“How much money do I need to buy a home?”

A common question among my clients who are looking to purchase a house in the Dallas area.

And it’s an important question because when you’re closing on a home, there are certain costs that both the Buyer and Seller must pay in order to finalize the deal.

These costs are known as CLOSING COSTS.

Many first-time home buyers are unaware of these charges or have a limited understanding of why they exist and what they entail.

That’s why the purpose of this article is to educate first-time home buyers about closing costs and how they can impact their decision to buy a home.

Here are some key takeaways:

– Closing costs are a part of the real estate transaction.

– Home buyers in the Dallas area must account for closing costs when planning to buy a house.

– There are various ways for first-time home buyers to pay Closing Costs.

– There are also strategies to reduce or even avoid paying Closing Costs altogether.

So, let’s dive into what Closing Costs are and why they exist.

What are Closing Costs?

Closing costs can significantly impact the purchase of a home, so it’s essential to have a clear understanding of what they are and how they can affect your home buying process.

Closing costs are the expenses that both buyers and sellers have in a real estate transaction. In simpler terms, if you’re buying a home, closing costs will be involved.

In a nutshell, the closing costs for home buyers include expenses associated with obtaining a loan, expenses related to the property, and service fees. It’s worth noting that the specific closing costs will vary depending on the obligations and liabilities of each party involved.

In order to complete the home-buying transaction, both the Buyer and Seller must have sufficient funds to cover the closing costs.

This means that as a buyer, you need to have a certain amount of money set aside and readily available to cover these expenses.

Where can home buyers find information about closing cost items?

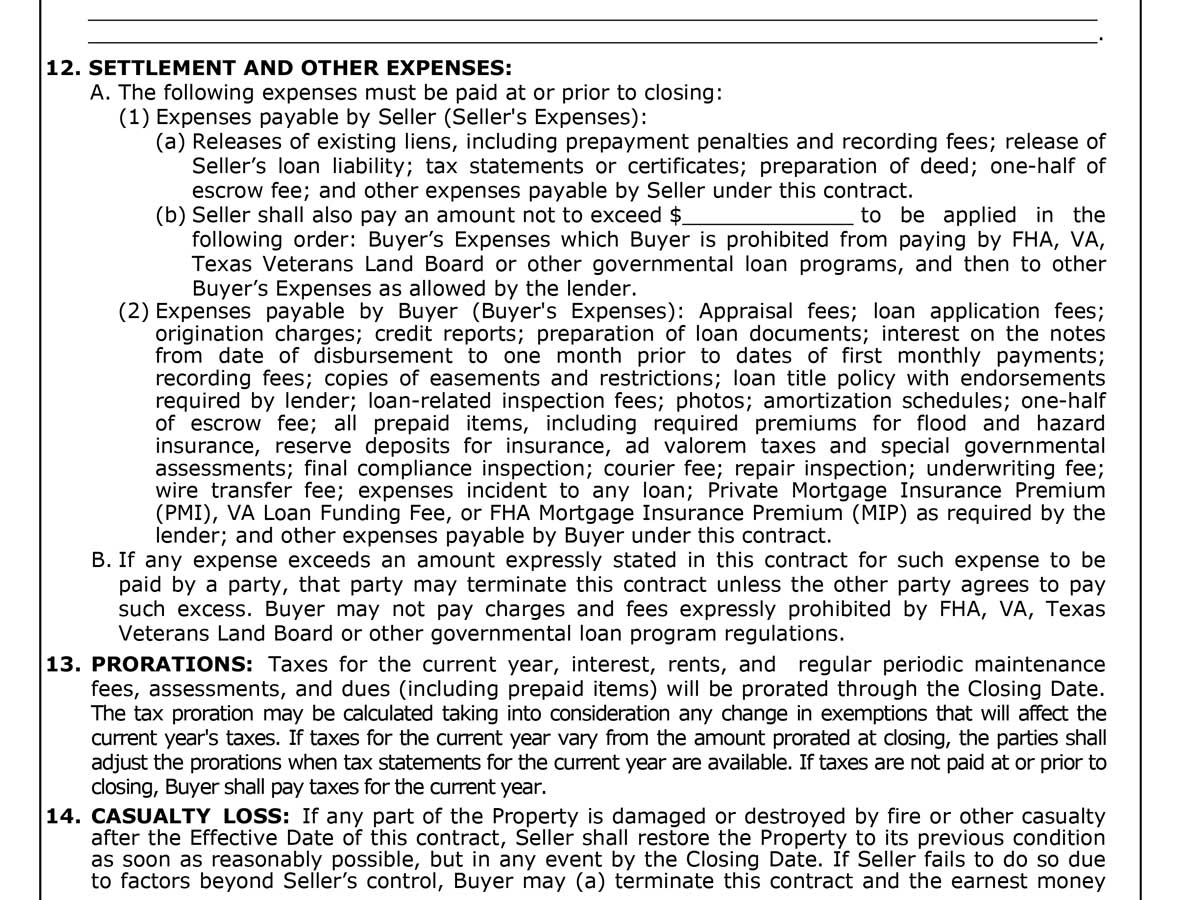

If you’re wondering where to find information about the specific items included in closing costs, you can refer to Paragraph 12 of the home purchase contract.

This section provides details about the expenses for both the Buyer and Seller. Additionally, prorations are described in Paragraph 13.

It’s important to note that the TREC contract, which outlines these details, is available for public use. This means you can access the contract language to fully understand what expenses you may be responsible for.

https://www.trec.texas.gov/agency-information/contracts

Here is the language of the contract at the time of publishing this article:

By understanding and being aware of closing costs, first-time home buyers can make informed decisions and better plan their home purchase.

Unlock Exceptional Service!

Assistance with all your real estate needs in the Dallas-Fort Worth area is just a click or call away. Reach out at 214-940-8149 or connect through the links below.

How to Find Your Exact Closing Costs as a Home Buyer

When it comes to finding out how much you’ll need to cover closing costs, there are a few key steps to keep in mind. Let’s break it down in a simple and straightforward way.

So, Here’s how it works:

If the home buyer is financing their purchase with a loan. Just remember, you’ll need to provide the lender with the exact address of the home you want to buy or have an executed home purchase contract:

Step 1: Loan Estimate

After submitting the loan application or executing the home purchase contract, the lender will provide the home buyer with a Loan Estimate. This document, consisting of 3 pages, includes essential information such as the estimated interest rate, monthly payment, costs of taxes and insurance, and total closing costs for the loan. Keep in mind that this is just an estimate based on available information.

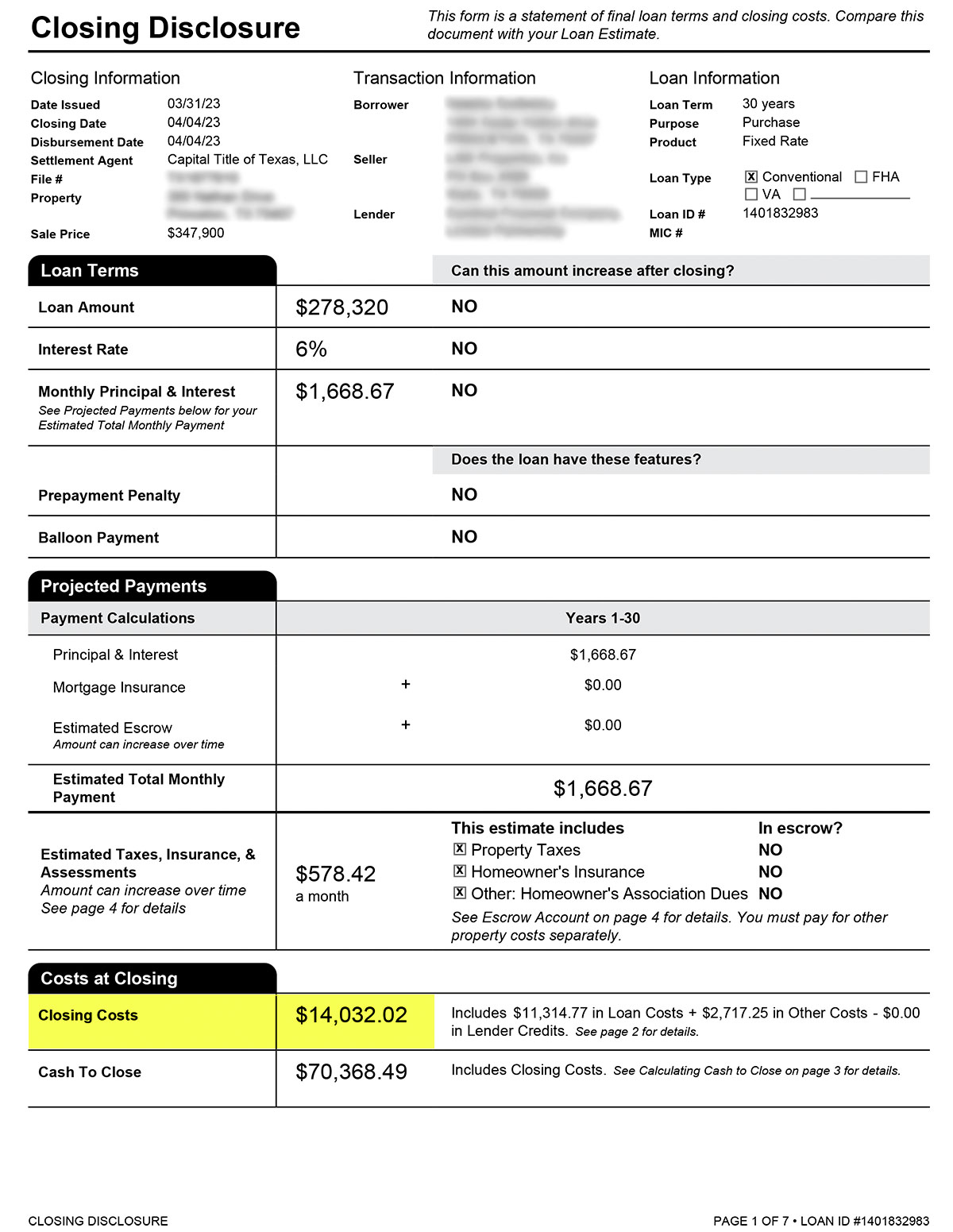

Step 2: Closing Disclosure

The final numbers for the Closing Costs will be reflected in the Closing Disclosure as the home buying transaction progresses. The lender is required to provide this document at least three days before closing. The Closing Disclosure, which consists of 5 pages, provides the home buyer with the final numbers for closing costs.

The Consumer Financial Protection Bureau (CFPB) has an amazing example of Closing disclosure with the items explanation and tips for home buyers.

https://www.consumerfinance.gov/owning-a-home/closing-disclosure/

But what if the home buyer is not taking a loan?

In this case, the Title company will provide the Closing Disclosure.

Whether paying cash or financing, the only way to find out the exact closing costs is through the Closing Disclosure.

When Do You Receive the Closing Disclosure?

Typically, the Closing Disclosure becomes available three days before closing. While waiting for it can be nerve-wracking, having an estimate beforehand will give you peace of mind and help you prepare.

It’s important to note that this document is typically available very close to the closing day, causing some anxiety for home buyers. However, having an estimate can provide peace of mind and help with preparation.

How much are the Closing Costs?

Now, let’s address the question of how much the closing costs actually are.

Closing costs are additional expenses that home buyers have to pay on top of the down payment. (The Closing Cost expenses and the down payment are called CASH TO CLOSE.)

Closing costs can vary greatly due to factors such as the home price, loan product used, Seller’s concessions, property taxes, home insurance, mortgage insurance, HOA transfer fees, and other expenses.

On average, in the Dallas area, closing costs range from 3% to 7% of the home price.

To provide an example, if the home price is $350,000, the Buyer’s closing costs can range anywhere from $10,500 to $24,500. Keep in mind that this is just an example, and the actual closing costs will depend on your specific situation.

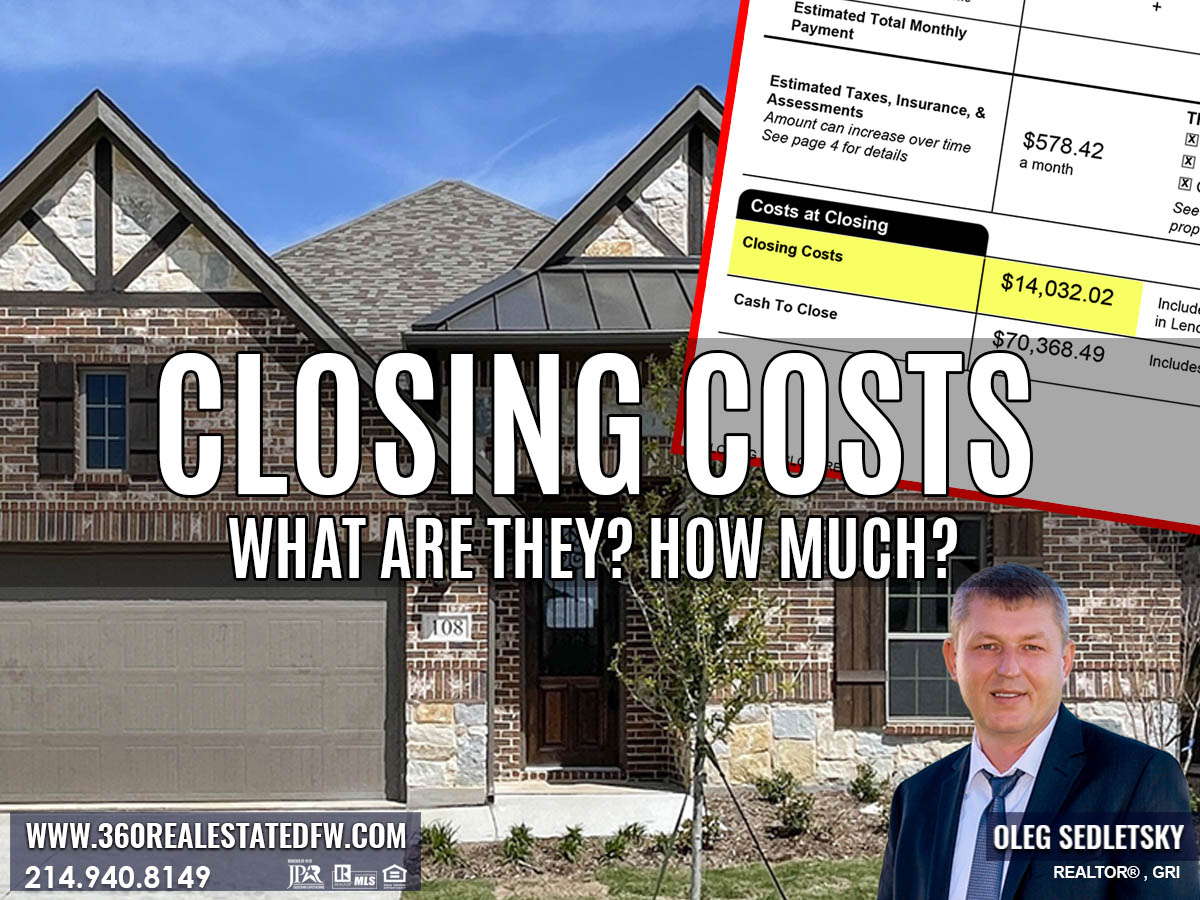

Here’s a real-life example to illustrate:

In April 2023, my client purchased a home with conventional financing, and we negotiated a few seller concessions. The home price was $347,900, and the closing costs amounted to $14,032, which is roughly 4% of the home price.

In this case, the home buyer had set aside funds equivalent to 10% of the home price as a precaution, but it turned out that 4% was sufficient.

Source of Funds for Closing Costs

Now, let’s discuss how home buyers can pay the closing costs.

Home buyers can pay closing costs using various sources; just remember that all funds must be verified. The closing costs can be paid by the home Buyer, lender, Seller, or realtors or can be a gift from family or a “family-like” relationship.

So there are various options available to cover these costs.

Are Closing Costs Tax Deductible?

Want a quick answer? In most cases, closing costs are not tax deductible. However, certain expenses related to mortgage and state and local real estate taxes can be deducted. For a more detailed answer, consult your CPA or head straight to the IRS website.

Attention First-Time Home Buyers: Can You Avoid Closing Costs?

The good news is, yes, you can find ways to dodge those pesky closing costs. One option is to take advantage of grants and down payment assistance programs.

Additionally, your realtor may be able to negotiate with the Seller to cover a significant portion or all of the closing costs, depending on the market and the specific property.

Some closing costs are also negotiable, and the timing of your home purchase can play a role in reducing these expenses (e.g., closing at the end of the month or year).

To explore ways to reduce your closing costs, it’s recommended to consult with your lender and realtor.

In conclusion,

Closing Costs are a reality that every home buyer will face. While there are ways to reduce or have someone else pay for these expenses, that’s a topic for another article. The goal of this article is to inform first-time home buyers about the existence of closing costs and how they can impact the home-buying decision.

Are you ready to experience the joy of homeownership in the vibrant Dallas-Fort Worth area?

Whether you’re in search of an existing home or a brand-new construction, rest assured that I’m here to assist you every step of the way.

With a dedicated Realtor by your side, the home-buying process becomes a breeze. Say goodbye to stress, and let me handle all the intricate details on your behalf.

Getting the guidance you need is as simple as filling out a brief questionnaire on my Homebuyers contact form. From there, I’ll take care of everything, ensuring a seamless and hassle-free journey towards finding your dream home.

Call/Text 214.940.8149

The Buyer’s Agent Duty

READ: Texas Real Estate Commission Information About Brokerage Services

AS AGENT FOR BUYER/TENANT: The broker becomes the buyer/tenant’s agent by agreeing to represent the buyer, usually through a

written representation agreement. A buyer’s agent must perform the broker’s minimum duties above and must inform the buyer of any

material information about the property or transaction known by the agent, including information disclosed to the agent by the seller or

seller’s agent.

A BROKER’S MINIMUM DUTIES REQUIRED BY LAW (A client is the person or party that the broker represents):

– Put the interests of the client above all others, including the broker’s own interests;

– Inform the client of any material information about the property or transaction received by the broker;

– Answer the client’s questions and present any offer to or counter–offer from the client; and

– Treat all parties to a real estate transaction honestly and fairly.

TO AVOID DISPUTES, ALL AGREEMENTS BETWEEN YOU AND A BROKER SHOULD BE IN WRITING AND CLEARLY ESTABLISH:

– The broker’s duties and responsibilities to you, and your obligations under the representation agreement.

– Who will pay the broker for services provided to you, when payment will be made and how the payment will be calculated.

TYPES OF REAL ESTATE LICENSE HOLDERS:

– A BROKER is responsible for all brokerage activities, including acts performed by sales agents sponsored by the broker.

– A SALES AGENT must be sponsored by a broker and works with clients on behalf of the broker.

Latest from Dallas Real Estate Blog

– Texas Homebuyers Tips, Tricks and Lifehacks

– New Construction Homes in Dallas TX

– Mortgages for Homebuyers and Investors in Dallas-Fort Worth