Dallas Housing Market: Prices | Trends | May 2023

Housing Report for Dallas-Fort Worth-Arlington Metropolitan Statistical Area – May 2023

Single-Family Homes SUMMARY

Sales volume for single-family homes decreased 1.86% YoY from 9,034 to 8,866 transactions.

Year-to-date sales reached a total of 35,028 closed listings.

Dollar volume dipped from $4.83 billion to $4.52 billion.

The average sales price dipped 4.63% YoY from $534,560 to $509,825

The average price per square foot subsequently declined from $220.41 to $210.17.

Median price declined 5.75% YoY from $435,000 to $410,000

The median price per square foot also declined from $207.41 to $197.33.

Months inventory for single-family homes rose from 1.3 to 2.2 months supply.

Days to sell rose from 54 to 77.

—

(Days to Sell = Days on Market + Days to Close)

(YoY – Year-over-Year is a calculation commonly used in economics or financial data to show how information from one time period compares to the year prior. )

Dallas-Fort Worth Housing Report May 2023 (single family homes residential)

May 2023 | YoY %

Home Sales: 8,866 | -1.86%

Dollar Volume: $4,520,107,135 | -6.40%

Median Close Price: $410,000 | -5.75%

New Listings: 11,112 | -13.10%

Active Listings: 16,330 | 50.67%

Months Inventory: 2.2 | 74.04%

Days to Sell: 77 | 42.59%

Average Price PSF: $210.17 | -4.64%

Median Price PSF: $197.33 | -4.86%

Median Square Feet: 2,128 | -0.75%

Close to Original List Price: 97.36% | -7.35%

COLLIN COUNTY HOUSING REPORT – May 2023

May 2023 | YoY %

New Listings: 1,985 | – 16.2%

Average Sales Price: $590,118 | – 8.8%

Median Sales Price: $524,990 | – 8.8%

Days on Market Until Sale: 41 | + 192.9%

Inventory of Homes for Sale: 2,350 | + 14.5%

Months Supply of Inventory: 1.9

Relocating to Dallas-Fort Worth?

Consider New Construction Homes in Princeton, Texas

Princeton, TX is located in Collin County Texas and is part of Dallas-Fort Worth metropolitan area.

About the data used in this report

Data used in Dallas-Fort Worth- Arlington report come from Texas Realtor® Data Relevance Project, a partnership between the Texas Association of Realtors® and local Realtor® associations throughout the state. The analysis is provided through a research agreement with the Real Estate Center at Texas A&M University

Data used in Collin County report come from North Texas Real Estate Information Services, Inc.

You may also be interested in:

Latest from Dallas Real Estate Blog

– Texas Homebuyers Tips, Tricks and Lifehacks

– New Construction Homes in Dallas TX

– Texas Home Sellers Tips, Tricks and Lifehacks

– Mortgages for Homebuyers and Investors in Dallas-Fort Worth

Dallas-Fort Worth Relocation Guide

Explore an important information for Home Sellers in the Dallas-Fort Worth area

Explore an important information for Home Buyers in the Dallas-Fort Worth area

2025

Dallas-Fort Worth Housing Market – Collin County Housing Market: Prices and Trends | January 2025

Dallas-Fort Worth Housing Market – Collin County Housing Market: Prices and Trends | February 2025

Dallas-Fort Worth Housing Market – Collin County Housing Market: Prices and Trends | March 2025

Dallas-Fort Worth Housing Market – Collin County Housing Market: Prices and Trends | April 2025

Dallas-Fort Worth Housing Market – Collin County Housing Market: Prices and Trends | May 2025

Dallas-Fort Worth Housing Market – Collin County Housing Market: Prices and Trends | June 2025

Dallas-Fort Worth Housing Market – Collin County Housing Market: Prices and Trends | July 2025

Dallas-Fort Worth Housing Market – Collin County Housing Market: Prices and Trends | August 2025

Dallas-Fort Worth Housing Market – Collin County Housing Market: Prices and Trends | September 2025

Dallas-Fort Worth Housing Market – Collin County Housing Market: Prices and Trends | October 2025

Dallas-Fort Worth Housing Market – Collin County Housing Market: Prices and Trends | November 2025

Dallas-Fort Worth Housing Market – Collin County Housing Market: Prices and Trends | December 2025

2024

Dallas-Fort Worth Housing Market: Prices and Trends | December 2024

Dallas-Fort Worth Housing Market: Prices and Trends | November 2024

Dallas-Fort Worth Housing Market: Prices and Trends | October 2024

Dallas-Fort Worth Market: Prices and Trends | September 2024

Dallas-Fort Worth Housing Market: Prices and Trends | August 2024

Dallas-Fort Worth Housing Market: Prices and Trends | July 2024

Dallas-Fort Worth Housing Market: Prices and Trends | June 2024

Dallas-Fort Worth Housing Market: Prices and Trends | May 2024

Dallas-Fort Worth Housing Market: Prices and Trends | April 2024

Dallas-Fort Worth Housing Market: Prices and Trends | March 2024

Dallas-Fort Worth Housing Market: Prices and Trends | February 2024

Dallas-Fort Worth Housing Market: Prices and Trends | January 2024

2023

Dallas-Fort Worth Housing Market: Prices and Trends | December 2023

Dallas-Fort Worth Housing Market: Prices and Trends | November 2023

Dallas-Fort Worth Housing Market: Prices and Trends | October 2023

Dallas-Fort Worth Housing Market: Prices and Trends | September 2023

Dallas-Fort Worth Housing Market: Prices and Trends | August 2023

Dallas-Fort Worth Housing Market: Prices and Trends | July 2023

Dallas-Fort Worth Housing Market: Prices and Trends | June 2023

Dallas-Fort Worth Housing Market: Prices and Trends | May 2023

Dallas-Fort Worth Housing Market: Prices and Trends | April 2023

Dallas-Fort Worth Housing Market: Prices and Trends | March 2023

Dallas-Fort Worth Housing Market: Prices and Trends | February 2023

Dallas-Fort Worth Housing Market: Prices and Trends | January 2023

2022

Dallas-Fort Worth Housing Market: Prices and Trends | December 2022

Dallas-Fort Worth Housing Market: Prices and Trends | November 2022

Dallas-Fort Worth Housing Market: Prices and Trends | October 2022

Dallas-Fort Worth Housing Market: Prices and Trends | September 2022

Dallas-Fort Worth Housing Market: Prices and Trends | August 2022

Dallas-Fort Worth Housing Market: Prices and Trends | July 2022

Dallas-Fort Worth Housing Market: Prices and Trends | June 2022

Dallas-Fort Worth Housing Market: Prices and Trends | May 2022

Dallas-Fort Worth Housing Market: Prices and Trends | April 2022

Dallas-Fort Worth Housing Market: Prices and Trends | March 2022

Dallas-Fort Worth Housing Market: Prices and Trends | February 2022

Dallas-Fort Worth Housing Market: Prices and Trends | January 2022

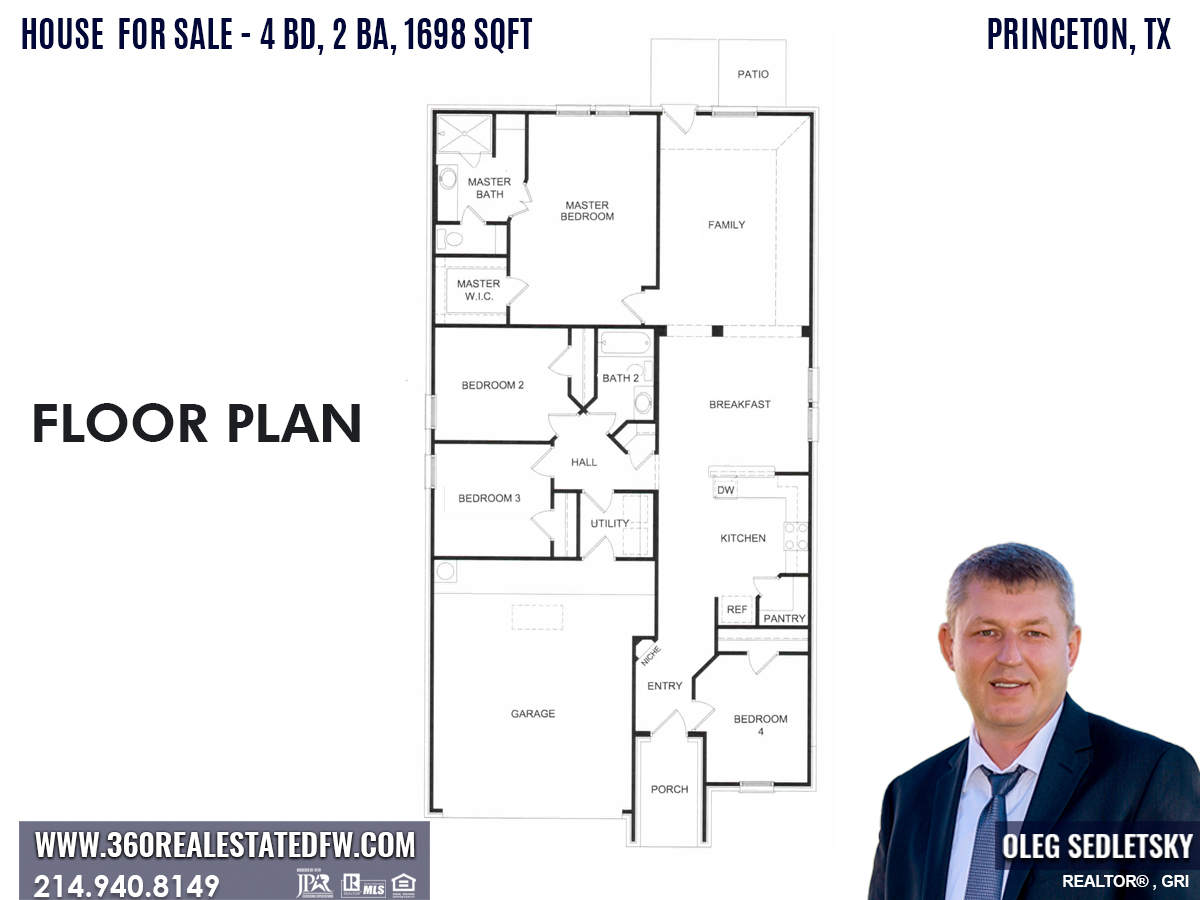

Comfortable 4 Bedroom Home for Sale in Princeton, TX

A beautiful, 1 story home that boasts an open concept floor plan with 4 bedrooms and 2 baths, spanning across a generous 1698 sqft in Princeton, TX at an affordable price!

While this specific home has already been sold, there are numerous other homes that have been built with the same floorplan. If you are interested in this floorplan, I would be more than happy to assist you in finding a very similar home in Princeton, TX.

Homes For Sale In the Dallas area

Hey there, if you’re in the market for a new place to live in the Dallas area, you gotta check out Princeton, TX! Princeton is located in Northeast Collin County between the cities of McKinney and Greenville Texas on U.S. Highway 380.

This place is seriously a hidden gem. It’s growing but still has that small-town charm that we all crave.

Plus, it’s super convenient being right off HWY 380 and only a hop, skip, and a jump away from McKinney, TX, Allen, TX, Fairview, TX, and even Dallas (yep, it’s just 41 miles away!).

Homes For Sale in Princeton, TX

Let me tell you, there are so many great homes available for sale in Princeton, but I personally want to bring your attention to one that caught my eye.

It’s a beautiful, 1 story home that boasts an open concept floor plan with 4 bedrooms and 2 baths, spanning across a generous 1698 sqft.

Unlock Exceptional Service!

Assistance with all your real estate needs in the Dallas-Fort Worth area is just a click or call away. Reach out at 214-940-8149 or connect through the links below.

PROPERTY DETAILS

Bedroom 2 – 10×10 ft Walk-in Closet

Bedroom 3 – 10×11 ft Walk-in Closet

Bedroom 4 – 10×12 ft Walk-in Closet

Primary Owner’s Suite – 18×13 ft

Family/living room – 18×13 ft

2 Car Garage – 17×22 ft

SQFT Total – 1698

Backyard – 62×23 Sqft

No MUD, No PID

And the backyard? Let’s just say it’s perfect for all your summertime BBQs.

Not to mention, the community amenities are top-notch, with a pool and playground for the kiddos.

LOCATION! LOCATION! LOCATION!

This home location is very convenient. With shopping, schools, a hospital, parks, and a lake nearby, you’ll have everything you need right at your fingertips.

Distance from this home in Princeton, TX to major highways

U.S. 380 – 0.5 mile

State Highway 5 – 5 miles

U.S. 75 – 6.7 miles

State Highway 121 – 9.8 miles

Distance from this home in Princeton, TX to shopping

Specs – 1.4 miles

Walmart -2.2 miles

Costco – 8.1 miles

Whole Foods – 11.6 miles

Target – 7.2 miles

Home Depot – 7.4 miles

Lowes – 7.2 miles

Best buy – 7.1 miles

Kroger – 6.6 miles

Winco – 6.3 miles

Academy – 6.7 miles

Historic Downtown McKinney – 6.4 miles

Distance from this home in Princeton, TX to parks and recreation

J.M. Caldwell Sr. Community Park -2 miles

Ticky Creek Park -9 miles

Municipal center park – 4.6 miles

Distance from this home in Princeton, TX to the center of major cities and towns

to McKinney, TX – 8.1 mi

to Fairview, TX – 9.1 mi

to Lucas, TX – 12.3 mi

to Melissa, TX -11 mi

to Allen, TX – 14 mi

to Prosper, TX -18 mi

to Plano, TX – 20 mi

to Frisco, TX – 22 mi

to Celina, TX – 23 mi

to Dallas, TX – 41 mi

Distance from this home in Princeton, TX to the hospital

Medical City McKinney – 9.1 miles

Distance from this home in Princeton, TX to schools

Smith Elementary – 0.6 miles

https://www.princetonisd.net/Domain/798

Southard Middle School – 1.6 miles

https://www.princetonisd.net/Domain/1355

Princeton High School – 3.8 miles

https://www.princetonisd.net/Domain/52

Photos of a 4 Bedrooms Home For Sale in Princeton, TX

New Construction Homes in Van Alstyne TX - 1-ACRE LOT, 2 STORY, 5 CAR GARAGE, 4400 SqFt, 6BD, 3BA, OFFICE, MEDIA, GAMEROOM, COVERED PATIO, FIREPLACE

If you’re in the market for a spacious new construction home, this 2 story beauty on 1-Acre lot might be just what you’re looking for!

Hi Everyone, welcome to another installment of my Dallas-Fort Worth Home tour series, where I’m featuring homes on large lots, available to buy or build in the Dallas area!

Today, I’m featuring a magnificent 2-story new construction home on a 1-acre lot that’s available to buy or build in Van Alstyne, TX

If you’re interested in learning more about Van Alstyne, Texas as your potential new hometown, be sure to check out my Van Alstyne, TX Relocation Guide.

PRICE: $744,000*

*Price and Home Availability is subject to change without notice. Square footages are approximate.

AVAILABLE NOW! If you are interested, contact me (Call/Text 214-940-8149) as soon as possible.

This floor plan may be available in different locations around the Dallas-Fort Worth area.

This 2 story new construction home is situated on 1-acre lot, and boasts almost 4400 square feet of living space with 6 Bedrooms, 3.1 Bathrooms, an Office, a Gameroom, a Media room and 5 Car Garage.

Now, let me tell you what features this home offers for the price.

You’ll get a a 5 car garage with an oversized bay for bigger vehicles,

Hand-scraped hardwood floors, a full stone fireplace,

A Chef’s Kitchen complete with a double oven, wood range hood, granite countertops, lots of cabinets and a farm sink,

Bay windows in the primary owner’s suite for some breathtaking views, and an oversized covered patio that’s perfect for outdoor entertaining.

So, as you can see this home has so much to offer,

If you are interested in buying this home or build the same floor plan on a different 1-acre lot within this community contact me for details and availability

Watch Video: INSIDE A 6 BEDS NEW HOME ON 1 ACRE LOT NEAR DALLAS – $743,000 – NO HOA – 4400 SQFT, 5-CAR GARAGE

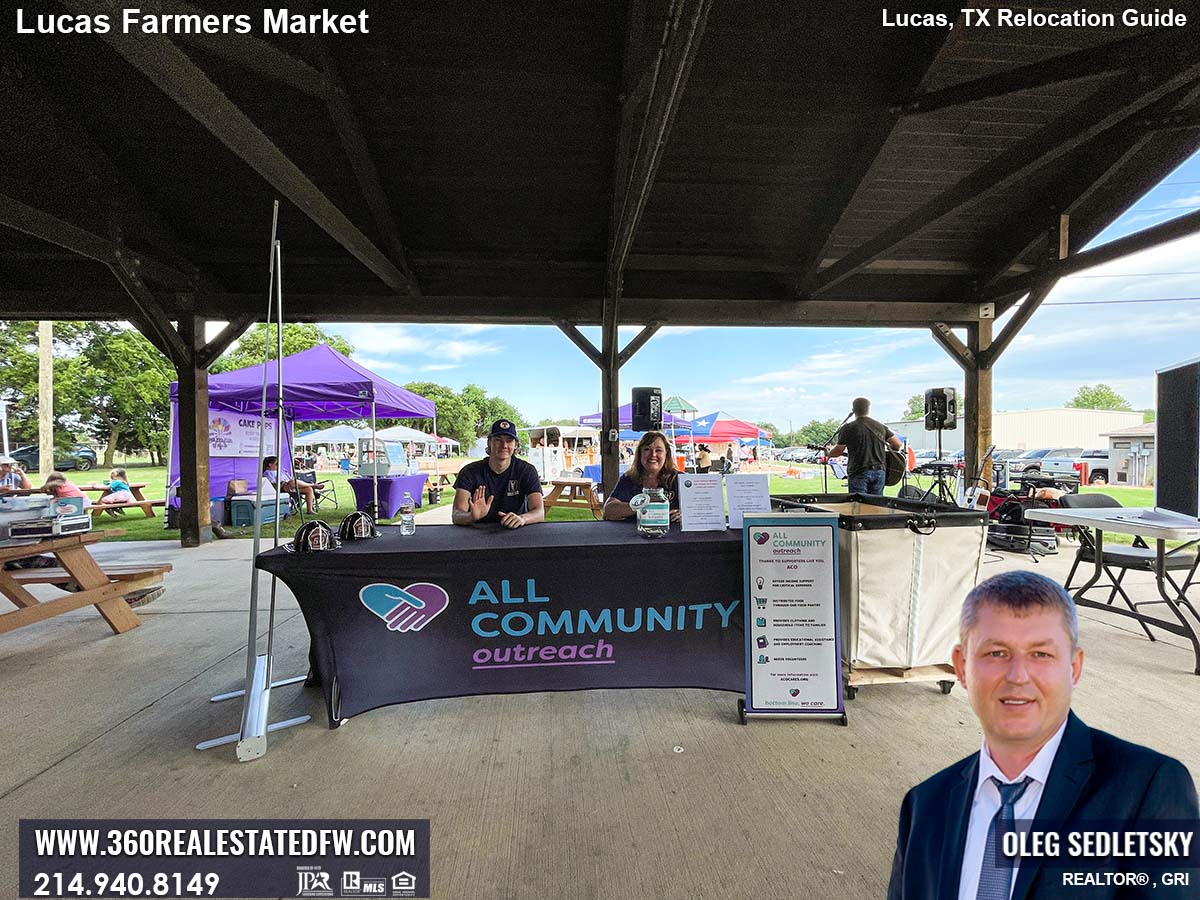

Things To Do in Lucas TX-Discover the Hidden Gem of Lucas, Texas: The Lucas Farmers Market

Discover the Charm of Lucas, Texas and Unwind at the Lucas Farmers Market!

Lucas, Texas, might not be on the top of your list when it comes to must-visit destinations in the North Dallas area, but it certainly should be!

Beyond its quiet neighborhoods and rural charm, Lucas has one hidden gem that all locals and visitors should check out: the Lucas Farmers Market.

In this article, I will share with you why the Lucas Farmers Market is a must-visit destination and what you can expect when you visit.

The Lucas Farmers Market is a community-based market

The Lucas Farmers Market is a community-based market and is unlike any other farmers market you’ve ever visited. Located in the Lucas Community Park, the market opens every second and fourth Saturday of the month from 8 am to noon.

What I love most about this event is that it’s not just about selling products; it’s about creating a social experience where the community and visitors can interact with local vendors, farmers, food producers, and artists.

Lucas Farmers Market supports local farmers and small businesses

Speaking of vendors, the Lucas Farmers Market has a plethora of local vendors that sell an array of products that cater to everyone’s needs.

From fresh produce to grass-fed meats, artisan crafts, and local honey to homemade jams, jellies, and hot sauces, the market offers a wide range of unique products that you can’t find anywhere else.

One of our favorite things about the Lucas Farmers Market is how it supports local farmers and small businesses.

By purchasing from local vendors, you’re not only getting high-quality products, but you’re also supporting the local community and helping small businesses thrive.

It’s a great way to give back to the community while also enjoying yourself.

Live music performances and food-tasting demonstrations

Apart from the vendors, there’s also a lot of entertainment at the market. You can enjoy live music performances and food-tasting demonstrations.

The Lucas Farmers Market is a family-friendly event that offers something for everyone to enjoy.

If you’re looking for something different to do on a lazy Saturday morning, head out to the Lucas Farmers Market.

You will be satisfied with the selection of high-quality products, family-friendly entertainment, and community interaction.

You can also feel good about supporting local vendors and small businesses while enjoying a fun day out.

The market is located at 665 Country Club Road, Lucas, TX

Hours: from 8 am to noon on the second and fourth Saturdays of each month.

Make sure you put it on your North Dallas must-visit list!

Nothing found.

Are you ready to experience the joy of homeownership in the vibrant Dallas-Fort Worth area?

Whether you’re in search of an existing home or a brand-new construction, rest assured that I’m here to assist you every step of the way.

With a dedicated Realtor by your side, the home-buying process becomes a breeze. Say goodbye to stress, and let me handle all the intricate details on your behalf.

Getting the guidance you need is as simple as filling out a brief questionnaire on my Homebuyers contact form. From there, I’ll take care of everything, ensuring a seamless and hassle-free journey towards finding your dream home.

Call/Text 214.940.8149

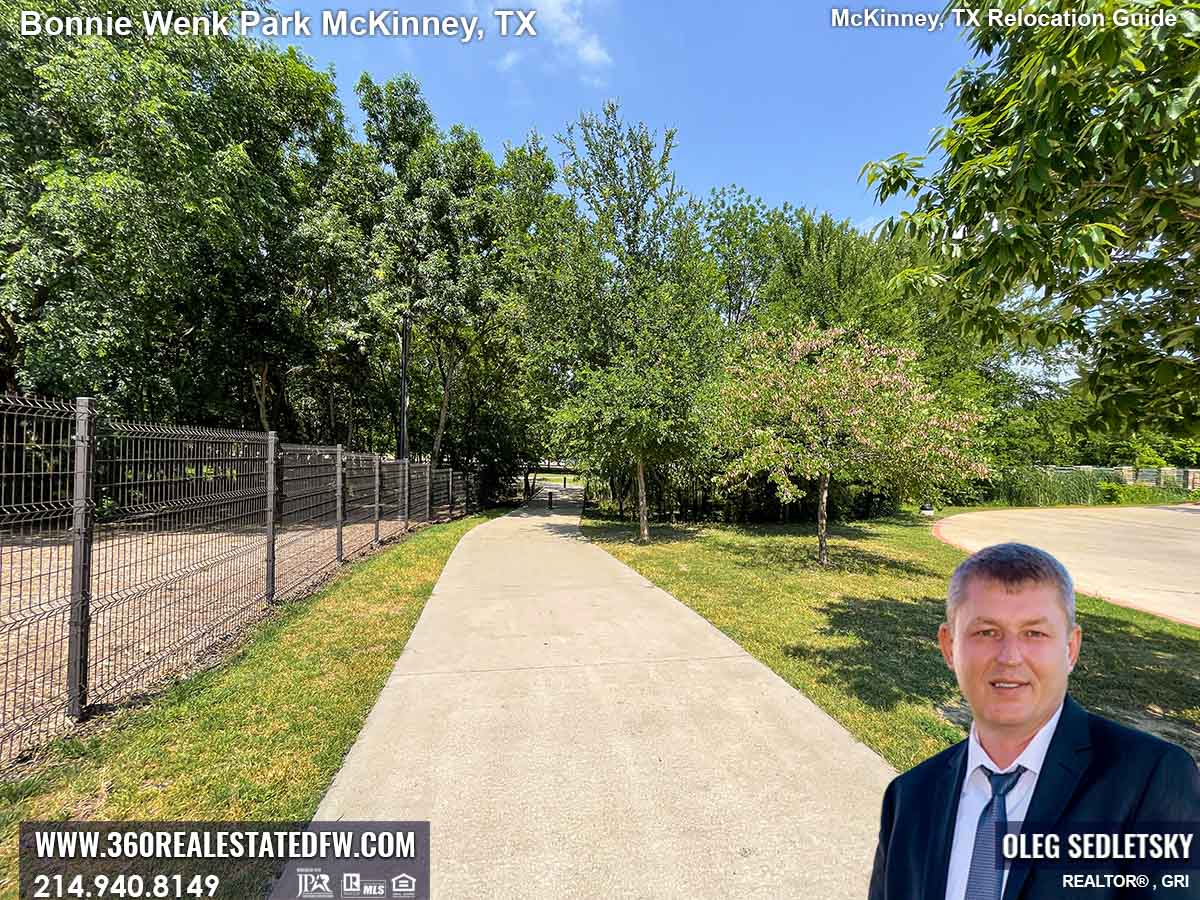

Explore the All-Abilities Playground at Bonnie Wenk Park - Things To Do In McKinney Texas

A Guide to the All-Abilities Playground at Bonnie Wenk Park in McKinney, TX

Are you looking for a fun and inclusive playground in the Dallas area? Look no further than Bonnie Wenk Park’s all-abilities playground in McKinney, Texas!

With unique equipment, beautiful surroundings, and a focus on accessibility, this playground will surely delight children of all ages and abilities.

Read on for a guide to the all-abilities playground at Bonnie Wenk Park.

Bonnie Wenk Park’s All-Abilities Playground is genuinely one of a kind. With features like zip lines, a ropes course, and an obstacle course-style play structure, children will find endless opportunities for adventure and play.

The playground is also thoughtfully designed with safety in mind, with a soft padded surface throughout and no sharp edges. The playground is divided into three areas, each with its own distinct equipment and play opportunities.

Accessibility is a top priority at Bonnie Wenk Park’s all-abilities playground. The playground is designed with children with special needs in mind, with accessible equipment and features throughout the play structure. Children with mobility challenges can enjoy swings that accommodate wheelchairs or play on a raised sandbox with ramp access. Sensory elements like chimes and a raised garden bed are also available. The playground also has a variety of seating options, including picnic tables and benches.

Bonnie Wenk Park’s all-abilities playground is not only fun and accessible but also beautiful. The playground is set among a manicured park, with surrounding trees and plants providing natural shade and beauty. The playground is also situated near a lake and walking trails, and plenty of open spaces exist for children to run and play.

Bonnie Wenk Park’s All-Abilities Playground is a popular destination for local families, and its appeal is understandable.

Nearly 10% of the McKinney ISD’s student population has special needs, and the city of McKinney and the park officials have worked tirelessly to make Bonnie Wenk Park wheelchair-friendly and create an inclusive playground environment.

The playground is a joint effort between the city and the Rotary Club of McKinney and is designed explicitly for children with all abilities to interact with the play equipment independently.

It’s a testament to McKinney’s inclusivity and dedication to children with special needs that they have placed such importance on creating access to play parks that promote physical activity and fun.

Just so you know, the other closest All-Inclusive playgrounds are:

in Frisco, TX. Hope Park Playground,

in Anna, TX. All-inclusive playground at Johnson Park,

in Plano, TX.

Liberty Playground – Inside Windhaven Meadows Park (5400 Windhaven Pkwy, Plano, TX 75093)

Jack Carter Playground (2800 Maumelle Drive, Plano, TX)

Bonnie Wenk Park is a prime example of what can be achieved when communities come together to cater to the needs of everyone.

The park is a testament to McKinney’s spirit of inclusivity and working together to build a more welcoming environment for all its citizens. The all-abilities playground at Bonnie Wenk Park should be on your must-visit list, whether you are a McKinney local or visiting from out of town.

Address: 2996 Virginia Pkwy, McKinney, TX 75071

Nothing found.

Are you ready to experience the joy of homeownership in the vibrant Dallas-Fort Worth area?

Whether you’re in search of an existing home or a brand-new construction, rest assured that I’m here to assist you every step of the way.

With a dedicated Realtor by your side, the home-buying process becomes a breeze. Say goodbye to stress, and let me handle all the intricate details on your behalf.

Getting the guidance you need is as simple as filling out a brief questionnaire on my Homebuyers contact form. From there, I’ll take care of everything, ensuring a seamless and hassle-free journey towards finding your dream home.

Call/Text 214.940.8149

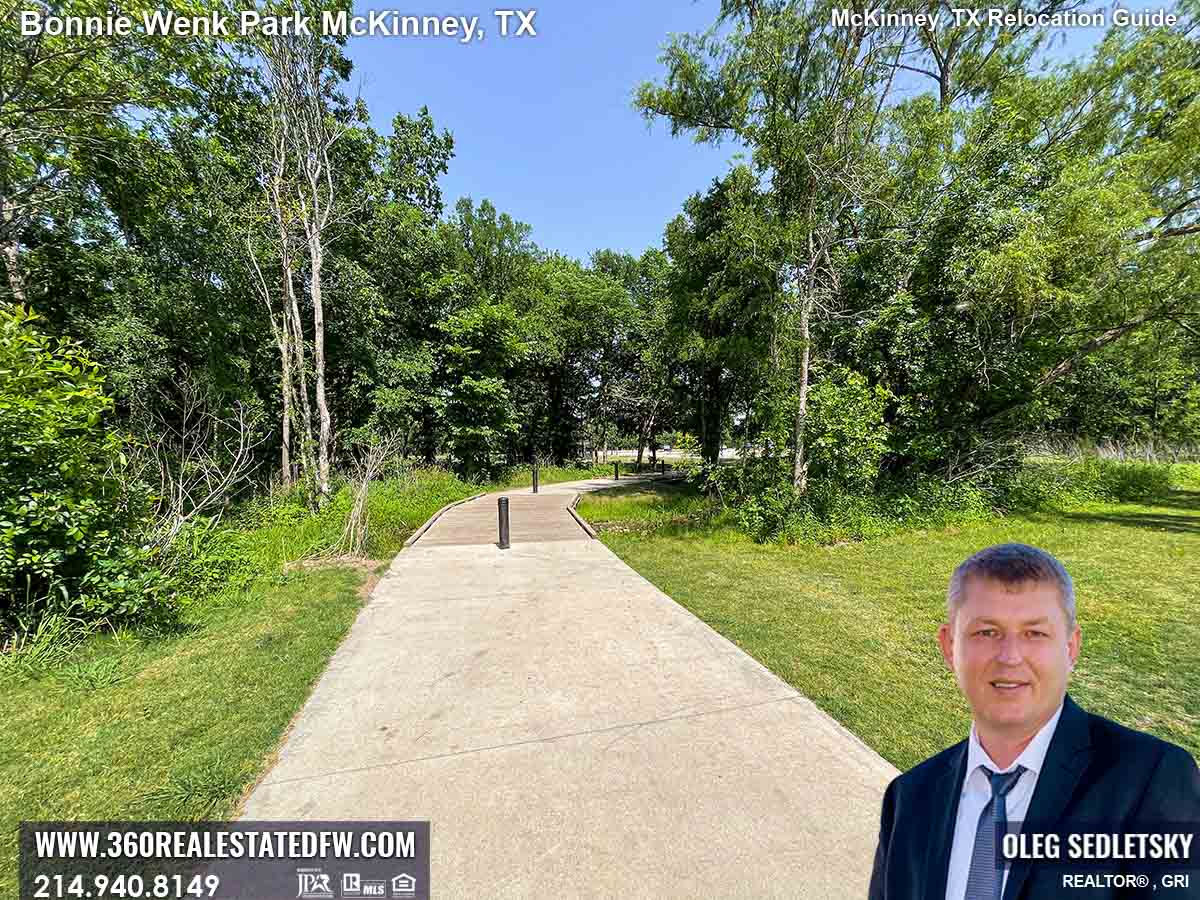

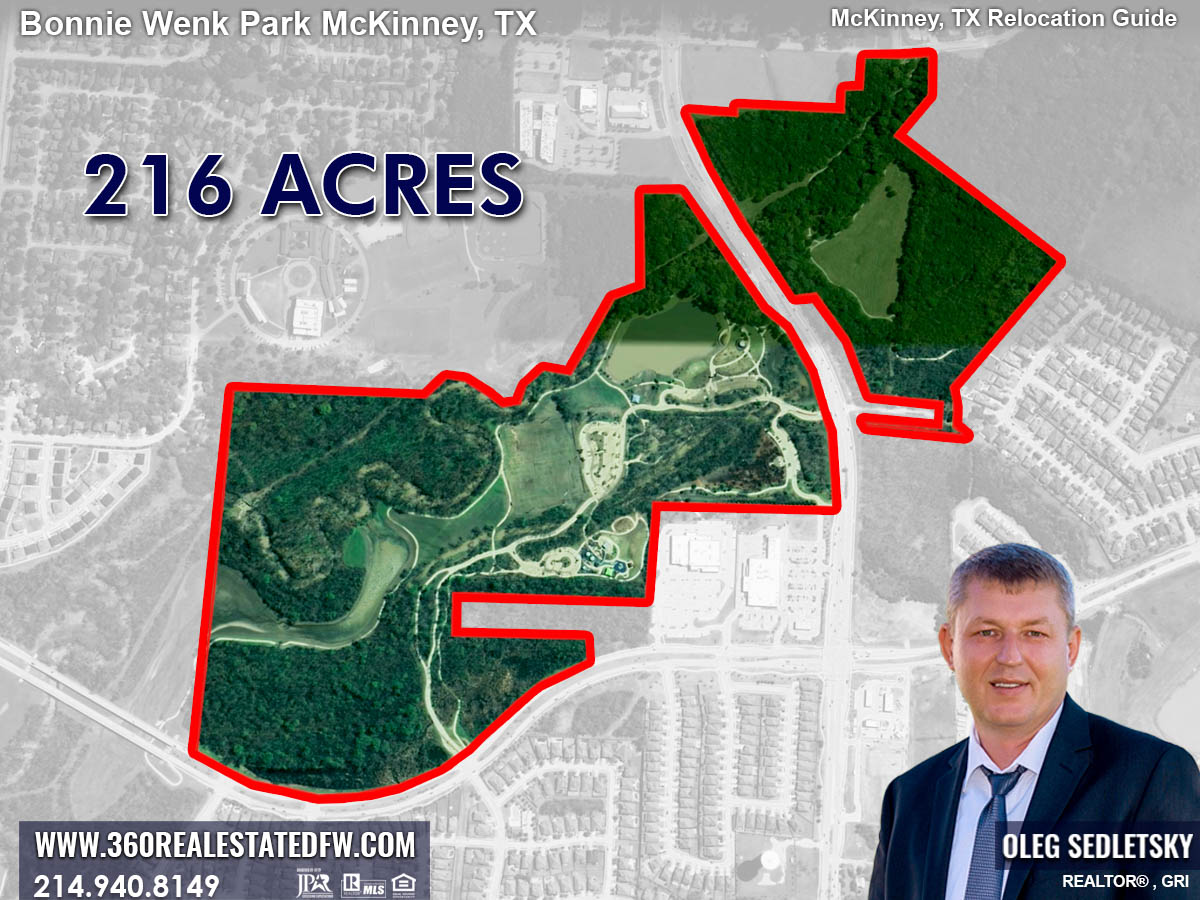

Discover the Fun and Exciting Things to Do in McKinney, Texas, at Bonnie Wenk Park

Explore the Fun Side of McKinney, Texas, by Visiting Bonnie Wenk Park!

Are you getting ready to make a move to the Dallas area but still need to scope out some potential destinations for your family outings?

Or you’re already a resident but new to the area and looking for fresh ideas for fun things to do.

Regardless of your situation, let me introduce you to Bonnie Wenk Park, a must-visit attraction in McKinney, Texas.

This expansive 216-acre park is jam-packed with an array of amenities for the entire family, including a dog park, a playground, hiking, and bike trails, a fitness court, a fishing pond, and an outdoor amphitheater.

In this article, we’ll take a closer look at all the exciting things to do at Bonnie Wenk Park.

Bonnie Wenk Park amenities: Dog Park

First up, let’s talk about the dog park. Bonnie Wenk Park boasts a 2-acre, fenced, off-leash dog park area perfect for your furry friends to run free and play.

Please read my article dedicated to this incredible dog park.

Bonnie Wenk Park amenities: All-Abilities Playground

Designed for children of all ages, abilities, and needs, the all-abilities playground at Bonnie Wenk Park is a joint effort between the city and the Rotary Club of McKinney.

This unique playground is a place where kids can play regardless of their physical or cognitive limitations.

Its inclusive design includes ramps, swings, and sensory-rich play equipment, making it a perfect place for kids of all abilities to socialize and have fun.

Please read my article dedicated to All-Abilities Playground at Bonnie Wenk Park

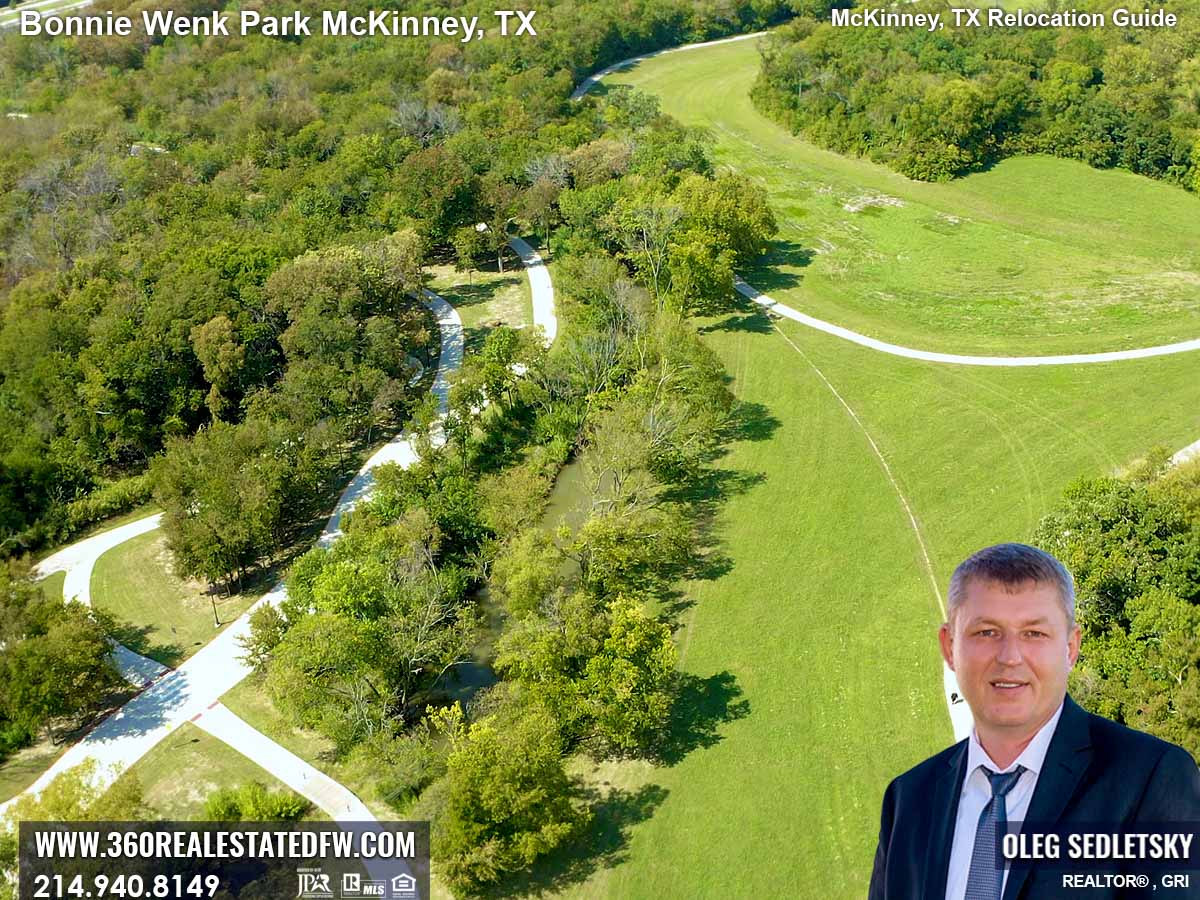

Bonnie Wenk Park amenities: Hiking & Biking Trails

Bonnie Wenk Park’s nationally-recognized trail network comprises ten miles of well-maintained, scenic trails for hiking, biking, and jogging.

The Dog Park Loop is a popular .44-mile path that dog owners can walk with their pets.

The trails offer stunning views and ample opportunities to spot wildlife such as rabbits, birds, and turtles.

Bonnie Wenk Park amenities: Fitness Court

The Fitness Court at Bonnie Wenk Park provides a fun, free, and functional workout alternative to traditional gyms.

Its adult-friendly design includes seven stations that provide a full-body workout, all in a scenic outdoor setting.

Users of ability levels can access the court for free and engage in a range of fitness routines.

Bonnie Wenk Park amenities: Fishing Pond

The five-acre fishing pond at Bonnie Wenk Park is a perfect spot for anglers and nature lovers to relax and unwind.

You can also catch a concert or take a walk around the pond while enjoying the beautiful natural scenery.

Bonnie Wenk Park amenities: Amphitheater

The outdoor amphitheater at Bonnie Wenk Park plays host to several concert series throughout the summer. Make sure to check out park calendar to stay up-to-date on all the events you can enjoy here.

The amphitheater is the perfect place to enjoy pond views or watching live performances.

Bonnie Wenk Park amenities: Multi-purpose Fields

The park boasts multi-purpose fields that are perfect for soccer, football, and other team sports.

Bonnie Wenk Park amenities: 5 play structures

There are also 5 play structures for kids to climb and explore.

And if you need to take a quick break, the park’s restrooms are conveniently located nearby.

Bonnie Wenk Park offers something for everyone, regardless of age, abilities, and interests. From dogs to hikers, anglers to fitness enthusiasts, there are so many fun activities to choose from at this expansive park. So, whether you’re a local resident or a first-time visitor, we invite you to come out and spend a day in Bonnie Wenk Park. Make sure to add it to your list of McKinney attractions if you haven’t already!

Address: 2996 Virginia Pkwy, McKinney, TX 75071

Park Website: https://www.mckinneytexas.org/1148/Bonnie-Wenk-Park

Photos of Bonnie Wenk Park in McKinney, TX

Nothing found.

Are you ready to experience the joy of homeownership in the vibrant Dallas-Fort Worth area?

Whether you’re in search of an existing home or a brand-new construction, rest assured that I’m here to assist you every step of the way.

With a dedicated Realtor by your side, the home-buying process becomes a breeze. Say goodbye to stress, and let me handle all the intricate details on your behalf.

Getting the guidance you need is as simple as filling out a brief questionnaire on my Homebuyers contact form. From there, I’ll take care of everything, ensuring a seamless and hassle-free journey towards finding your dream home.

Call/Text 214.940.8149

Things to Do in McKinney, Texas - An Incredible Dog Park - Bonnie Wenk Park in McKinney, TX

One-of-a-kind Dog Park in McKinney Texas

Hey there, fellow dog owners! Are you relocating to North Dallas, or are you already a proud resident but new to the area?

Well, whether you’re a new dog parent or a seasoned one, In this blog, I’ll introduce you to a one-of-a-kind dog park in McKinney, Texas, that you simply cannot afford to miss out on.

As a Dallas area real estate agent and a loving owner of furry friends, I’m a frequent visitor to this particular dog park. From my personal experience, I can tell you that the amenities here are absolutely top-notch!

Let’s explore this Dog Park!

Watch the video on my YouTube Channel: https://www.youtube.com/watch?v=8zA2Do8seu4

This dog park is located inside a Bonnie Wenk Park in the beautiful city of McKinney, Texas

Bonnie Wenk Park is a stunning park that offers a vast array of amenities, and in this article I’ll be focusing on the Dog park that will leave you and your pets delighted.

I’ll take you on a virtual tour of the Dog Park to showcase all the unique features it has to offer.

2 Acres In Size

This Dog Park spans over 2 acres and is completely fenced off to ensure the safety of our furry friends.

It is divided into sections to accommodate big and small dogs

It has a splash pad for dogs

But here’s the truly unique part – it has a splash pad for dogs. How cool is that! And let me tell you, the dogs absolutely love it!

The Dog Park has trees and shaded areas throughout the park for dog owners

There are also plenty of trees and shaded areas throughout the park for dog owners to relax and cool off.

From the state-of-the-art amenities to the abundance of open space, the Dog Park inside the Bonnie Wenk Park in McKinney, TX is the perfect place to unwind and engage in some exciting playtime with your furry buddy.

The park is open every day from dawn to 11 p.m. and the splash pad is open year-round.

The Dog Park Address: 2996 Virginia Pkwy, McKinney, TX 75071

So, what are you waiting for? Let’s grab those leashes and head on over to the park – I promise you won’t regret it!

Nothing found.

Are you ready to experience the joy of homeownership in the vibrant Dallas-Fort Worth area?

Whether you’re in search of an existing home or a brand-new construction, rest assured that I’m here to assist you every step of the way.

With a dedicated Realtor by your side, the home-buying process becomes a breeze. Say goodbye to stress, and let me handle all the intricate details on your behalf.

Getting the guidance you need is as simple as filling out a brief questionnaire on my Homebuyers contact form. From there, I’ll take care of everything, ensuring a seamless and hassle-free journey towards finding your dream home.

Call/Text 214.940.8149

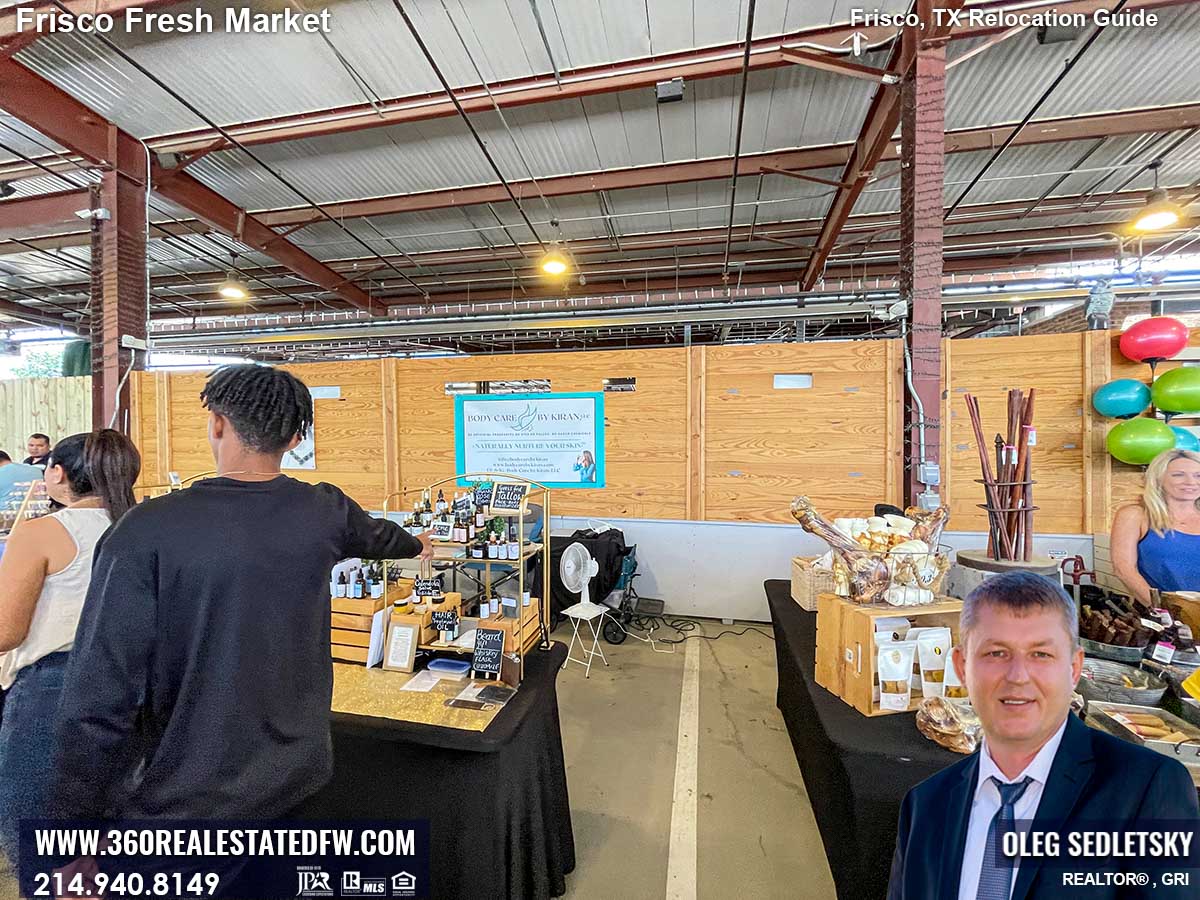

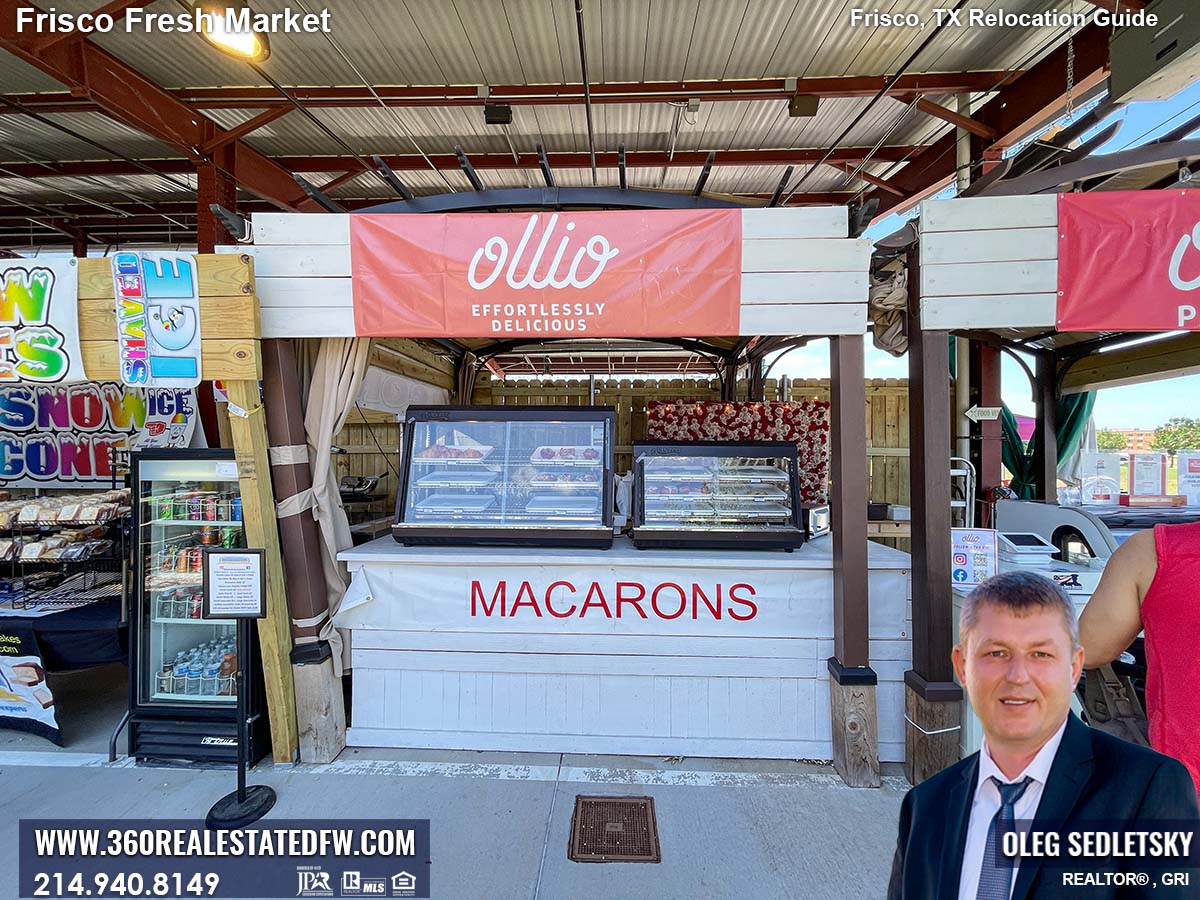

Things to Do in Frisco, Texas - Frisco Fresh Market - 5 Things to do at Frisco Fresh Market

5 Things to do at Frisco Fresh Market

Suppose you are a new Frisco, TX resident or considering relocating to the Dallas area. In that case, Frisco Fresh Market is the place to visit and explore.

Frisco Fresh Market is a haven for locally-sourced produce, artisan foods, high-quality dog treats, pastured meats, and eggs.

This local spot is the perfect location to stock up on healthy food items while meeting and engaging with local vendors.

It’s situated in the heart of Frisco, TX, and is open year-round every Saturday and Sunday.

In this article, I’ll highlight the top 5 things to do while at Frisco Fresh Market.

Farm-To-Table Produce and Products

The Frisco Fresh Market brings together local Texas farmers and vendors to provide you with fresh & healthy produce, as well as high-quality handmade crafts.

You can stock up on tasty fruits and vegetables, honey, meats, pastries, and more products from a wide variety of vendors.

Many of these vendors utilize bio-diverse principles in their farming and businesses, ensuring the guilt-free enjoyment of your favorite products.

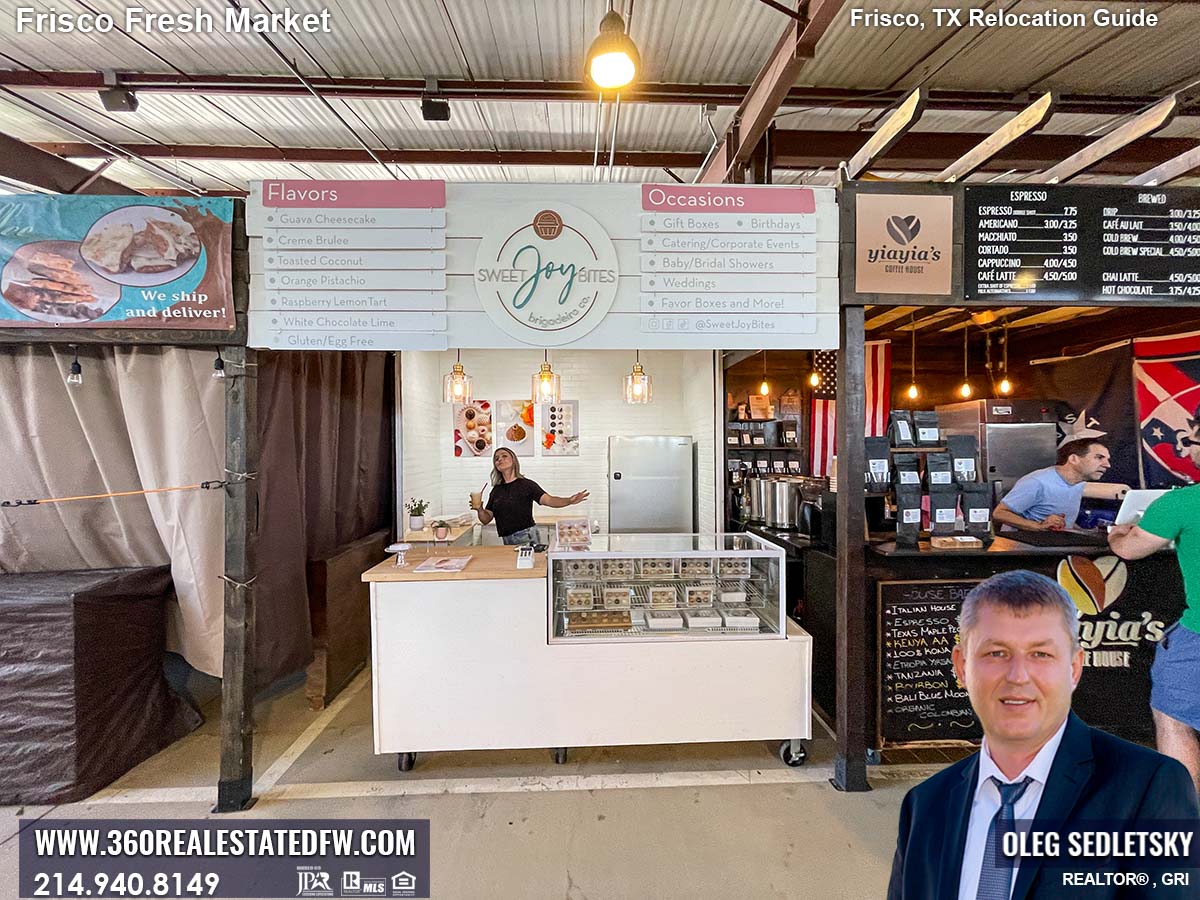

Grab breakfast or lunch

The Frisco Fresh Market is home to several food vendors serving breakfast or lunch options.

You can grab a BBQ, pastrami sandwiches, tacos, greek salads, and other yummy items with coffee from local coffee vendors and enjoy your meal under the shade of an umbrella.

Satisfying your appetite while taking in the sights and sounds of the market is a perfect morning or lunchtime option.

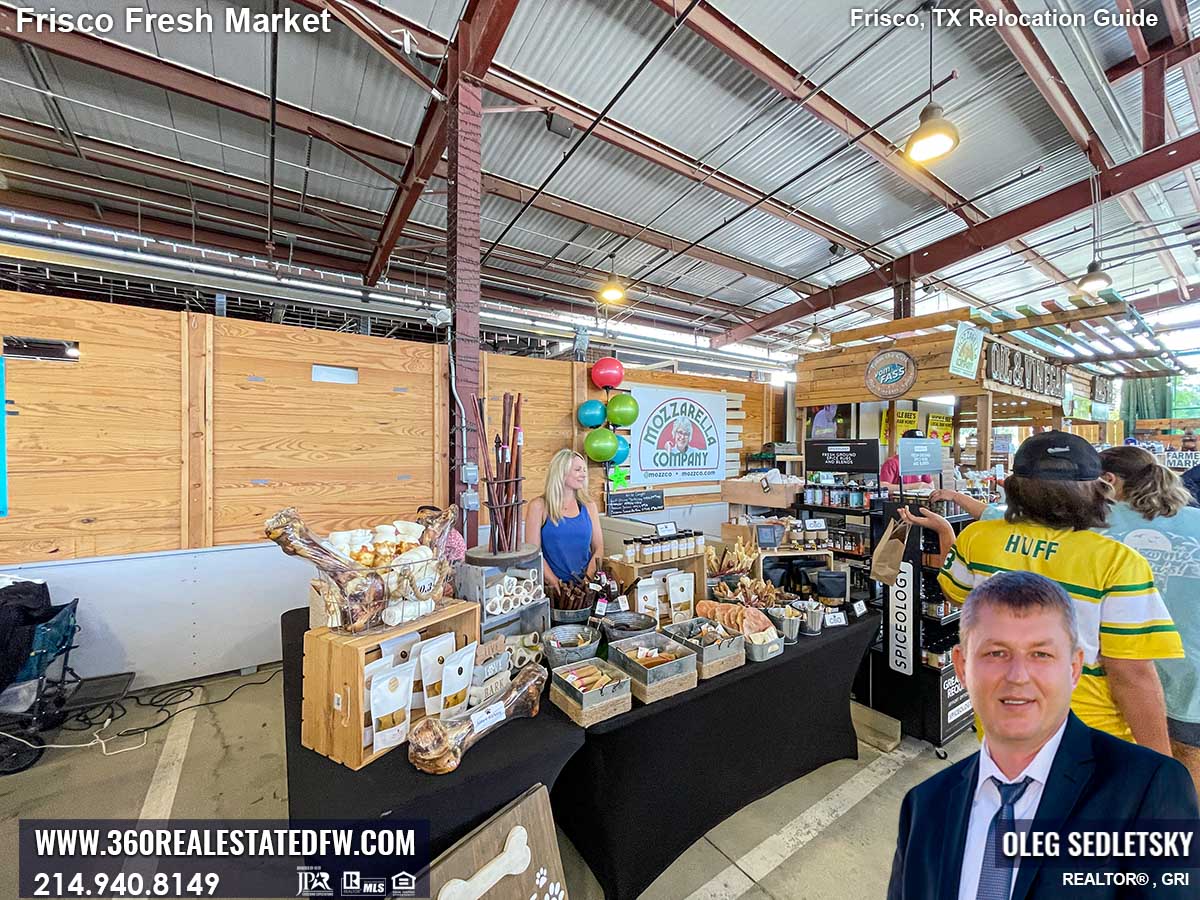

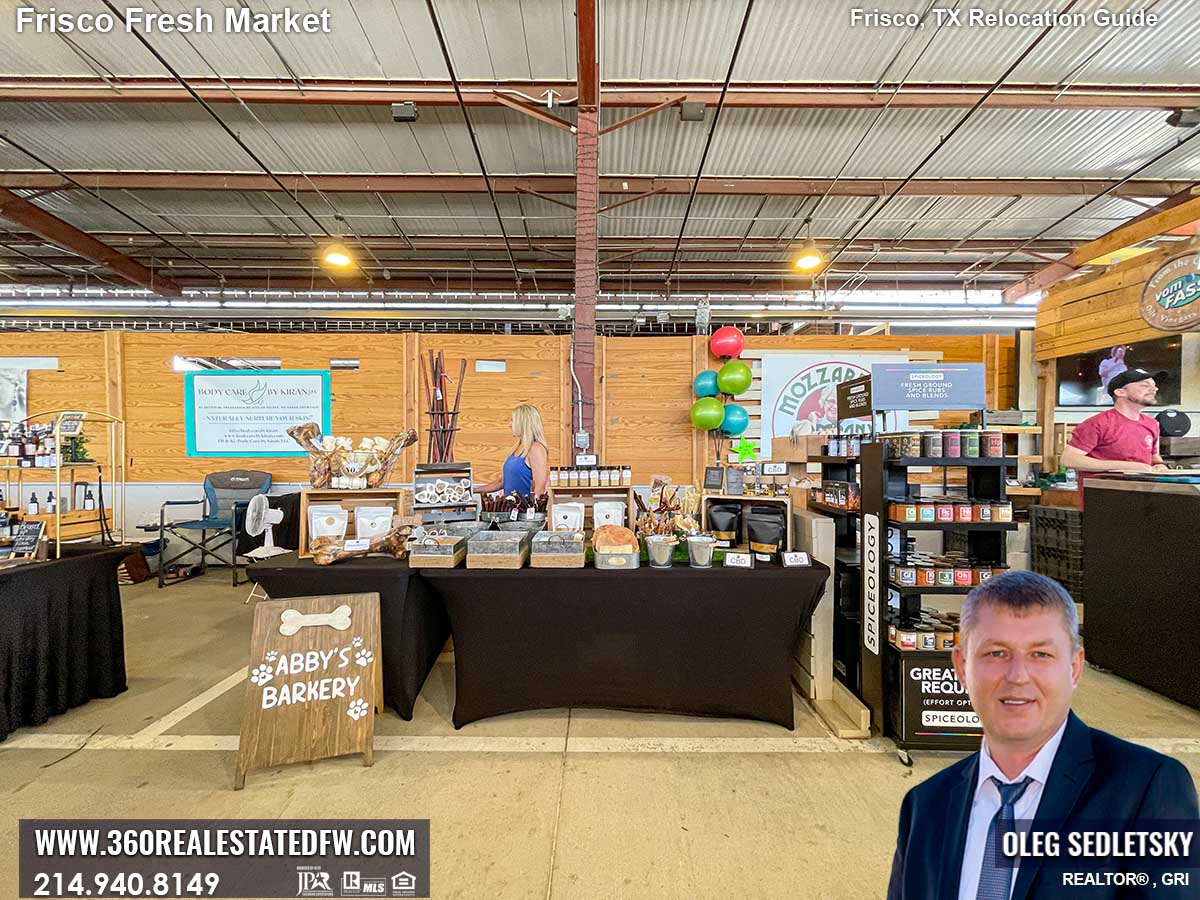

Shop for unique items

The Frisco Fresh Market is the perfect place to shop for unique artisan foods and support small businesses and people who are passionate about their crafts.

You’ll find items like infused olive oils, balsamic vinegar, handmade pasta, freshly-made bread, and locally roasted coffee.

You can also pick up high-quality dog treats, tasty honey, and locally sourced jams and jellies. These items make for great gifts or a treat for yourself.

Family and Pet-Friendly

Everybody can come! If you were wondering whether your dog could accompany you to this authentic market, here’s some good news – pets are allowed.

This venue is suitable for families with small children who always have a great time running around and exploring the market.

With its fun environment, the Frisco Fresh Market is perfect for a family outing!

Stunning Location and Access

The Frisco Fresh Market is located in the heart of downtown Frisco, TX

at 9215 John W. Elliott Dr, Frisco, TX 75034

So, if you are looking for things to do in Frisco, TX, definitely visit Frisco Fresh Market! Remember to come equipped with a few essentials: an empty stomach, comfortable footwear, cash or cards, your grocery bags, and your camera.

Frisco Fresh Market provides a unique opportunity to enjoy and explore locally-sourced food in the Dallas area. Whether you’re looking for a new breakfast place, a gift idea, or just want to connect with local vendors, Frisco Fresh Market is an excellent place to explore.

Photos of Frisco Fresh Market

Nothing found.

Are you ready to experience the joy of homeownership in the vibrant Dallas-Fort Worth area?

Whether you’re in search of an existing home or a brand-new construction, rest assured that I’m here to assist you every step of the way.

With a dedicated Realtor by your side, the home-buying process becomes a breeze. Say goodbye to stress, and let me handle all the intricate details on your behalf.

Getting the guidance you need is as simple as filling out a brief questionnaire on my Homebuyers contact form. From there, I’ll take care of everything, ensuring a seamless and hassle-free journey towards finding your dream home.

Call/Text 214.940.8149

New Construction Homes in Van Alstyne TX - 1-ACRE LOT, 2 STORY, 6 CAR GARAGE, 2640 SqFt, 4BD, 3BA, OFFICE, GAMEROOM, COVERED PATIO, FIREPLACE

A Hard To Find 2 Story New Construction Home on 1-Acre Lot in Van Alstyne, TX

Hey everyone! I’m thrilled to share that I’m launching a brand new section of my Dallas-Fort Worth Home Tour series, featuring homes on expansive lots that will take your breath away.

When I say large, I mean these properties are situated on 1-Acre or more! The Dallas area offers magnificent homes with acreage that can be bought or built on.

I’m Oleg Sedletsky local Dallas-Fort Worth Realtor®, and I invite you to take a closer look at a fantastic new construction home on a 1-acre lot that’s available to buy or build in Van Alstyne, TX.

If you’re unfamiliar with this charming city, check out my VAN ALSTYNE TEXAS RELOCATION GUIDE

NO HOA!

PRICE: $619,000*

*Price and Home Availability is subject to change without notice. Square footages are approximate.

AVAILABLE NOW! If you are interested, contact me (Call/Text 214-940-8149) as soon as possible.

If Van Alstyne, TX isn’t your ideal location; this floor plan may be available in other locations around the Dallas-Fort Worth area.

This 2 story home sits on 1-Acre lot and boasts a spacious open concept floor plan with 2,640 Square feet, 4 Bedrooms, 3 Bathrooms, Office, Game room, 6 Car Garage!

I want to highlight a few stand-out features of this home.

The first thing you’ll notice is that this home is situated on a beautiful 1-acre lot and just moments away from HWY 75.

But the real magic of this house is in the details.

The best part? It comes loaded with a bunch of must-have features at no extra cost.

We’re talking a 6-car garage featuring an oversized bay for larger vehicles, hand-scraped hardwood floors, and a cast stone fireplace.

The chef’s kitchen boasts a double oven, a wood range hood, granite countertops, and a farm sink;

Oh, and don’t miss the bay windows in the primary owner’s suite and an oversized covered patio.

Don’t miss this opportunity to make this charming home yours! contact me today!

Other Articles In This Category:

Nothing found.

Are you ready to experience the joy of homeownership in the vibrant Dallas-Fort Worth area?

Whether you’re in search of an existing home or a brand-new construction, rest assured that I’m here to assist you every step of the way.

With a dedicated Realtor by your side, the home-buying process becomes a breeze. Say goodbye to stress, and let me handle all the intricate details on your behalf.

Getting the guidance you need is as simple as filling out a brief questionnaire on my Homebuyers contact form. From there, I’ll take care of everything, ensuring a seamless and hassle-free journey towards finding your dream home.

Call/Text 214.940.8149

The Buyer’s Agent Duty

READ: Texas Real Estate Commission Information About Brokerage Services

AS AGENT FOR BUYER/TENANT: The broker becomes the buyer/tenant’s agent by agreeing to represent the buyer, usually through a

written representation agreement. A buyer’s agent must perform the broker’s minimum duties above and must inform the buyer of any

material information about the property or transaction known by the agent, including information disclosed to the agent by the seller or

seller’s agent.

A BROKER’S MINIMUM DUTIES REQUIRED BY LAW (A client is the person or party that the broker represents):

– Put the interests of the client above all others, including the broker’s own interests;

– Inform the client of any material information about the property or transaction received by the broker;

– Answer the client’s questions and present any offer to or counter–offer from the client; and

– Treat all parties to a real estate transaction honestly and fairly.

TO AVOID DISPUTES, ALL AGREEMENTS BETWEEN YOU AND A BROKER SHOULD BE IN WRITING AND CLEARLY ESTABLISH:

– The broker’s duties and responsibilities to you, and your obligations under the representation agreement.

– Who will pay the broker for services provided to you, when payment will be made and how the payment will be calculated.

TYPES OF REAL ESTATE LICENSE HOLDERS:

– A BROKER is responsible for all brokerage activities, including acts performed by sales agents sponsored by the broker.

– A SALES AGENT must be sponsored by a broker and works with clients on behalf of the broker.

Latest from Dallas Real Estate Blog

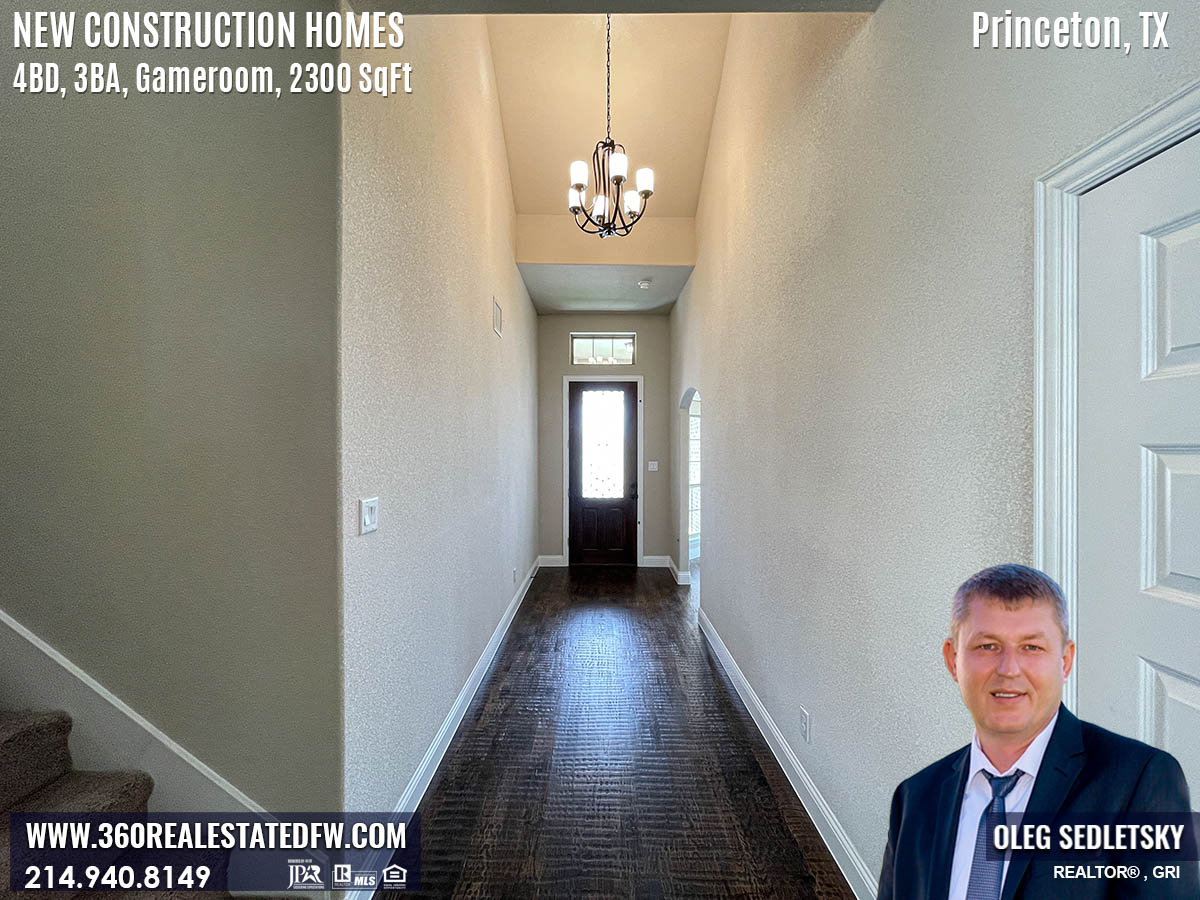

New Construction Homes in Princeton TX - 2 Story, 2300 SqFt, 4BD, 3BA, GAMEROOM, 2 CAR GARAGE, COVERED PATIO, FIREPLACE

A stunning 2 Story New Construction Home in Princeton, TX

Greetings everyone! Welcome to my Dallas-Fort Worth Home Tour series, where I showcase new construction homes available to build or buy in the Dallas area.

Today, we’re taking a closer look at a stunning new construction home located in the charming city of Princeton, Texas.

PRICE: $450,000*

*Price and Home Availability is subject to change without notice. Square footages are approximate.

Please note, there is limited availability of this floor plan so if you are interested, contact me (Call/Text 214-940-8149) as soon as possible.

However, if Princeton isn’t your ideal location; this floor plan may be available in other locations around the Dallas-Fort Worth area.

This 2 story home boasts a spacious open concept floor plan with 2,300 square feet, 4 bedrooms, 3 bathrooms, and even a game room.

An impressive list of standard features in this home include a beautiful hand scraped hardwood floors, a full stone fireplace, a double oven, a wood range hood, a granite counter tops, covered patio & more…

Don’t miss this opportunity to make this charming home yours! contact me today!

Looking for your dream home? Check out the photos and video of this charming home is located in Princeton, TX and has everything you could want in a new space.

Reach out to me at 214-940-8149, and let’s work together to make your dream a reality!

I am here to help you find the perfect home not only in Princeton TX but also in other cities in the DFW area.

2 Story, 4 BD, 3 BA, 2300 SqFt, New Construction Home in Princeton TX Photo Gallery

Unlock Exceptional Service!

Assistance with all your real estate needs in the Dallas-Fort Worth area is just a click or call away. Reach out at 214-940-8149 or connect through the links below.

Greetings! I’m Oleg Sedletsky, and I’m excited to introduce myself as your go-to full-time licensed Texas REALTOR® and Mortgage Loan Originator.

I proudly represent JPAR® – Real Estate Brokerage as a REALTOR® and Utopia Mortgage LLC as a Mortgage Loan Originator! My designations and certifications reflect my dedication to helping you achieve your real estate goals in Princeton, TX and other locations in the vibrant Dallas-Fort Worth area!

My commitment to ongoing professional development means I’m always enhancing my skills to serve you better. You can count on me as your trusted expert throughout your real estate journey. Plus, I’m fluent in English, Ukrainian, and Russian and ready to assist you every step of the way!

It’s All About You and Your Real Estate Goals!

My mission is to serve you! With my knowledge and expertise, I’m here to help you achieve all your real estate goals!

I’m passionate about helping buyers and sellers navigate the exciting real estate landscape in Princeton, Texas! Whether you’re searching for your dream home, exploring land options, or looking for commercial properties, my Real Estate Services have you covered.

Contact me today for all your real estate needs in Princeton, Texas! Call/text 214-940-8149