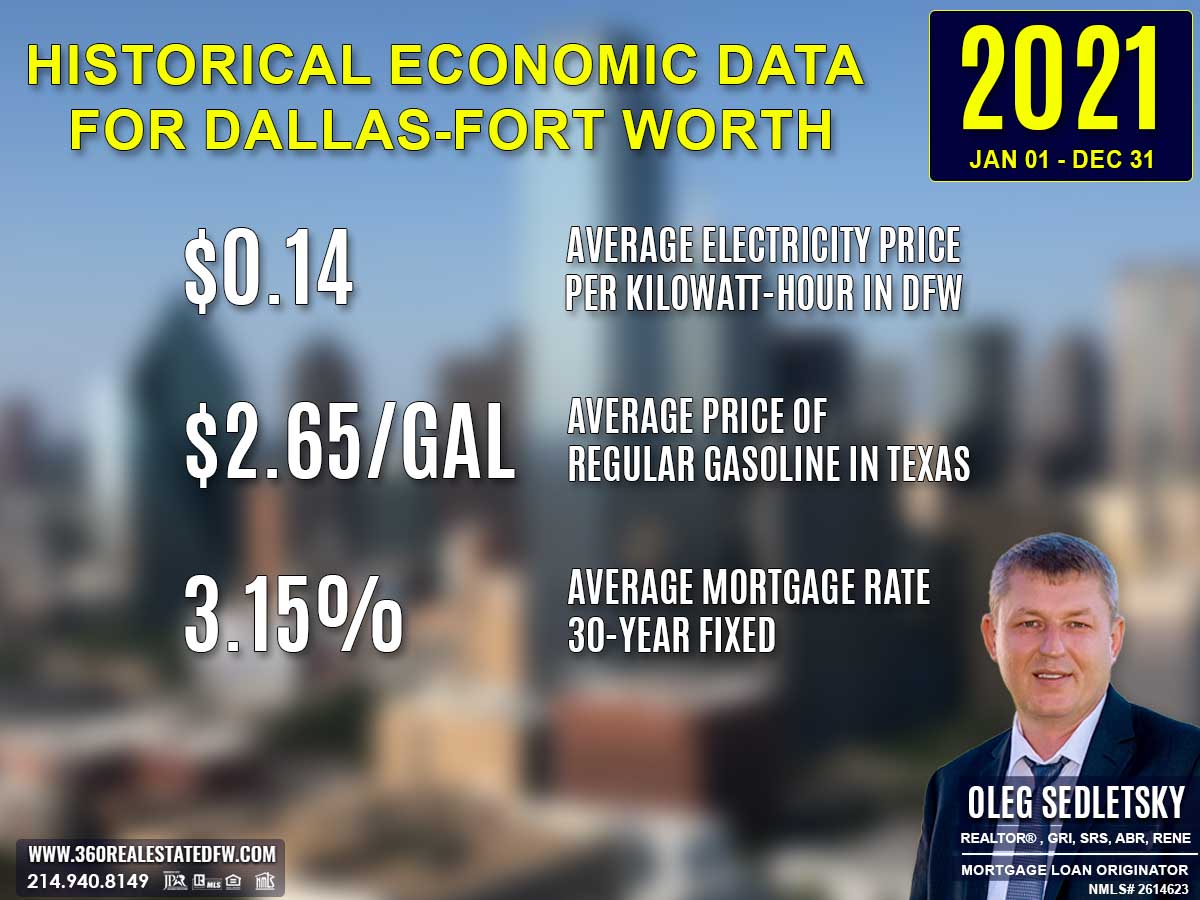

Economic context

Average Electricity Costs in Dallas-Fort Worth in 2021

Electricity prices rose again to $0.14 per kilowatt-hour in 2021, up from $0.13 in 2020. This upward trend in energy costs likely pushed buyers to prioritize homes with efficient heating and cooling systems. Green-certified homes may have seen increased interest as buyers sought to offset higher utility bills.

Average Price for Regular Gasoline in Texas in 2021

Gas prices climbed to $2.65 per gallon in 2021, up from $1.82 in the prior year. This sharp increase put pressure on household budgets, especially for buyers with long commutes. Urban properties or homes in transit-accessible locations likely became more appealing as buyers aimed to minimize transportation expenses.

Average 30-Year Fixed Mortgage Rate in 2021

The average 30-year fixed mortgage rate dropped slightly to 3.15% in 2021, down from 3.38% in 2020. This decline further fueled homebuying demand, making mortgages more affordable despite rising home prices. Potential homebuyers were strongly advised to secure pre-approval through local mortgage loan originators to enhance their financial readiness during highly competitive conditions.

Curious about today’s mortgage rates and the home you can comfortably afford?

Submit a no-obligation mortgage application today and get pre-approved to determine your budget and take the first step toward homeownership with confidence.

Overview of Differences Between the 2020 and 2021 Real Estate Markets in Princeton, Texas

Volume of Sales

Sales volume surged from 560 homes in 2020 to 849 homes in 2021, marking a 51% increase, reflecting heightened market activity and buyer demand.

Pricing

- Minimum Price: Increased from $122,458 to $130,000, showing a slight rise in entry-level pricing.

- Maximum Price: Jumped significantly from $734,000 to $1,025,000, illustrating growth in the luxury segment.

- Average Price: Rose from $260,958 to $311,550, a $50,592 increase showcasing steady appreciation.

- Median Price: Climbed from $248,950 to $300,000, reflecting overall market growth.

Market Efficiency

- Days on Market (DOM): Declined from 40 to 38 days, indicating slightly faster transactions.

- ClsPr/LstPr Ratio: Improved from 98.52% to 101.70%, highlighting strong buyer willingness to pay above listing prices.

- ClsPr/OLP Ratio: Increased from 99.29% to 104.22%, showcasing competitive offers even on original listings.

Property Features

- Average Square Footage: Grew from 2,080 sqft in 2020 to 2,080 sqft in 2021, remaining stable.

- Average Lot Size: Declined slightly, with acreage medians dropping from 0.150 to 0.145 acres, reflecting smaller lot sizes on average.

- Homes with Pools: Decreased from 15 homes in 2020 to 12 in 2021, reducing leisure-oriented inventory.

- New Construction Homes: Boomed from 224 homes in 2020 to 402 in 2021, emphasizing accelerating development and homebuyer interest in new builds.

Economic Context

Mortgage rates dipped from 3.38% to 3.15%, making home purchases more accessible, despite rising property values. The sustained influence of the pandemic further drove demand for larger and lifestyle-oriented properties, as families continued to prioritize comfort over location.

These differences highlight the rapid growth and dynamic shifts in Princeton’s real estate market during 2021, underscoring its resilience and adaptability in a transitioning economic climate.

Summary of Real Estate Market Analysis for Princeton, TX in 2021

The 2021 real estate market in Princeton, TX was marked by intense activity and opportunity, creating unique dynamics for both homebuyers and home-sellers.

Homebuyers’ Perspective

For homebuyers, historically low mortgage rates averaging 3.15% provided a rare opportunity to secure financing at affordable terms. However, increased property prices—especially with the average price rising to $311,550—created challenges for entry-level buyers. New construction homes, accounting for 402 of the sales, stood out as an attractive option for those seeking modern amenities and energy-efficient features. The competitive nature of the market, reflected in the jump in close-to-list price ratios above 101.70%, meant buyers needed to act quickly and decisively to secure their desired properties. For many, focusing on lifestyle priorities like additional space and comfort became more critical than ever.

Home-Sellers’ Perspective

For home-sellers, the 2021 market offered strong incentives, with higher property valuations driving increased profits. The rise in both average and median prices represented a lucrative environment to sell, while a slightly shorter 38-day average DOM indicated sustained buyer interest. Sellers who priced their properties competitively were more likely to attract offers above the listing price, as shown by the robust ClsPr/LstPr ratios. Larger homes with features like more bedrooms, larger lot sizes, or pools continued to command attention, and the growing demand for spacious, lifestyle-oriented properties presented an opportunity to maximize value. By tailoring listings to highlight these sought-after features, sellers could further capitalize on the prevailing market trends.

2021 showcased a market shaped by resilience and adaptability. Lower financing costs and evolving buyer priorities drove competitive demand, while sellers enjoyed the rewards of higher valuations for well-positioned properties. Both groups benefited from the dynamic synergy of accelerated development and shifting needs, solidifying Princeton’s market strength during another extraordinary year.

The Importance of Statistical Data in Princeton, Texas Real Estate Market

Did you know that appraisers and Realtors rely on historical statistical data to determine a property’s current value?

Analyzing historical market data is essential for making informed decisions in today’s real estate market. Examining past trends provides valuable insights that facilitate accurate pricing, more strategic negotiations, and a comprehensive understanding of market dynamics. By understanding market dynamics, both homebuyers and home-sellers can leverage the conditions to achieve their goals.

Unlock Exceptional Service!

Assistance with all your real estate needs in the Dallas-Fort Worth area is just a click or call away. Reach out at 214-940-8149 or connect through the links below.

Greetings! I’m Oleg Sedletsky, and I’m excited to introduce myself as your go-to full-time licensed Texas REALTOR® and Mortgage Loan Originator.

I proudly represent JPAR® – Real Estate Brokerage as a REALTOR® and Utopia Mortgage LLC as a Mortgage Loan Originator! My designations and certifications reflect my dedication to helping you achieve your real estate goals in Princeton, TX and other locations in the vibrant Dallas-Fort Worth area!

My commitment to ongoing professional development means I’m always enhancing my skills to serve you better. You can count on me as your trusted expert throughout your real estate journey. Plus, I’m fluent in English, Ukrainian, and Russian and ready to assist you every step of the way!

It’s All About You and Your Real Estate Goals!

My mission is to serve you! With my knowledge and expertise, I’m here to help you achieve all your real estate goals!

I’m passionate about helping buyers and sellers navigate the exciting real estate landscape in Princeton, Texas! Whether you’re searching for your dream home, exploring land options, or looking for commercial properties, my Real Estate Services have you covered.

Contact me today for all your real estate needs in Princeton, Texas! Call/text 214-940-8149

A Comprehensive Analysis of Single-Family Residential Housing Market in Princeton, TX: 2010 to Present

Discover the trends, stats, and insights shaping Princeton’s real estate market year by year!

2010-2020

Princeton, TX Real Estate Market Report 2010: Analysis and Trends

Princeton, TX Real Estate Market Report 2011: Analysis and Trends

Princeton, TX Real Estate Market Report 2012: Analysis and Trends

Princeton, TX Real Estate Market Report 2013: Analysis and Trends

Princeton, TX Real Estate Market Report 2014: Analysis and Trends

Princeton, TX Real Estate Market Report 2015: Analysis and Trends

Princeton, TX Real Estate Market Report 2016: Analysis and Trends

Princeton, TX Real Estate Market Report 2017: Analysis and Trends

Princeton, TX Real Estate Market Report 2018: Analysis and Trends

Princeton, TX Real Estate Market Report 2019: Analysis and Trends

Princeton, TX Real Estate Market Report 2020: Analysis and Trends

This market analysis is intended solely for educational purposes. This market analysis is based on data sourced from NTREIS, Inc. This analysis is exclusively focused on single-family homes and does not account for other property types. The total number of real estate transactions within the specified period and location may vary. Data accuracy cannot be guaranteed due to potential input errors made by NTREIS users. This market analysis does not account for all new construction home sales. If you need detailed information about recorded property sales or other public records, please contact the appropriate city or county office.

Princeton, TX Real Estate: A Comprehensive Analysis of the 2020 Single-Family Residential Housing Market

The 2020 real estate market in Princeton, Texas reflected resilience amidst the unprecedented challenges of COVID-19. The pandemic sparked changes in housing demand, as remote work and health concerns reshaped priorities. This analysis examines the year’s performance, focusing on key metrics such as pricing, property features, and market trends that defined Princeton during this unique period.

Key Takeaways and Trends from Princeton’s 2020 Real Estate Market

Pricing Range: The market expanded upward, with the highest sale at $734,000 and a broader gap between high and low ends.

Market Efficiency: Minor shifts in DOM suggest homebuyers were still quick to close, but price corrections were slightly more common.

Unique Outliers: Larger acreage and pools in high-end homes gained traction.

Mortgage Rates Impact: The drop to an average of 3.38% made homeownership more accessible, fueling market activity.

Total Homes Closed

A total of 560 homes closed in 2020, an increase from 514 in 2019.

New construction homes: Represented 224 properties, down from the previous year’s count.

Homes with pools: Grew significantly to 15 homes, signaling increased demand for lifestyle features as buyers sought more leisure amenities amidst pandemic lockdowns.

Property Pricing Insights

- Minimum price: $55,500, reflecting higher affordability compared to 2019.

- Maximum price: $734,000, a notable peak reflecting luxury market demand.

- Average price: $260,958, an increase reflective of robust market performance.

- Median price: $248,950, significantly higher than the mid-point price from the previous year.

Property Size and Features

- Beds: Properties averaged 4 bedrooms, maintaining the previous year’s trend.

- Baths: Average was 2 bathrooms, with full baths remaining consistent across properties.

- Square footage: Ranged from 820 to 4,662 sqft, with an average of 2,027 sqft, larger than in 2019.

- Lot Size: Expanded, with plenty sizes averaging 0.511 acres, larger than 2019’s figure.

Market Dynamics

- Days on Market (DOM): Increased marginally to 40 days from the previous year’s average of 38 days.

- ClsPr/LstPr Ratio: Achieved 98.52%, showing minor adjustments compared to 2019.

- ClsPr/OLP Ratio: Slightly improved to 99.29%, reflecting stronger alignment with original listing prices.

- Average price per square foot: Rose to $131.02, indicating incremental value increases.

Insights into the Most Expensive Princeton, TX Property Sold in 2020

The standout property of 2020 was a luxurious home priced at $734,000. This home featured high-end finishes, ample space, and premium amenities, including a pool and 12 acres of land.

Key Highlights:

- Beds: 3

- Baths: 3 (2 full, 1 half)

- Size: 3,034 sqft

- Lot: 12.27 acres

- Price per sqft: $241.92

- Days on Market: 25

- ClsPr/LstPr & ClsPr/OLP Ratios: 97.88%

- Year Built: 1995

This property exemplifies the continued interest in premium homes offering privacy and space, particularly during the pandemic when lifestyle needs changed.

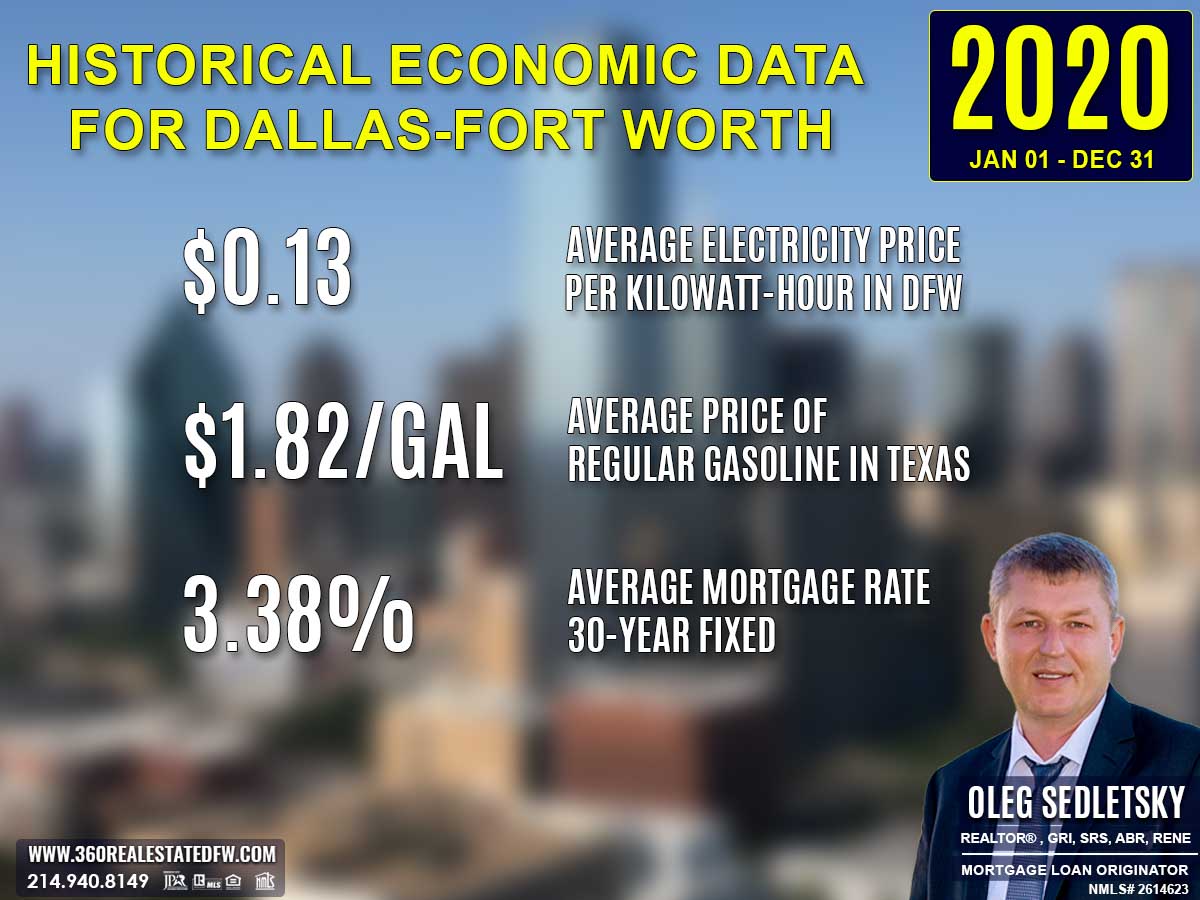

Economic context

Average Electricity Costs in Dallas-Fort Worth in 2020

Electricity prices returned to $0.13 per kilowatt-hour in 2020, slightly lower than 2019’s $0.14. This small decrease might have supported household budgets as the economy faced numerous uncertainties. Energy savings further highlighted the appeal of efficient homes, adding value to sustainable designs and energy-conscious upgrades.

Average Price for Regular Gasoline in Texas in 2020

Gas prices dipped to $1.82 per gallon in 2020, down significantly from $2.29 in 2019. Lower transportation costs provided financial relief to homebuyers, potentially boosting interest in suburban and rural areas where homes were larger and more affordable. The drop in gas prices gave buyers more flexibility in location choices.

Average 30-Year Fixed Mortgage Rate in 2020

Mortgage rates averaged just 3.38% in 2020, a steep drop from 4.13% the previous year. This marked an historic low, attracting a surge of homebuyers eager to lock in affordable financing. Pre-approval with local mortgage loan originators became an essential first step as buyers navigated increased competition in a hot market.

Curious about today’s mortgage rates and the home you can comfortably afford?

Submit a no-obligation mortgage application today and get pre-approved to determine your budget and take the first step toward homeownership with confidence.

Overview of Differences Between the 2019 and 2020 Real Estate Markets in Princeton, Texas

Volume of Sales

Sales volume increased from 514 homes in 2019 to 560 homes in 2020, reflecting a strong and growing market despite the pandemic.

Pricing

- Minimum price rose from $40,000 to $55,500, showing greater entry-level price stability.

- Maximum price increased from $600,000 to $734,000, highlighting growing demand in the luxury segment.

- Average price jumped from $234,809 to $260,958, a year-over-year increase of over $26,000.

- Median price climbed from $220,000 to $248,950, reflecting more consistent value growth.

Market Efficiency

- Days on Market (DOM): Increased slightly from 38 to 40 days, indicating a slightly slower pace of sales.

- ClsPr/LstPr Ratio: Decreased marginally from 98.84% to 98.52%, signaling small price adjustments to close deals.

- ClsPr/OLP Ratio: Improved from 99.13% to 99.29%, showing stronger alignment with original listing prices.

Property Features

- Square Footage: Average property size grew from 1,892 sqft in 2019 to 2,027 sqft in 2020, suggesting buyers sought larger homes.

- Lot Size: The average lot size increased from 0.487 acres to 0.511 acres, reflecting a desire for more outdoor space during a pandemic year.

- Homes with Pools: Increased from 7 homes in 2019 to 15 homes in 2020, showcasing growing interest in lifestyle and leisure properties.

- New Construction Homes: Declined from 275 homes in 2019 to 224 in 2020, suggesting a disruption in construction activity or a potential shift in focus toward preowned homes.

Economic Context

The average 30-year fixed mortgage rate fell from 4.13% in 2019 to 3.38% in 2020, enhancing affordability and driving higher sales activity.

COVID-19 reshaped buyer preferences, as work-from-home trends increased demand for spacious homes, larger lots, and lifestyle-enhancing features like pools.

Despite the challenges brought by the pandemic, the real estate market in Princeton, TX experienced significant growth and demonstrated remarkable adaptability, highlighting its resilience and ability to cater to evolving buyer needs.

Summary of Real Estate Market Analysis for Princeton, TX in 2020

The 2020 real estate market in Princeton, TX showcased both opportunity and competition, with insights for homebuyers and home-sellers.

Homebuyers’ Perspective

For homebuyers, the market offered enticing opportunities despite increasing prices. The drop in the average 30-year fixed mortgage rate to 3.38% made homeownership more affordable, allowing many to explore larger homes, spacious lots, and properties with pools—features that gained popularity due to the pandemic. However, the rising average and median prices meant entry-level buyers faced more competition and higher costs. Quick decision-making was crucial, as homes spent an average of 40 days on the market, slightly longer than the previous year but still indicative of high demand. Buyers looking for value could still find opportunities in resale properties and leverage market trends favoring lifestyle-driven features.

Home-Sellers’ Perspective

Home-sellers found themselves in a favorable position as the market remained robust, with average property prices increasing to $260,958 and median prices to $248,950. This growth in value was supported by a strong appetite for spacious homes and unique property features like pools or large lots. Sellers could capitalize on these trends by emphasizing such amenities. However, the slight increase in Days on Market (40 days) underscored the importance of pricing strategies that appealed to well-informed buyers.

Additionally, close price ratios—ClsPr/LstPr at 98.52% and ClsPr/OLP at 99.29%—showcased the importance of accurately listing homes, providing high-quality photos and property videos, and embracing the growing demand for 3D virtual tours—an innovation driven by the pandemic to sustain buyer interest while reducing the need for price cuts. Sellers who aligned with buyer preferences for lifestyle and space found greater success in closing deals faster.

Overall, Princeton’s 2020 real estate market thrived despite the challenges posed by COVID-19, offering affordability and lifestyle features to buyers, while rewarding sellers with higher property valuations and strong buyer interest. Both groups’ ability to adapt to shifting trends defined market resilience during this extraordinary year.

The Importance of Statistical Data in Princeton, Texas Real Estate Market

Did you know that appraisers and Realtors rely on historical statistical data to determine a property’s current value?

Analyzing historical market data is essential for making informed decisions in today’s real estate market. Examining past trends provides valuable insights that facilitate accurate pricing, more strategic negotiations, and a comprehensive understanding of market dynamics. By understanding market dynamics, both homebuyers and home-sellers can leverage the conditions to achieve their goals.

Unlock Exceptional Service!

Assistance with all your real estate needs in the Dallas-Fort Worth area is just a click or call away. Reach out at 214-940-8149 or connect through the links below.

Greetings! I’m Oleg Sedletsky, and I’m excited to introduce myself as your go-to full-time licensed Texas REALTOR® and Mortgage Loan Originator.

I proudly represent JPAR® – Real Estate Brokerage as a REALTOR® and Utopia Mortgage LLC as a Mortgage Loan Originator! My designations and certifications reflect my dedication to helping you achieve your real estate goals in Princeton, TX and other locations in the vibrant Dallas-Fort Worth area!

My commitment to ongoing professional development means I’m always enhancing my skills to serve you better. You can count on me as your trusted expert throughout your real estate journey. Plus, I’m fluent in English, Ukrainian, and Russian and ready to assist you every step of the way!

It’s All About You and Your Real Estate Goals!

My mission is to serve you! With my knowledge and expertise, I’m here to help you achieve all your real estate goals!

I’m passionate about helping buyers and sellers navigate the exciting real estate landscape in Princeton, Texas! Whether you’re searching for your dream home, exploring land options, or looking for commercial properties, my Real Estate Services have you covered.

Contact me today for all your real estate needs in Princeton, Texas! Call/text 214-940-8149

A Comprehensive Analysis of Single-Family Residential Housing Market in Princeton, TX: 2010 to Present

Discover the trends, stats, and insights shaping Princeton’s real estate market year by year!

2010-2020

Princeton, TX Real Estate Market Report 2010: Analysis and Trends

Princeton, TX Real Estate Market Report 2011: Analysis and Trends

Princeton, TX Real Estate Market Report 2012: Analysis and Trends

Princeton, TX Real Estate Market Report 2013: Analysis and Trends

Princeton, TX Real Estate Market Report 2014: Analysis and Trends

Princeton, TX Real Estate Market Report 2015: Analysis and Trends

Princeton, TX Real Estate Market Report 2016: Analysis and Trends

Princeton, TX Real Estate Market Report 2017: Analysis and Trends

Princeton, TX Real Estate Market Report 2018: Analysis and Trends

Princeton, TX Real Estate Market Report 2019: Analysis and Trends

Princeton, TX Real Estate Market Report 2020: Analysis and Trends

This market analysis is intended solely for educational purposes. This market analysis is based on data sourced from NTREIS, Inc. This analysis is exclusively focused on single-family homes and does not account for other property types. The total number of real estate transactions within the specified period and location may vary. Data accuracy cannot be guaranteed due to potential input errors made by NTREIS users. This market analysis does not account for all new construction home sales. If you need detailed information about recorded property sales or other public records, please contact the appropriate city or county office.

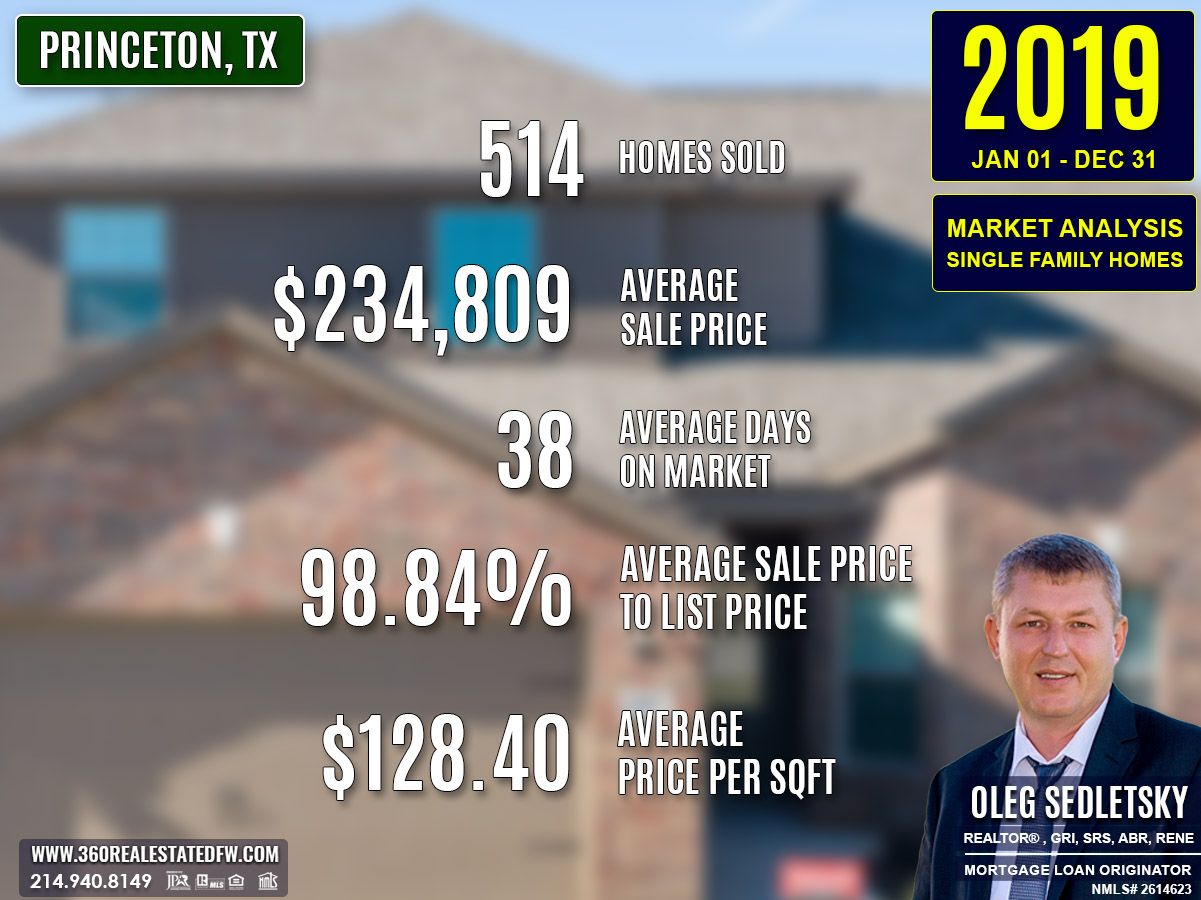

Princeton, TX Real Estate: A Comprehensive Analysis of the 2019 Single-Family Residential Housing Market

The Princeton, Texas real estate market in 2019 displayed balanced growth and stability amid evolving buyer preferences and fluctuating economic conditions. This analysis identifies trends, highlights notable data, and examines key market dynamics, providing a comprehensive look at Princeton’s housing activity over the year.

Key Takeaways and Trends from Princeton’s 2019 Real Estate Market

Pricing Range: Homes spanned from $40,000 to $600,000, indicating a wider affordability spectrum. While the average price saw marginal growth, the minimum price drop allowed more entry-level opportunities.

Market Efficiency: Rising DOM to 38 days suggests slower sales turnover, but improved ClsPr/OLP and ClsPr/LstPr ratios indicate slightly firmer pricing expectations.

Unique Outliers: The most expensive sale demonstrated demand for high-end amenities but required nearly 7 months on market.

Mortgage Rates Impact: Lower mortgage rates at 4.13%, compared to 4.70% in the prior year, improved affordability and may have stabilized the market.

Total Homes Closed

- Closed transactions: The market closed 514 homes, showing steady activity with only a minor decline from 2018’s 525.

- New construction homes: Sales reached 275 homes, increasing from 264 in 2018, underscoring strong development efforts.

- Homes with pools: Dip in sales to 7 homes from 10 properties in 2018, reflecting a downward trend in luxury pool homes.

Property Pricing Insights

The market displayed slight price adjustments compared to 2018:

- Minimum price: Fell significantly from $72,000 to $40,000, introducing more affordable options.

- Maximum price: Incrementally increased from $599,000 to $600,000, driven by a luxury property at the upper end.

- Average price: Rose marginally by 0.6%, from $233,494 to $234,809, maintaining steady pricing levels.

- Median price: Decreased slightly to $227,900, down from $228,900, signaling stabilization in the mid-market.

Property Size and Features

Princeton’s homes catered to varied preferences with consistent property features:

- Bedrooms: Average of 4 bedrooms, consistent with 2018.

- Bathrooms: Average of 2 bathrooms, unchanged from the prior year.

- Square footage: Average size declined modestly to 1,867 sqft, down from 1,897 sqft in 2018.

- Lot sizes: Averaged 0.304 acres, smaller than 2018’s 0.377 acres, reflecting more compact real estate options.

Market Dynamics

The market shifted slightly in terms of efficiency and value:

- Days on Market (DOM): Homes averaged 38 days, up from 30 days in 2018, indicating slower turnover.

- ClsPr/LstPr Ratio: Remained steady at 98.84%, a minor improvement from 98.79%.

- ClsPr/OLP Ratio: Rose to 99.13%, improving from 97.81%, showing better alignment of closing and original prices.

- Average price per sqft: Increased to $128.40, up from 2018’s $125.24, reflecting a 2.5% growth in property value per unit space.

Insights into the Most Expensive Princeton, TX Property Sold in 2019

The standout sale of the year was a luxurious home featuring:

- Price: $600,000

- Beds/Baths: 4 bedrooms, 4 bathrooms (3 full, 1 half)

- Square Footage: 4,612 sqft

- Price per sqft: $130.10

- Lot Size: 1.390 acres

- Days on Market (DOM): 218 days

- ClsPr/LstPr Ratio: 100.00%

- ClsPr/OLP Ratio: 92.31%

- Year Built: 2001

- Unique Feature: Included a pool for premium outdoor living

This high-value property highlighted continued interest in luxury homes within Princeton, despite its extended DOM of 218 days. The sale showcased buyer willingness to pay premium prices for spacious homes with amenities, such as a private pool.

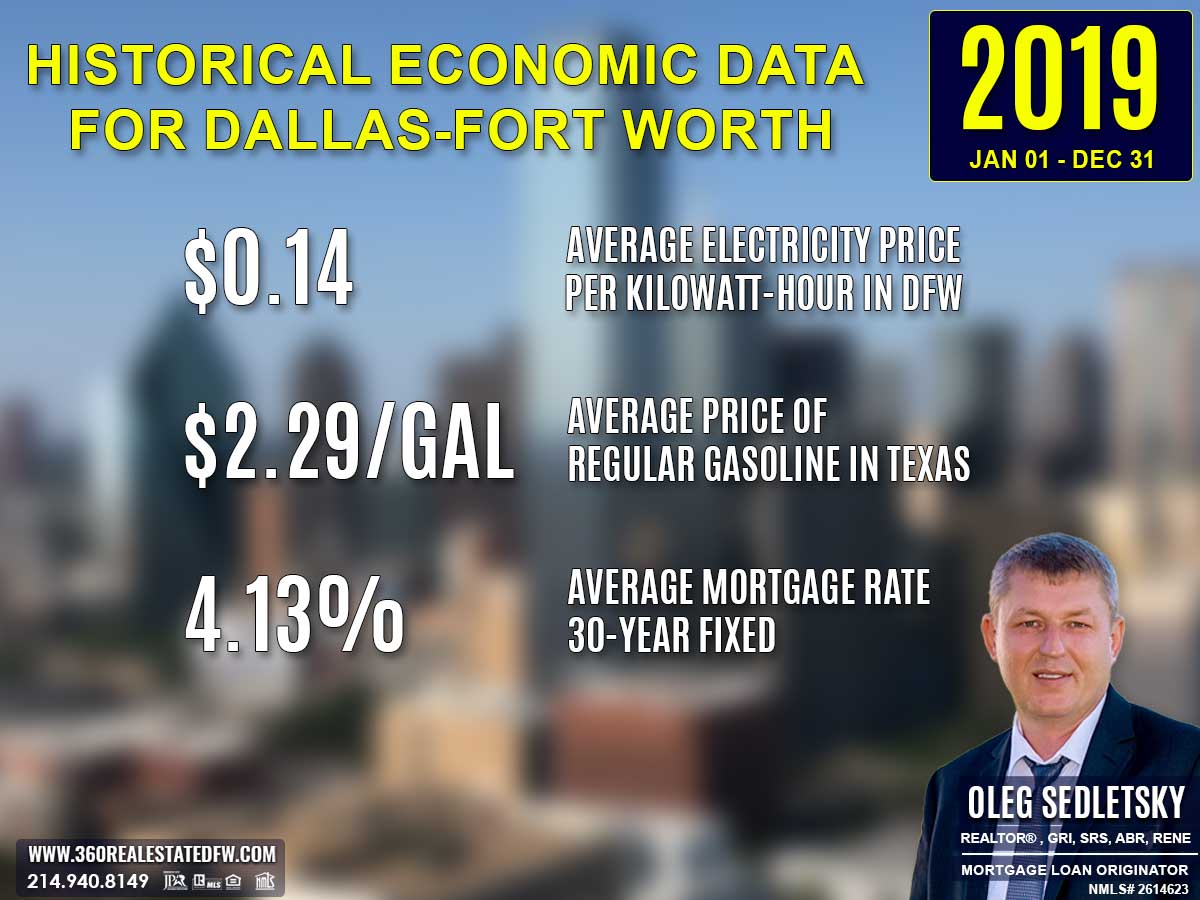

Economic context

Average Electricity Costs in Dallas-Fort Worth in 2019

The average electricity price in 2019 climbed to $0.14 per kilowatt-hour, up from $0.13 in 2018. This uptick added some pressure on household budgets, further solidifying the need for energy-efficient homes. Properties featuring solar panels or smart home technologies likely gained value as homebuyers sought ways to mitigate rising energy expenses.

Average Price for Regular Gasoline in Texas in 2019

Gas prices fell slightly to $2.29 per gallon in 2019, down from $2.44 in 2018. This small decline brought modest relief to transportation costs and may have encouraged suburban home purchases, where commuting distances tend to be longer. Homebuyers likely balanced fuel costs with home prices when making location decisions.

Average 30-Year Fixed Mortgage Rate in 2019

Mortgage rates averaged 4.13% in 2019, down from 4.70% the year before. This noticeable decline made homeownership more attainable for many homebuyers and likely spurred activity in the housing market. Pre-approvals through local mortgage loan originators remained key for buyers wanting to confidently pursue homes amid favorable rate conditions.

Curious about today’s mortgage rates and the home you can comfortably afford?

Submit a no-obligation mortgage application today and get pre-approved to determine your budget and take the first step toward homeownership with confidence.

Overview of Differences Between the 2018 and 2019 Real Estate Markets in Princeton, Texas

Volume of Sales

Closed transactions slightly declined from 525 homes in 2018 to 514 homes in 2019, reflecting a 2.1% decrease.

Pricing

- Minimum price: Dropped from $72,000 to $40,000, introducing more affordable options.

- Maximum price: Increased marginally from $599,000 to $600,000, indicating consistent high-end market interest.

- Average price: Rose slightly by 0.6%, from $233,494 to $234,809, maintaining price stability.

- Median price: Declined marginally from $228,900 to $227,900, signaling a slight shift in mid-market dynamics.

Market Efficiency

- Days on Market (DOM): Increased from 30 days to 38 days, showing slightly slower turnover.

- ClsPr/LstPr Ratio: Improved slightly from 98.79% to 98.84%, reflecting stable seller pricing.

- ClsPr/OLP Ratio: Grew from 97.81% to 99.13%, signaling better alignment with original listing prices.

Property Features

- Square footage: Decreased slightly from 1,897 sqft to 1,867 sqft, indicating slightly smaller homes overall.

- Lot size: Reduced from 0.377 acres to 0.304 acres, a shift toward more compact property offerings.

- Homes with pools: Fell from 10 homes in 2018 to 7 homes in 2019, marking a decline in this luxury feature.

- New construction homes: Increased from 264 homes in 2018 to 275 homes in 2019, demonstrating continued strength in development.

Economic Context

- Mortgage rates: Dropped from 4.70% in 2018 to 4.13% in 2019, improving housing affordability.

- Average electricity cost: Rose slightly from $0.13 to $0.14 per kilowatt hour, while gas prices fell from $2.44 to $2.29 per gallon, balancing living costs.

The 2019 market was marked by marginal adjustments, with a slight cooling in sales volume and DOM increasing. However, pricing remained consistent, and new construction saw growth, supported by lower mortgage rates, providing stability and growth opportunities.

Summary of Real Estate Market Analysis for Princeton, TX in 2019

The 2019 real estate market in Princeton, Texas presented a balanced landscape with opportunities and challenges for both homebuyers and home-sellers.

Homebuyers’ Perspective

For homebuyers, 2019 was a year of increased affordability and opportunity. With the minimum home price dropping to $40,000, entry-level buyers found it easier to enter the market. The surge in new construction homes (275 properties) offered modern design and updated features, appealing to those seeking move-in-ready options. Additionally, lower mortgage rates (4.13%) boosted affordability by reducing monthly payments, making homeownership more attainable.

Buyers also had room to negotiate, particularly on properties with longer Days on Market (38 days) compared to the previous year. This added time allowed buyers to carefully evaluate options and secure favorable deals, especially on higher-priced or luxury homes.

Home-Sellers’ Perspective

Home-sellers faced increased competition and evolving buyer preferences, requiring strategic adjustments to ensure success. The slight rise in DOM meant it was crucial to price homes competitively from the start. Accurate and realistic pricing aligned with market expectations could lead to quicker closings and fewer adjustments throughout the sales process. However, the improved ClsPr/LstPr (98.84%) and ClsPr/OLP (99.13%) ratios showed that buyers were willing to meet listing prices for well-positioned properties.

New construction homes proved to dominate, reflecting continued demand for updated amenities and turnkey homes. Sellers of older properties might benefit from minor upgrades to match these buyer preferences. Additionally, while pool homes saw a decline in sales to just 7 properties, luxury homes—like the $600,000 standout sale—demonstrated demand for premium features such as larger living areas, pools, and expansive lots. Sellers in this segment should prepare for longer timelines but know that buyers are still willing to pay for the right property.

The Importance of Statistical Data in Princeton, Texas Real Estate Market

Did you know that appraisers and Realtors rely on historical statistical data to determine a property’s current value?

Analyzing historical market data is essential for making informed decisions in today’s real estate market. Examining past trends provides valuable insights that facilitate accurate pricing, more strategic negotiations, and a comprehensive understanding of market dynamics. By understanding market dynamics, both homebuyers and home-sellers can leverage the conditions to achieve their goals.

Unlock Exceptional Service!

Assistance with all your real estate needs in the Dallas-Fort Worth area is just a click or call away. Reach out at 214-940-8149 or connect through the links below.

Greetings! I’m Oleg Sedletsky, and I’m excited to introduce myself as your go-to full-time licensed Texas REALTOR® and Mortgage Loan Originator.

I proudly represent JPAR® – Real Estate Brokerage as a REALTOR® and Utopia Mortgage LLC as a Mortgage Loan Originator! My designations and certifications reflect my dedication to helping you achieve your real estate goals in Princeton, TX and other locations in the vibrant Dallas-Fort Worth area!

My commitment to ongoing professional development means I’m always enhancing my skills to serve you better. You can count on me as your trusted expert throughout your real estate journey. Plus, I’m fluent in English, Ukrainian, and Russian and ready to assist you every step of the way!

It’s All About You and Your Real Estate Goals!

My mission is to serve you! With my knowledge and expertise, I’m here to help you achieve all your real estate goals!

I’m passionate about helping buyers and sellers navigate the exciting real estate landscape in Princeton, Texas! Whether you’re searching for your dream home, exploring land options, or looking for commercial properties, my Real Estate Services have you covered.

Contact me today for all your real estate needs in Princeton, Texas! Call/text 214-940-8149

A Comprehensive Analysis of Single-Family Residential Housing Market in Princeton, TX: 2010 to Present

Discover the trends, stats, and insights shaping Princeton’s real estate market year by year!

2010-2020

Princeton, TX Real Estate Market Report 2010: Analysis and Trends

Princeton, TX Real Estate Market Report 2011: Analysis and Trends

Princeton, TX Real Estate Market Report 2012: Analysis and Trends

Princeton, TX Real Estate Market Report 2013: Analysis and Trends

Princeton, TX Real Estate Market Report 2014: Analysis and Trends

Princeton, TX Real Estate Market Report 2015: Analysis and Trends

Princeton, TX Real Estate Market Report 2016: Analysis and Trends

Princeton, TX Real Estate Market Report 2017: Analysis and Trends

Princeton, TX Real Estate Market Report 2018: Analysis and Trends

Princeton, TX Real Estate Market Report 2019: Analysis and Trends

Princeton, TX Real Estate Market Report 2020: Analysis and Trends

This market analysis is intended solely for educational purposes. This market analysis is based on data sourced from NTREIS, Inc. This analysis is exclusively focused on single-family homes and does not account for other property types. The total number of real estate transactions within the specified period and location may vary. Data accuracy cannot be guaranteed due to potential input errors made by NTREIS users. This market analysis does not account for all new construction home sales. If you need detailed information about recorded property sales or other public records, please contact the appropriate city or county office.

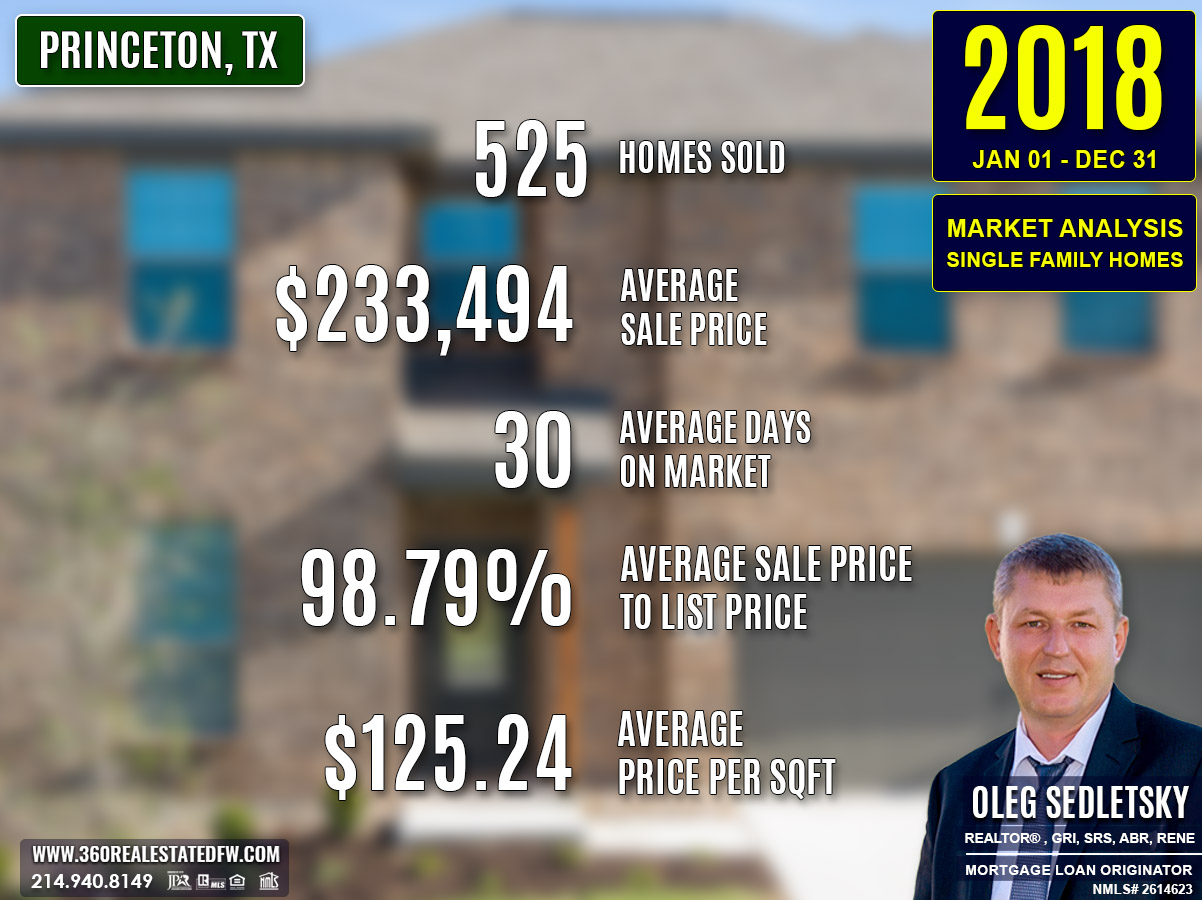

Princeton, TX Real Estate: A Comprehensive Analysis of the 2018 Single-Family Residential Housing Market

The 2018 Princeton, Texas real estate market showcased rapid growth fueled by robust new construction activity, rising home prices, and increasing demand. This analysis uncovers key market patterns and trends, providing a detailed breakdown of sales data, property characteristics, and economic factors shaping the year.

Key Takeaways and Trends from Princeton’s 2018 Real Estate Market

Pricing Range: Homes spanned from $72,000 to $599,000, with average and median prices trending upward. The market was increasingly segmented, with opportunities for first-time buyers and luxury clients alike.

Market Efficiency: While DOM increased to 30 days, price per square foot and turnover in luxury properties suggest strong underlying demand.

Unique Outliers: The normalized ClsPr/OLP ratio and growth in pool home sales reflect shifts in inventory and homebuyer desires.

Mortgage Rates Impact: Higher rates of 4.70%, up from 4.14% in 2017, likely weighed on market entry points but were offset by rising wages and economic optimism.

Total Homes Closed

- Closed transactions: A total of 525 homes sold, reflecting strong activity and a 25.9% increase from 2017’s 417 sales.

- New construction homes: 264 homes, a remarkable rise from 187 in 2017, indicating a booming housing development sector.

- Homes with pools: Sales rose to 10 homes, up from 6 in the prior year, showing increased interest in luxury amenities.

Property Pricing Insights

The pricing metrics for 2018 denote steady growth across all segments:

- Minimum price: Increased from $62,000 to $72,000, suggesting higher minimum valuations per property.

- Maximum price: Rose from $540,000 to $599,000, driven by luxury sector demand.

- Average price: Climbed 8.5%, from $215,261 to $233,494, reflecting overall market appreciation.

- Median price: Jumped to $228,900, up 6% from $215,900, showcasing a healthier mid-market sector.

Property Size and Features

The Princeton, TX real estate market in 2018 served buyers with diverse needs, offering properties across a range of specifications:

- Bedrooms: An average of 4 bedrooms, consistent with 2017.

- Bathrooms: Typically 2 bathrooms, maintaining similar trends to the prior year.

- Square footage: Homes ranged from 840 sqft to 3,907 sqft, with 1,897 sqft as the average, up slightly from 1,882 sqft in 2017.

- Lot sizes: Averaged 0.377 acres, compared to 0.361 acres in 2017, reflecting slight growth in property space.

Market Dynamics

Efficiency remained a central theme with slight adjustments to specific metrics:

- Days on Market (DOM): Homes required an average of 30 days to sell, up from 23 days in 2017, signaling a longer turnover cycle.

- ClsPr/LstPr Ratio: Slight dip to 98.79%, showing slightly softer negotiations compared to 99.41% in 2017.

- ClsPr/OLP Ratio: Dropped to 97.81%, normalizing after the overbidding anomalies in 2017’s 134.60%.

- Average price per sqft: Grew to $125.24, up from $116.61, representing a 7.4% increase in property value per unit of space.

Insights into the Most Expensive Princeton, TX Property Sold in 2018

The year’s luxury sale was a stunning estate that captured attention for its exceptional features:

- Price: $599,000

- Beds/Baths: 4 bedrooms, 5 bathrooms (3 full, 2 half)

- Square Footage: 3,725 sqft

- Price per sqft: $160.81

- Lot Size: 5.330 acres

- Days on Market (DOM): 8 days

- ClsPr/LstPr Ratio: 100.00%

- ClsPr/OLP Ratio: 100.00%

- Year Built: 2008

- Unique Feature: Pool and spacious acreage

This premium sale underscored the rise of high-end properties in Princeton, reflecting buyers’ willingness to invest in luxury amenities like pools and expansive lots. Its quick sale time of 8 days highlights strong demand for upscale homes.

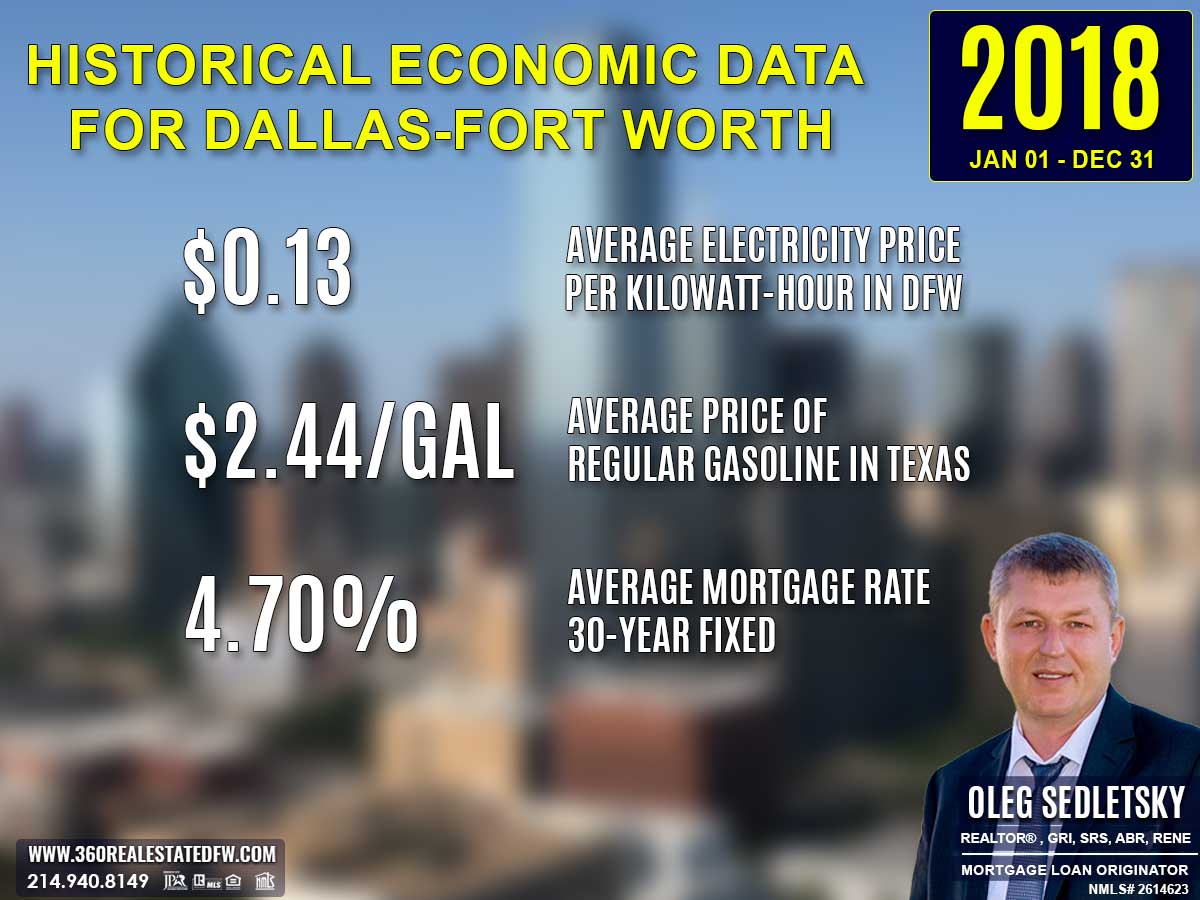

Economic context

Average Electricity Costs in Dallas-Fort Worth in 2018

Electricity prices increased to $0.13 per kilowatt-hour in 2018, compared to $0.12 in 2017. This climb likely drove demand for energy-efficient housing and renovations, placing greater emphasis on properties with modern upgrades that helped households manage increasing utility costs.

Average Price for Regular Gasoline in Texas in 2018

Gas prices also rose, reaching $2.44 per gallon in 2018, up from $2.19 in 2017. With transportation becoming more expensive, proximity to workplaces and public transportation remained important for homebuyers. Walkable neighborhoods and mixed-use developments gained traction during this period.

Average 30-Year Fixed Mortgage Rate in 2018

Mortgage rates climbed to 4.70% in 2018, from 4.14% in the previous year. For many homebuyers, this level of interest rate signaled urgency to act before rates increased further. Getting pre-approved by a local mortgage loan originator was pivotal for navigating the pressures of a market increasingly shaped by rising rates.

Curious about today’s mortgage rates and the home you can comfortably afford?

Submit a no-obligation mortgage application today and get pre-approved to determine your budget and take the first step toward homeownership with confidence.

Overview of Differences Between the 2017 and 2018 Real Estate Markets in Princeton, Texas

Volume of Sales

Homes sold increased significantly, rising from 417 in 2017 to 525 in 2018, marking a 25.9% growth.

Pricing

- Minimum price: Increased from $62,000 to $72,000, reflecting rising property entry points.

- Maximum price: Grew from $540,000 to $599,000, driven by demand in the luxury segment.

- Average price: Climbed 8.5%, from $215,261 to $233,494, indicating a strong appreciation across the market.

- Median price: Rose by 6%, from $215,900 to $228,900, emphasizing the upward shift in mid-market properties.

Market Efficiency

- Days on Market (DOM): Increased slightly from 23 days to 30 days, signaling a slower turnover rate.

- ClsPr/LstPr Ratio: Drifted lower from 99.41% to 98.79%, pointing to marginally softer negotiations.

- ClsPr/OLP Ratio: Normalized from a high of 134.60% in 2017 to 97.81%, reducing anomalies seen previously.

Property Features

- Square footage: Averaged 1,897 sqft in 2018, a slight increase from 1,882 sqft in 2017, expanding property sizes.

- Lot size: Rose modestly from .361 acres to .377 acres, reflecting larger land offerings.

- Homes with pools: Almost doubled, growing from 6 sales in 2017 to 10 sales in 2018, highlighting luxury demand.

- New construction homes: Surged by 41%, from 187 to 264, demonstrating a booming development market.

Economic Context

- Mortgage rates: Climbed from 4.14% to 4.70%, making borrowing more expensive.

- Gas prices: Increased from $2.19 to $2.44 per gallon, and electricity costs rose from $0.12 to $0.13 per kilowatt hour, slightly raising overall living costs.

Princeton’s 2018 market displayed robust growth in sales and pricing, driven by increased demand and a surge in new construction, counterbalanced by slightly slower efficiency and higher economic costs.

Summary of Real Estate Market Analysis for Princeton, TX in 2018

Princeton’s real estate market in 2018 maintained its upward momentum, with strong gains in sales volume, pricing, and new construction. While affordability faced headwinds with higher interest rates, the market continued to grow through diversified inventory and demand across all buyer segments. The luxury market thrived with standout sales, like the $599,000 estate.

The Importance of Statistical Data in Princeton, Texas Real Estate Market

Did you know that appraisers and Realtors rely on historical statistical data to determine a property’s current value?

Analyzing historical market data is essential for making informed decisions in today’s real estate market. Examining past trends provides valuable insights that facilitate accurate pricing, more strategic negotiations, and a comprehensive understanding of market dynamics. By understanding market dynamics, both homebuyers and home-sellers can leverage the conditions to achieve their goals.

Unlock Exceptional Service!

Assistance with all your real estate needs in the Dallas-Fort Worth area is just a click or call away. Reach out at 214-940-8149 or connect through the links below.

Greetings! I’m Oleg Sedletsky, and I’m excited to introduce myself as your go-to full-time licensed Texas REALTOR® and Mortgage Loan Originator.

I proudly represent JPAR® – Real Estate Brokerage as a REALTOR® and Utopia Mortgage LLC as a Mortgage Loan Originator! My designations and certifications reflect my dedication to helping you achieve your real estate goals in Princeton, TX and other locations in the vibrant Dallas-Fort Worth area!

My commitment to ongoing professional development means I’m always enhancing my skills to serve you better. You can count on me as your trusted expert throughout your real estate journey. Plus, I’m fluent in English, Ukrainian, and Russian and ready to assist you every step of the way!

It’s All About You and Your Real Estate Goals!

My mission is to serve you! With my knowledge and expertise, I’m here to help you achieve all your real estate goals!

I’m passionate about helping buyers and sellers navigate the exciting real estate landscape in Princeton, Texas! Whether you’re searching for your dream home, exploring land options, or looking for commercial properties, my Real Estate Services have you covered.

Contact me today for all your real estate needs in Princeton, Texas! Call/text 214-940-8149

A Comprehensive Analysis of Single-Family Residential Housing Market in Princeton, TX: 2010 to Present

Discover the trends, stats, and insights shaping Princeton’s real estate market year by year!

2010-2020

Princeton, TX Real Estate Market Report 2010: Analysis and Trends

Princeton, TX Real Estate Market Report 2011: Analysis and Trends

Princeton, TX Real Estate Market Report 2012: Analysis and Trends

Princeton, TX Real Estate Market Report 2013: Analysis and Trends

Princeton, TX Real Estate Market Report 2014: Analysis and Trends

Princeton, TX Real Estate Market Report 2015: Analysis and Trends

Princeton, TX Real Estate Market Report 2016: Analysis and Trends

Princeton, TX Real Estate Market Report 2017: Analysis and Trends

Princeton, TX Real Estate Market Report 2018: Analysis and Trends

Princeton, TX Real Estate Market Report 2019: Analysis and Trends

Princeton, TX Real Estate Market Report 2020: Analysis and Trends

This market analysis is intended solely for educational purposes. This market analysis is based on data sourced from NTREIS, Inc. This analysis is exclusively focused on single-family homes and does not account for other property types. The total number of real estate transactions within the specified period and location may vary. Data accuracy cannot be guaranteed due to potential input errors made by NTREIS users. This market analysis does not account for all new construction home sales. If you need detailed information about recorded property sales or other public records, please contact the appropriate city or county office.

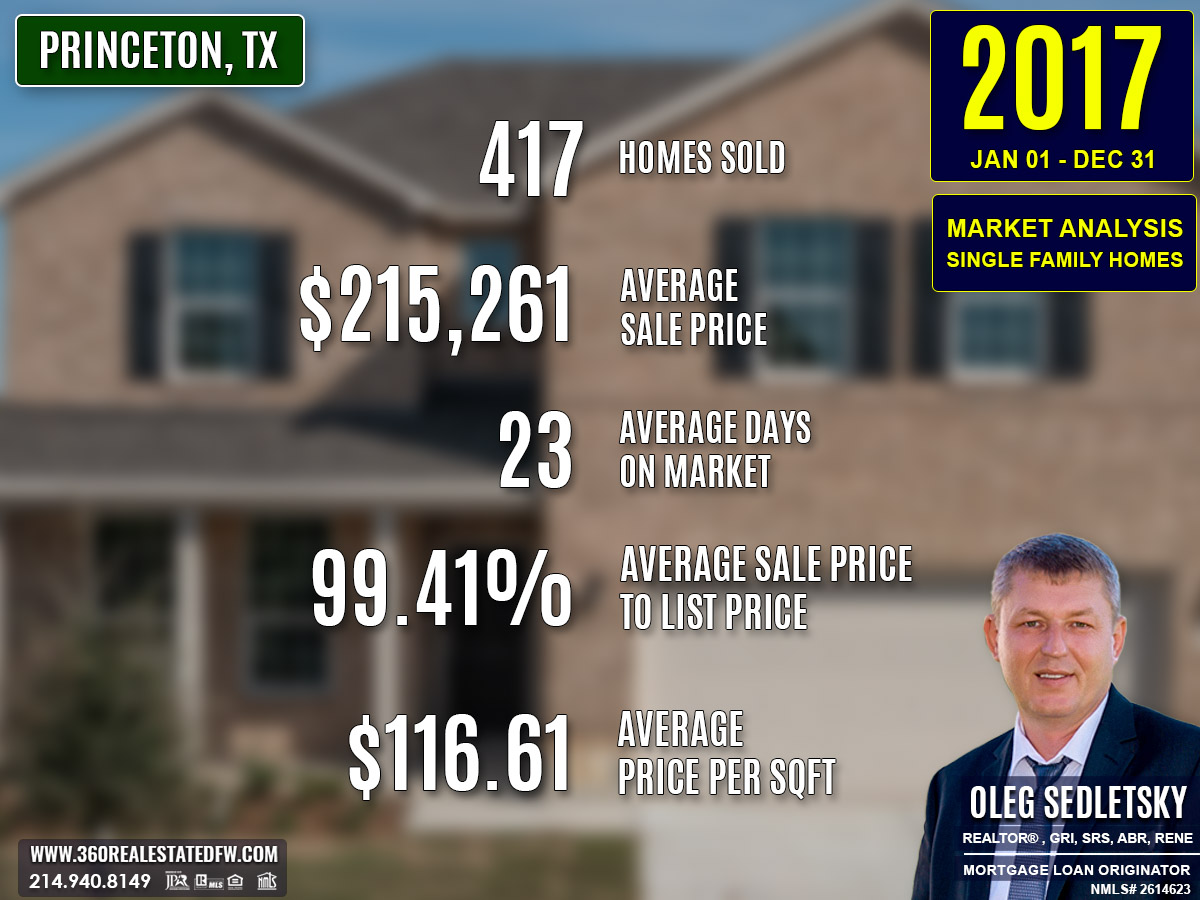

Princeton, TX Real Estate: A Comprehensive Analysis of the 2017 Single-Family Residential Housing Market

The 2017 real estate market in Princeton, Texas showed strong growth, driven by rising home prices, faster sales, and heightened activity in new construction and premium properties. This analysis dives into sales trends, pricing, property features, and market dynamics in Princeton for a deeper understanding of the year’s real estate landscape.

Key Takeaways and Trends from Princeton’s 2017 Real Estate Market

Pricing Range: Homes ranged from $62,000 to $540,000, offering products for both new homebuyers and luxury-seeking clients. Mid-market pricing rose steadily, bolstering confidence in the upper middle class.

Market Efficiency: Sales efficiency slightly slowed, with homes taking a few days longer to sell compared to the prior year.

Unique Outliers: With overbidding anomalies in ClsPr/OLP ratios and densifying developments, 2017 saw continued shifts in inventory makeup.

Mortgage Rates Impact: Higher average mortgage rates of 4.14%, up from 3.79% in 2016, slightly dampened affordability but didn’t heavily deter homebuyers.

Total Homes Closed

- Closed transactions: A total of 417 homes sold, a notable increase from 351 in 2016.

- New construction homes: 187 properties, indicating a booming construction sector and rising demand for new developments.

- Homes with pools: Only 6 homes sold with pools, a drop from 12 in 2016, signaling shifting preferences or availability.

Property Pricing Insights

The pricing metrics for 2017 reflect upward trends across the board:

- Minimum price: Dropped slightly to $62,000 from $65,000 in 2016, providing accessibility to budget homebuyers.

- Maximum price: Slightly decreased from $559,700 to $540,000, driven by a shift in luxury segment transactions.

- Average price: Rose 7.7% to $215,261, up from $199,966.

- Median price: Climbed to $215,900, representing an 11.3% increase from $194,000, emphasizing growth in the mid-market range.

Property Size and Features

The 2017 market offered a diverse range of home sizes catering to different buyer needs:

- Bedrooms: Typically 4 bedrooms, steady compared to 2016.

- Bathrooms: Averaged 2 bathrooms, but some homes included up to 5 bathrooms.

- Square footage: Ranged from 720 sqft to 3,799 sqft, maintaining the same average of 1,882 sqft as in 2016.

- Lot sizes: Averaged 0.361 acres, smaller compared to 0.470 acres in 2016, pointing to increasingly denser developments.

Market Dynamics

The overall efficiency of the market improved in 2017, helping sustain competitive conditions:

- Days on Market (DOM): Homes sold in an average of 23 days, slightly higher than the 20-day average in 2016, but still strong.

- ClsPr/LstPr Ratio: Improved marginally to 99.41%, up from 99.53%, sustaining tight seller-buyer negotiations.

- ClsPr/OLP Ratio: Surprisingly spiked to 134.60% from 98.90%, driven by anomalies in overbids and new construction premiums.

- Average price per sqft: Increased to $116.61, a significant 8.4% rise from $107.59 in 2016, showcasing higher property value per unit area.

Insights into the Most Expensive Princeton, TX Property Sold in 2017

The year’s priciest sale was a grand estate with standout features and a remarkable price tag:

- Price: $540,000

- Beds/Baths: 5 bedrooms, 4 bathrooms (3 full, 1 half)

- Square Footage: 3,354 sqft

- Price per sqft: $161.00

- Lot Size: 10 acres

- Days on Market (DOM): 61 days

- ClsPr/LstPr Ratio: 98.20%

- ClsPr/OLP Ratio: 98.20%

- Year Built: 1996

- Unique Feature: Pool with scenic acreage

This sale highlights the continued strength of Princeton’s luxury market, with large, high-end estates maintaining appeal among premium buyers. Its extended DOM reflects the selectiveness of this buyer segment.

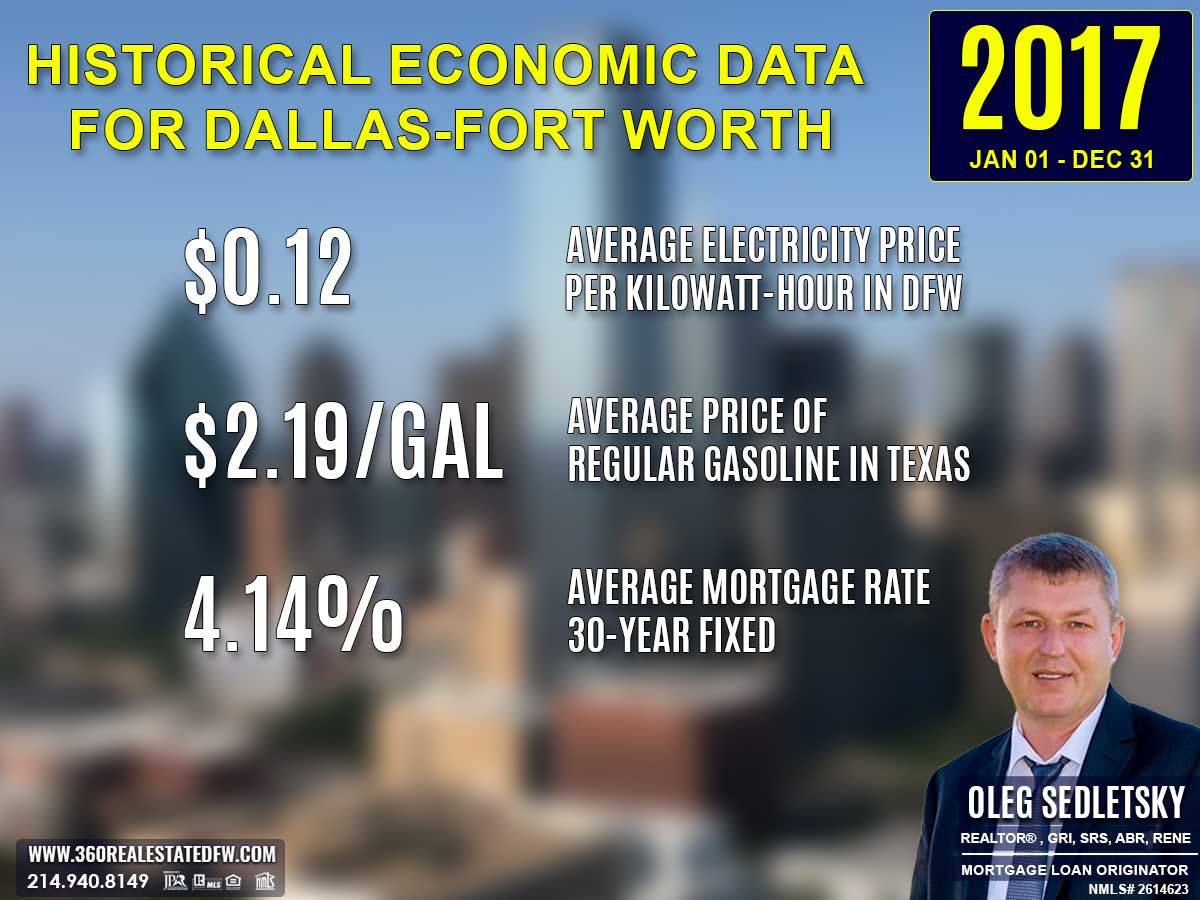

Economic context

Average Electricity Costs in Dallas-Fort Worth in 2017

Electricity prices rose to $0.12 per kilowatt-hour in 2017, after a year at $0.11. This small uptick likely reignited interest in smaller homes or energy-efficient features. homebuyers remained cautious about properties with older energy systems, viewing them as less desirable long-term investments.

Average Price for Regular Gasoline in Texas in 2017

Gas prices increased to $2.19 per gallon in 2017, up from $1.91 in 2016. While still relatively affordable, the rise may have led homebuyers to reconsider the financial trade-offs of suburban living. Proximity to public transportation hubs became a more significant factor during housing searches.

Average 30-Year Fixed Mortgage Rate in 2017

Mortgage rates rose to 4.14% in 2017, up from 3.79% the year prior. The return of higher rates reminded homebuyers of the importance of locking in favorable financing terms early. Pre-approval through local mortgage loan originators remained vital to navigating the shifting landscape effectively and with confidence.

Curious about today’s mortgage rates and the home you can comfortably afford?

Submit a no-obligation mortgage application today and get pre-approved to determine your budget and take the first step toward homeownership with confidence.

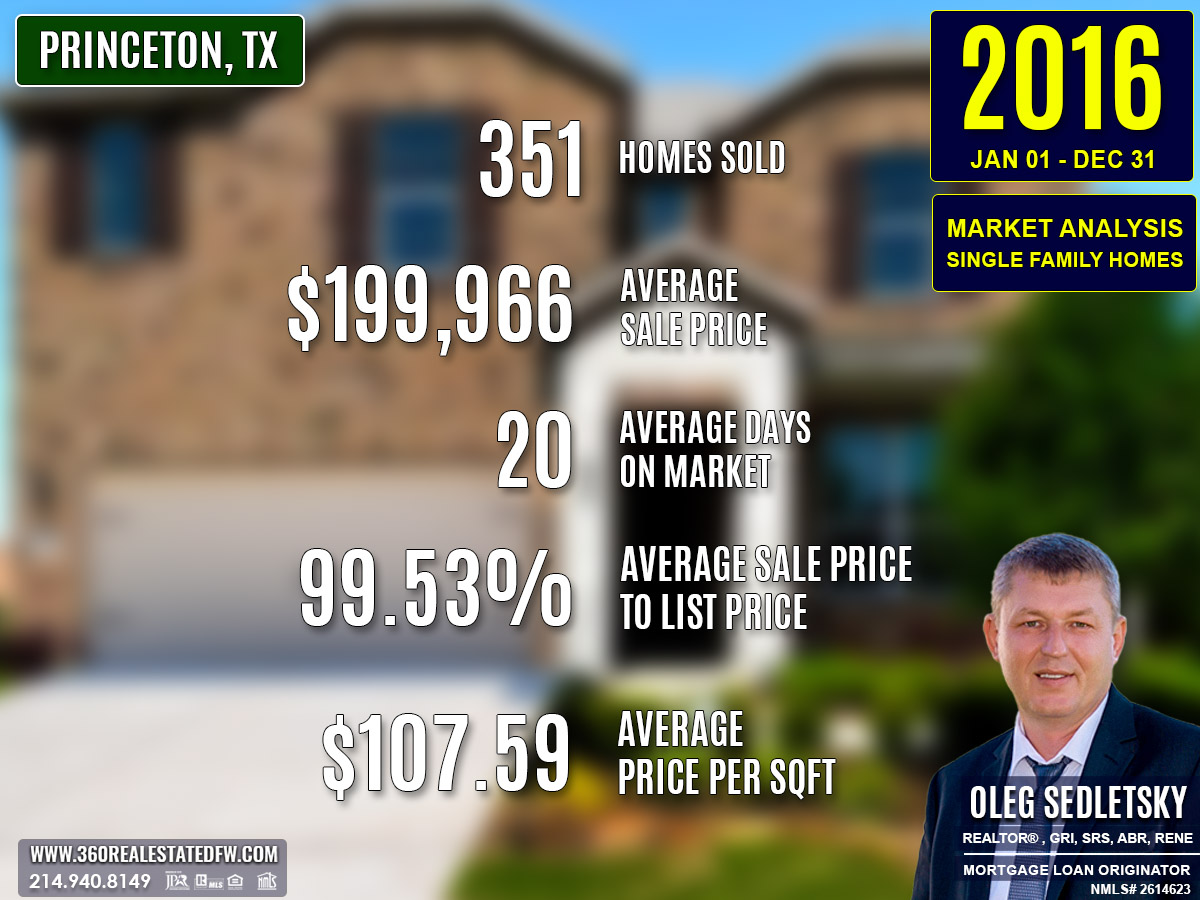

Overview of Differences Between the 2016 and 2017 Real Estate Markets in Princeton, Texas

Volume of Sales

Home sales increased by 18.8%, rising from 351 in 2016 to 417 in 2017, reflecting greater buyer activity.

Pricing

- Minimum price: Decreased slightly from $65,000 to $62,000, offering opportunities for budget buyers.

- Maximum price: Dropped modestly from $559,700 to $540,000, affecting the luxury segment.

- Average price: Rose 7.7%, from $199,966 to $215,261, signaling price growth across the market.

- Median price: Increased by 11.3%, from $194,000 to $215,900, emphasizing mid-market strength.

Market Efficiency

- Days on Market (DOM): Increased slightly from 20 to 23 days, showing a small slowdown in turnover.

- ClsPr/LstPr Ratio: Remained stable at around 99.5%, showcasing continued tight negotiations.

- ClsPr/OLP Ratio: Drastically spiked from 98.90% to 134.60%, influenced by outliers and overbidding in some properties.

Property Features

- Square footage: Remained consistent, averaging 1,882 sqft both years.

- Lot size: Declined in average from 0.470 acres to 0.361 acres, indicating more compact developments.

- Homes with pools: Dropped by half, from 12 in 2016 to 6 in 2017, likely due to supply changes.

- New construction homes: Increased by 37.5%, from 136 to 187, highlighting strong growth in newly built properties.

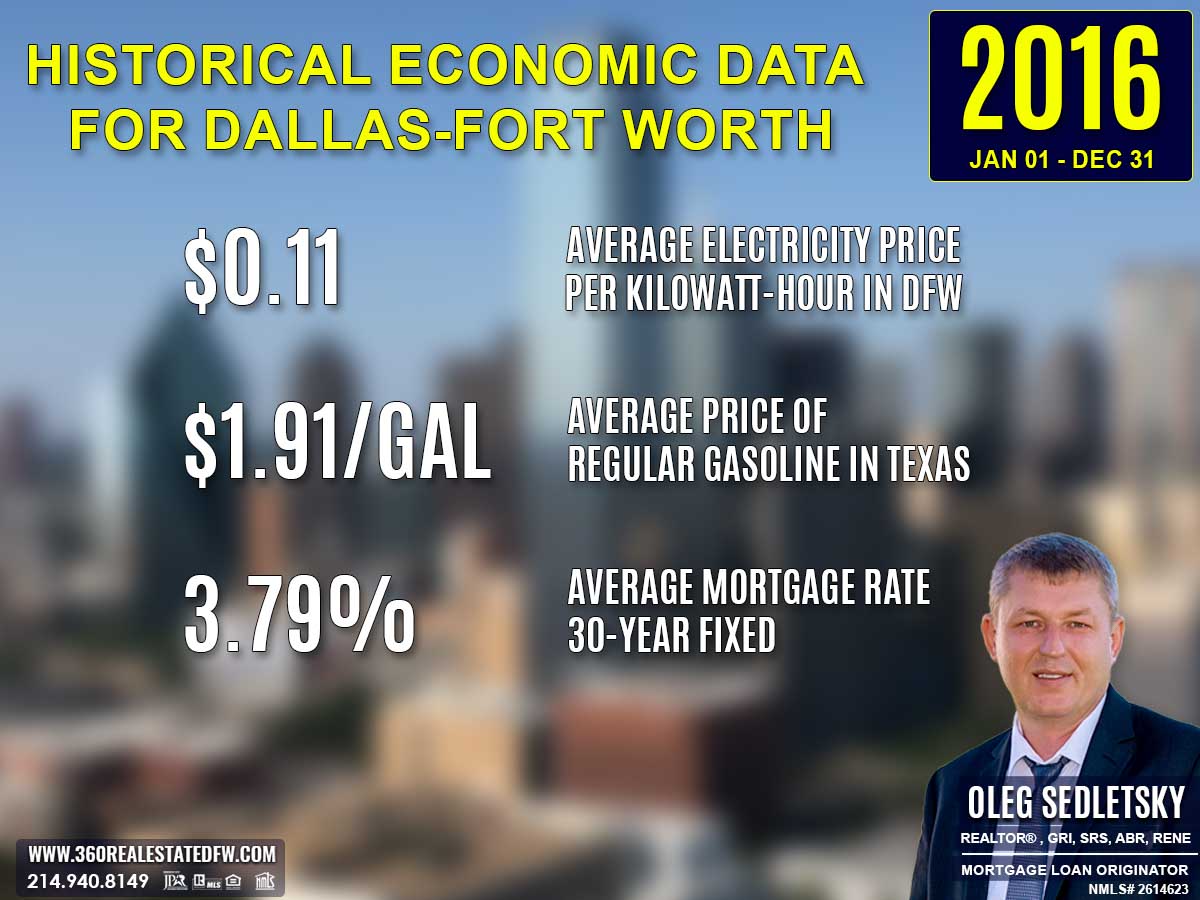

Economic Context

- Mortgage rates: Rose from 3.79% to 4.14%, potentially impacting affordability.

- Gas prices: Increased from $1.91 to $2.19 per gallon, and electricity costs rose from $0.11 to $0.12 per kilowatt hour, slightly elevating living expenses.

The 2017 market displayed a healthy increase in sales volume, higher overall pricing, robust new construction growth, and slightly slower market turnover, despite economic headwinds of rising costs and interest rates.

Summary of Real Estate Market Analysis for Princeton, TX in 2017

The 2017 real estate market in Princeton, Texas reinforced its upward trajectory, boasting increased sales, higher prices, and steady demand for new construction homes. Despite higher costs tied to loans and utilities, the market achieved sustained growth, driven by responsive developments and competitive buyer activity. Looking ahead, the market’s upward trend reflects a healthy balance of affordability and aspirational inventory, setting the tone for continued performance in 2018.

The Importance of Statistical Data in Princeton, Texas Real Estate Market

Did you know that appraisers and Realtors rely on historical statistical data to determine a property’s current value?

Analyzing historical market data is essential for making informed decisions in today’s real estate market. Examining past trends provides valuable insights that facilitate accurate pricing, more strategic negotiations, and a comprehensive understanding of market dynamics. By understanding market dynamics, both homebuyers and home-sellers can leverage the conditions to achieve their goals.

Unlock Exceptional Service!

Assistance with all your real estate needs in the Dallas-Fort Worth area is just a click or call away. Reach out at 214-940-8149 or connect through the links below.

Greetings! I’m Oleg Sedletsky, and I’m excited to introduce myself as your go-to full-time licensed Texas REALTOR® and Mortgage Loan Originator.

I proudly represent JPAR® – Real Estate Brokerage as a REALTOR® and Utopia Mortgage LLC as a Mortgage Loan Originator! My designations and certifications reflect my dedication to helping you achieve your real estate goals in Princeton, TX and other locations in the vibrant Dallas-Fort Worth area!

My commitment to ongoing professional development means I’m always enhancing my skills to serve you better. You can count on me as your trusted expert throughout your real estate journey. Plus, I’m fluent in English, Ukrainian, and Russian and ready to assist you every step of the way!

It’s All About You and Your Real Estate Goals!

My mission is to serve you! With my knowledge and expertise, I’m here to help you achieve all your real estate goals!

I’m passionate about helping buyers and sellers navigate the exciting real estate landscape in Princeton, Texas! Whether you’re searching for your dream home, exploring land options, or looking for commercial properties, my Real Estate Services have you covered.

Contact me today for all your real estate needs in Princeton, Texas! Call/text 214-940-8149

A Comprehensive Analysis of Single-Family Residential Housing Market in Princeton, TX: 2010 to Present

Discover the trends, stats, and insights shaping Princeton’s real estate market year by year!

2010-2020

Princeton, TX Real Estate Market Report 2010: Analysis and Trends

Princeton, TX Real Estate Market Report 2011: Analysis and Trends

Princeton, TX Real Estate Market Report 2012: Analysis and Trends

Princeton, TX Real Estate Market Report 2013: Analysis and Trends

Princeton, TX Real Estate Market Report 2014: Analysis and Trends

Princeton, TX Real Estate Market Report 2015: Analysis and Trends

Princeton, TX Real Estate Market Report 2016: Analysis and Trends

Princeton, TX Real Estate Market Report 2017: Analysis and Trends

Princeton, TX Real Estate Market Report 2018: Analysis and Trends

Princeton, TX Real Estate Market Report 2019: Analysis and Trends

Princeton, TX Real Estate Market Report 2020: Analysis and Trends

This market analysis is intended solely for educational purposes. This market analysis is based on data sourced from NTREIS, Inc. This analysis is exclusively focused on single-family homes and does not account for other property types. The total number of real estate transactions within the specified period and location may vary. Data accuracy cannot be guaranteed due to potential input errors made by NTREIS users. This market analysis does not account for all new construction home sales. If you need detailed information about recorded property sales or other public records, please contact the appropriate city or county office.

Princeton, TX Real Estate: A Comprehensive Analysis of the 2016 Single-Family Residential Housing Market

The 2016 real estate market in Princeton, Texas demonstrated remarkable growth in sales volume and efficiency, fueled by favorable economic conditions and robust buyer demand. This analysis summarizes closed transactions, pricing trends, property features, and market dynamics, offering key insights into the evolving landscape.

Key Takeaways and Trends from Princeton’s 2016 Real Estate Market

Pricing Range: Princeton’s market offered homes from $65,000 to $559,700, catering to diverse buyers and marking growth across all price points.

Market Efficiency: Homes sold faster, averaging just 20 DAYS, achieving near-list prices with minimal negotiation.

Unique Outliers: The $559,700 estate set a benchmark for high-value sales, while a rise in new homes bolstered inventory diversity.

Mortgage Rates Impact: Lower average mortgage rates at 3.79% helped enhance affordability and drew more buyers, driving rising sales and pricing.

Total Homes Closed

- Closed transactions: 351 homes sold, a substantial 67.9% increase from 2015, reflecting an overwhelmingly active market.

- New construction homes: 136 homes sold, a sharp rise from 15 the previous year, showcasing a boom in development activity.

- Homes with pools: 12 homes sold, up from 9 in 2015, highlighting steady demand for luxury features.

Property Pricing Insights

The following price metrics reflect growing market value and diversity:

- Minimum price: Increased from $38,000 in 2015 to $65,000, signaling improvements in the entry-level segment.

- Maximum price: Jumped from $407,500 in 2015 to $559,700, reflecting expanding high-end market activity.

- Average price: Rose to $199,966, up by 19.2% from $167,775 in 2015.

- Median price: Increased to $194,000, marking a 19.0% growth from $163,000 in 2015.

Property Size and Features

HomeBuyers had access to a range of home sizes and configurations in 2016.

- Bedrooms: Averaged 4 bedrooms, up from 3 in the previous year.

- Bathrooms: Increased to an average of 2 bathrooms, with homes offering up to 5 bathrooms.

- Square footage: Properties ranged from 768 sqft to 4,849 sqft, with an average of 1,882 sqft, slightly larger than the previous year.

- Lot sizes: Averaged a reduced 0.470 acres, down from 0.682 in 2015, reflecting denser development in new construction.

Market Dynamics

The market showcased impressive gains in efficiency and property value retention.

- Days on Market (DOM): Faster closings, averaging 20 days, down from 36 in 2015.

- ClsPr/LstPr Ratio: Improved to 99.53%, up slightly from 98.72%, reflecting continued tight pricing alignments.

- ClsPr/OLP Ratio: Dropped to 98.90%, indicating a decrease in over-list bids compared to the previous year’s 144.99%.

- Average price per sqft: Climbed to $107.59, representing a strong 17.4% increase from $91.65 in 2015.

Insights into the Most Expensive Princeton, TX Property Sold in 2016

The highest-priced property sold in 2016 was a luxurious estate reflecting market confidence in premium listings. Key features include:

- Price: $559,700

- Beds/Baths: 3 bedrooms, 3 bathrooms

- Square Footage: 2,991 sqft

- Price per sqft: $187.13

- Lot Size: 10 acres

- Days on Market (DOM): 8 days

- ClsPr/LstPr Ratio: 100.00%

- ClsPr/OLP Ratio: 100.00%

- Year Built: 1996