First-Time Homebuyer’s Guide: Understanding Earnest Money and Option Fee

Hey there, future homeowners of Dallas! Home-buying might initially seem like a puzzling maze with all the processes and jargon thrown at you. But don’t sweat it! I’m here to help you decipher two essential terms: Earnest Money and Option Fee. Once you’ve got these down, your path to owning your dream home will become a whole lot easier. So, let’s get started!

What’s the Deal with Earnest Money?

So, what’s this Earnest Money all about? Well, it’s a bit like a promise in the form of cash. You give it to the seller to say, “Hey, I’m serious about buying your place.”

Why’s it Called Earnest Money?

The term ‘Earnest Money’ comes from the word “earnest,” which means sincere or serious. It’s your way of proving to the seller that you mean business in buying their property.

Unlock Exceptional Service!

Assistance with all your real estate needs in the Dallas-Fort Worth area is just a click or call away. Reach out at 214-940-8149 or connect through the links below.

So, where exactly is the earnest money indicated in the home purchase contract?

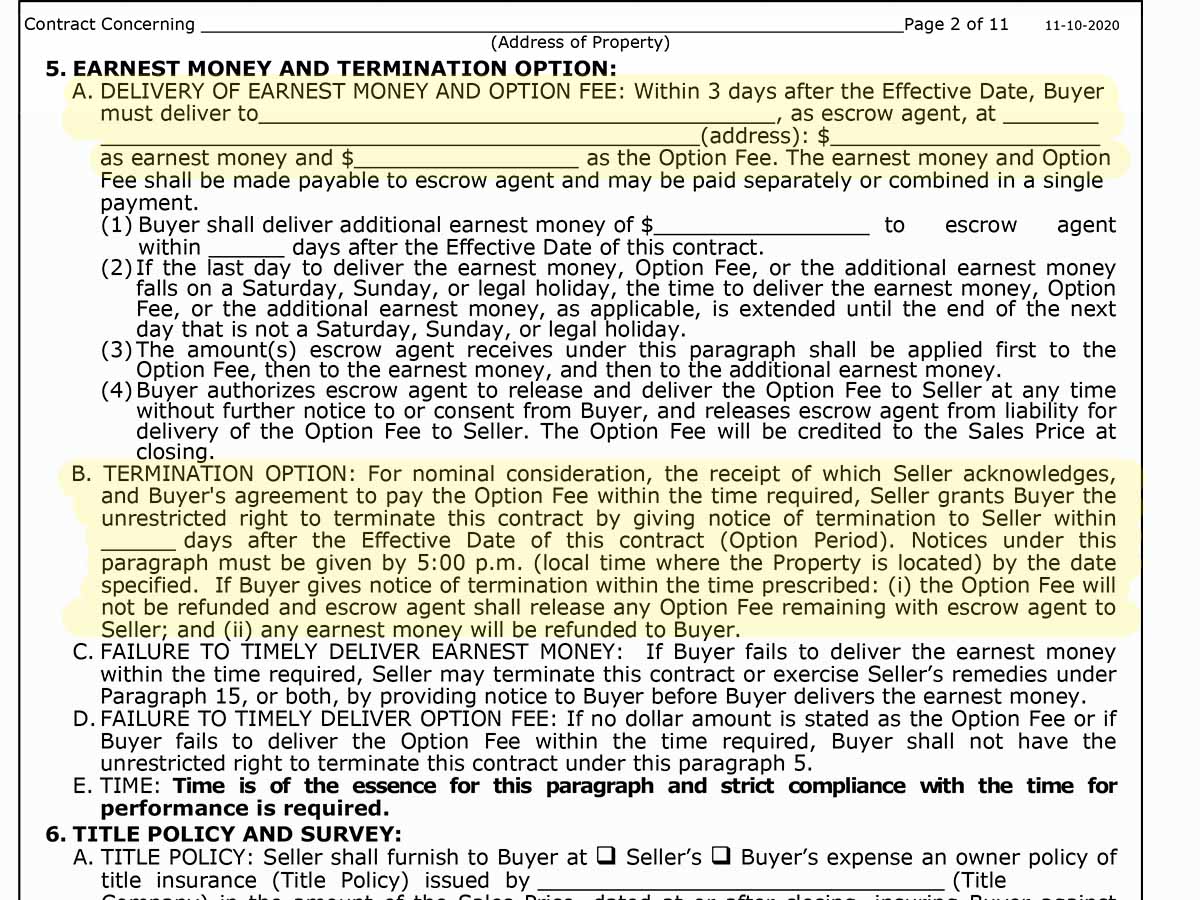

Most home purchase contracts in Texas use a standard home purchase contract created by TREC (Texas Real Estate Commission). If you go with the standard contract, you’ll find the details about Earnest Money and Option Money in Paragraph 5 of the TREC contract.

Is Earnest Money Required in Texas?

Well, technically, no. But here’s the thing – if you don’t put down the Earnest money, chances are your offer won’t be taken seriously and might not get accepted. Just something to keep in mind. 😉

When Do I Pay the Earnest Money in Texas?

You have to pay the earnest money pretty quickly after your offer is accepted, usually in about 1-3 days.

What Happens to Earnest Money at Closing?

Good news! At closing, your earnest money is applied toward your down payment or closing costs. It’s not an extra fee but part of your total cost of buying the home.

What’s the usual amount of earnest money in Texas?

There’s actually no fixed amount for the Earnest money. It’s totally up to you! Usually, buyers put down around 1-3% of the home’s sale price. But in the end, it’s your call. Sellers do prefer to see more significant numbers for Earnest money as it reflects how serious you are about buying the property.

Potential Risks: Can I Lose my Earnest Money?

Unfortunately, yes. If you decide to bail on the sale for no good reason, you might have to say goodbye to your earnest money. So make sure you understand your contract terms!

Who Gets the Earnest Money?

The earnest money usually goes into escrow account held by the title company or the real estate brokerage until the deal is closed.

Do you have to pay The Earnest Money when buying a New Construction Home in the Dallas area?

If you’re buying a brand-new home in Dallas, builders usually require you to pay earnest money. Sometimes, though, you might have a chance to negotiate the amount, but that’s pretty rare.

The amount of earnest money for new construction homes in Dallas varies, ranging from $500 to $50,000 or a percentage of the home price, like 3% to 50%. It all depends on the location, type of new home and upgrades, and a builder.

What About Option Fee When Buying A Home?

Option Fee is a little like a get-out-of-jail-free card. It’s money you give the seller for the right to back out of the contract for any reason within a specific time frame.

Why is it Called Option Fee?

It’s because you’re buying an “option” or a fixed period during which you can drop out of the deal with no strings attached.

When Do I Pay Option Fee?

Typically, Option Fee is paid to escrow along with Earnest Money after the contract has been executed. This practice ensures a smoother transaction process and provides security for all parties involved.

Who Gets the Option Fee?

The seller gets to keep the Option fee since the buyer buys the option to cancel the contract. It’s basically compensation for taking the house off the market for an agreed period of time.

What Happens to Option Fee at Closing?

The option fee will be credited to the sales price at closing. Alternatively, if the buyer decides to back out, it’ll be sent to the seller as payment for the option period.

Can I avoid Paying Option Fee?

The option period and, therefore, option fee are optional. Sorry for saying “option” too much! If the buyer decides to skip the option period, there’s no need for option fee. However, using the option period to do your due diligence (like home inspection) about the property is highly recommended.

What’s the usual amount of option fee in Texas?

There’s no set amount for the option fee. It’s totally up for negotiation. And remember, during the option period, the house won’t be on the market, so sellers will look for a way to make up for the time it’s not being marketed. Just ask your realtor to negotiate the option money and the length of the option period for you. No sweat!

Wrapping Up

Understanding Earnest Money and Option Money is super important when buying a house in the Dallas area. But remember, every deal is different, so getting advice from the real estate pros is smart. And remember, in the real estate world, the more you know, the better!

Are you ready to experience the joy of homeownership in the vibrant Dallas-Fort Worth area?

Whether you’re in search of an existing home or a brand-new construction, rest assured that I’m here to assist you every step of the way.

With a dedicated Realtor by your side, the home-buying process becomes a breeze. Say goodbye to stress, and let me handle all the intricate details on your behalf.

Getting the guidance you need is as simple as filling out a brief questionnaire on my Homebuyers contact form. From there, I’ll take care of everything, ensuring a seamless and hassle-free journey towards finding your dream home.

Call/Text 214.940.8149

The Buyer’s Agent Duty

READ: Texas Real Estate Commission Information About Brokerage Services

AS AGENT FOR BUYER/TENANT: The broker becomes the buyer/tenant’s agent by agreeing to represent the buyer, usually through a

written representation agreement. A buyer’s agent must perform the broker’s minimum duties above and must inform the buyer of any

material information about the property or transaction known by the agent, including information disclosed to the agent by the seller or

seller’s agent.

A BROKER’S MINIMUM DUTIES REQUIRED BY LAW (A client is the person or party that the broker represents):

– Put the interests of the client above all others, including the broker’s own interests;

– Inform the client of any material information about the property or transaction received by the broker;

– Answer the client’s questions and present any offer to or counter–offer from the client; and

– Treat all parties to a real estate transaction honestly and fairly.

TO AVOID DISPUTES, ALL AGREEMENTS BETWEEN YOU AND A BROKER SHOULD BE IN WRITING AND CLEARLY ESTABLISH:

– The broker’s duties and responsibilities to you, and your obligations under the representation agreement.

– Who will pay the broker for services provided to you, when payment will be made and how the payment will be calculated.

TYPES OF REAL ESTATE LICENSE HOLDERS:

– A BROKER is responsible for all brokerage activities, including acts performed by sales agents sponsored by the broker.

– A SALES AGENT must be sponsored by a broker and works with clients on behalf of the broker.

Latest from Dallas Real Estate Blog

– Texas Homebuyers Tips, Tricks and Lifehacks

– New Construction Homes in Dallas TX

– Mortgages for Homebuyers and Investors in Dallas-Fort Worth